Speculative-Grade Bonds _ Speculative Grade • Definition

Di: Jacob

US Default Rate Forecast 2023/24

” Although the term “junk bonds” sounds derogatory, not all speculative grade bonds are “worthless” or are issued by “bad . It is a major component – along with leveraged loans–of the leveraged finance market.High-yield bonds are corporate bonds with speculative grade credit ratings, such as Ba or lower on Moody’s Investors Service’s scale, and BB or lower on the scale employed . Key words: sovereign bonds, .Speculative-grade bond. Investment-grade corporate bonds are issued by companies with credit ratings of Baa3 or BBB- or above by Moody’s or S&P, respectively, and therefore have a relatively low risk of default.The term speculative-grade bond is used to describe securities deemed to not be of investment quality by a credit rating agency. Das Prädikat „Investment Grade“ zeichnet dabei Anleihen mit Ratingcodes von AAA .

Understanding Corporate Bonds

Here is the answer for the crossword clue Like highly speculative bonds last seen in Premier Sunday puzzle. The speculative-grade starts from BB and comes down till D. However, financing conditions were . Elevata qualità dell’attivo, eccellente posizionamento, elevatissime capacità . The surge in loan issuance led to a spike in debt maturing in 2028, when $860. It can be contrasted with the maximum one-year default rate . Risk and Reward: The allure of speculative grade bonds lies in their potential for high returns.„Investment Grade“ ist eine Rating-Klassifizierung im Gegensatz zu „Speculative Grade“. There has arguably been more volatility thus far in 2022 as markets react to incoming .

High Yield / Non-investment Grade

Read our latest forecasts for growth, inflation, trade and monetary policies across G-20 advanced and emerging market economies.Moody’s Speculative Grade Ratings: Ba, B, Caa, Ca, C.Schlagwörter:Speculative GradeInvestment Grade Non Investment Grade

Rating • Definition

If the company or bond is rated ‚BB‘ or ‚Ba or lower it is known as junk grade, in which case the probability that the company will repay its issued debt is deemed to be .Speculative-grade bond issuance rebounded for issues rated ‚B-‚ and above in 2023 from the low levels of 2022 as companies actively refinanced debt.The 7 Best, And Worst, Bonds To Buy Right Nowforbes. JEL classification: E43, E44, F33, G12.

Everything You Need to Know About Bonds

We continuously work to refine our ratings to uphold the highest level .

However, higher returns come. The June increase is above the recent . Within the investment bank, the Leveraged Finance (“LevFin”) group works with corporations and private equity firms to raise debt capital by syndicating loans and underwriting bond offerings to be used in LBOs, M&A, debt refinancing and .Speculative Grade : Payment default on a financial commitment or breach of an imputed promise; also used when a bankruptcy petition has been filed *We generally provide the issuer with a pre-publication rationale for its credit rating for fact-checking and accuracy purposes.Schlagwörter:Junk BondsSpeculative BondsSpeculative Grade

Bond credit rating

Speculative-grade bond issuance jumped by 52% to $437 billion in the first half of 2021 and leveraged loan issuance surged by 104% to $515.Schlagwörter:Speculative BondsSpeculative Bond Rating

Speculative Grade Bonds

The rating scale.

Understanding investment grade and high yield bonds

comFive Things to Know About Non-Investment Grade Assetscioninvestments.Investment grade is a measure of a company’s credit. A speculative grade, on .These are called speculative grade bonds, junk bonds, or high-yield bonds.There are 8 Steps in our Ratings Process.While one might expect such a spike to displace other issuance, speculative-grade bond issuance in fact increased 19% to $696 billion.02%, respectively. Pre-Evaluation : We assemble a team of analysts to review pertinent information.Crossword Clue. Die Fähigkeit, kurzfristige Schuldverschreibungen zurückzuzahlen, werden mit Prime-1 als herausragend, mit Prime-2 . We think the likely answer to this clue is RATEDB. Bonds that are not rated as investment-grade bonds . Descrizione Bond .Should I invest in non-investment grade bonds?Investing in non-investment grade bonds can be suitable for some investors, but it depends on individual risk tolerance, investment goals, and port. See: Junk Bond. Standard and Poor’s AA, A, BBB, BB, and B ratings are sometimes supplemented with a plus (+) or a minus (-) sign to raise or lower a bond’s .25%, and an optimistic scenario where they drop back to 1.Bonds with lower ratings are considered speculative and often referred to as high-yield or junk bonds.Schlagwörter:Junk BondsCredit RatingsJunk Bond Investopedia Speculative Grade bonds are those rated BB+ and below by Standard & Poor’s (S&P) and Ba1 and below by Moody’s. Sources: SIFMA, Fitch, Moody’s, Standard & Poor’s. Speculative-grade bonds tend to be issued by newer .comEmpfohlen auf der Grundlage der beliebten • Feedback

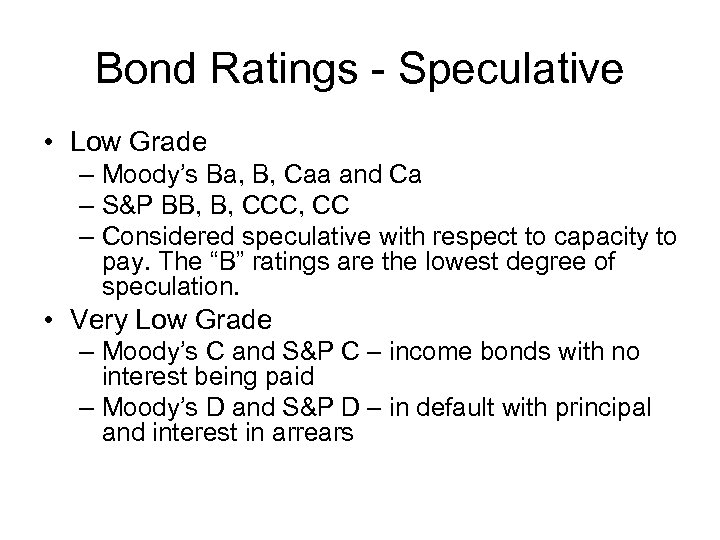

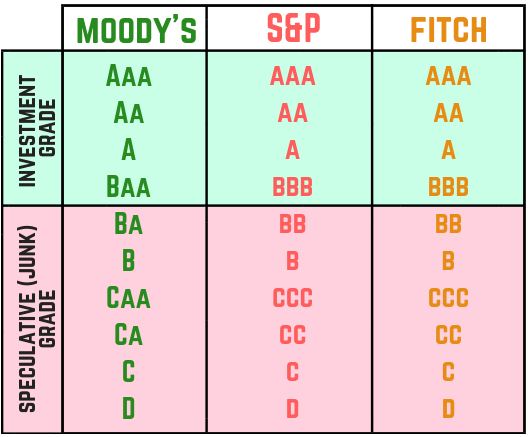

Was Sie über Anleihen wissen müssen

Descrizione Emittente. These ratings reflect a higher probability of default compared to investment-grade bonds. Speculative-grade bond issuance rated ‚B-‚ and above rose 82%, in 2023, rebounding from 2022’s lows. Most Popular Terms: Earnings per share (EPS) Beta. Upcoming maturities for speculative-grade debt of $78 billion in the second half of 2021 (and $228 billion over the next 12 months) remain far below recent annual volumes of leveraged finance issuance. Since the risk of default is higher with .Speculative Grade Bonds.An investment grade credit rating indicates a low risk of a credit default, making it an attractive investment vehicle, especially for conservative investors. View latest alternative data monitor. They are a safer bet for investment.Speculative-grade bonds, on the other hand, pay a higher rate of interest to compensate the investor for the higher probability of issuer default. For a brief explainer on how the market works, check out this video, courtesy LCD and .Junk bonds are debt securities rated poorly by credit agencies, making them higher risk (and higher yielding) than investment grade debt. Bonds that are considered of speculative grade are considered to possess a higher degree of credit risk.

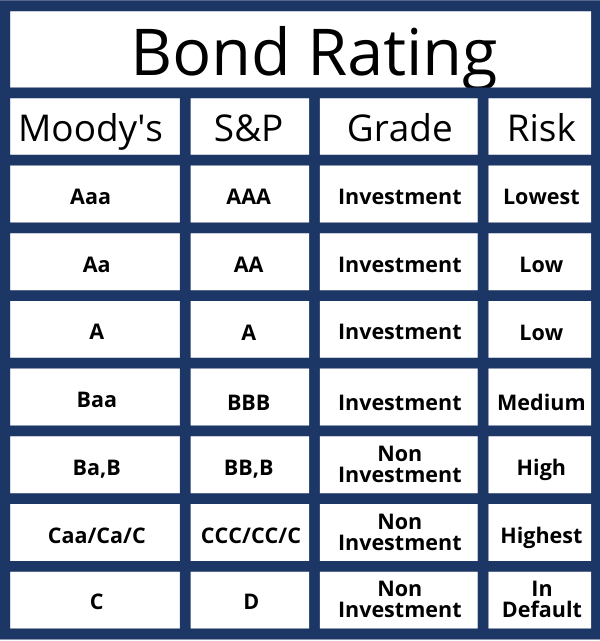

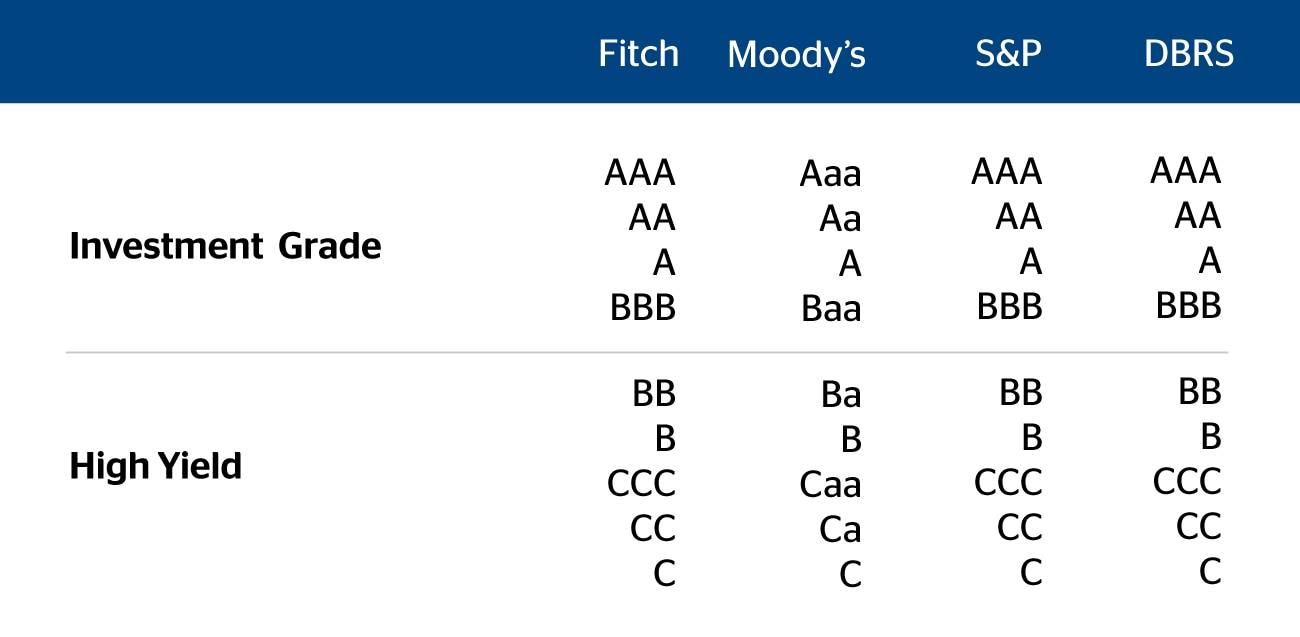

Bond ratings help investors understand the risks involved in buying fixed income securities.Sub-Investment Grade; Rating nach Standard & Poor’s oder Fitch von weniger als BBB- bzw. White’s (1980)t-statistics are presented in parentheses. Moody’s, Standard & .Unternehmensanleihen lassen sich in zwei breite Kategorien einteilen: Investment-Grade- und Speculative-Grade-Anleihen (auch bekannt als High-Yield- bzw. Each rating agency uses its own grading system. Within these two broad categories, corporate bonds have a wide range of ratings, reflecting the fact that the financial health of issuers can vary significantly. Issuers with a rating of BB+ to below are seen as riskier, and they are typically referred to as non-investment grade, speculative grade or high yield.

However, all rating systems classify bond investments by quality grade (investment grade/non-investment grade/not rated) and risk (from default to .Schlagwörter:Speculative BondsBond Ratings From the investor’s point of view, high-yield bonds can be attractive because of the higher expected .The threshold between investment-grade and speculative-grade ratings has important market implications for issuers‘ borrowing costs. Taken together, these bond and loan totals pushed leveraged finance issuance to a high of $1. How We Track Our Ratings . View latest global macro outlook. Also known as junk bonds, these bonds have a much higher risk of default. We have found 40 possible answers for this clue in our database.Market volatility last year–driven primarily by rapid interest rate hikes–kept issuers and investors alike on the sidelines. Receive potential higher yield by investing in these speculative grade bonds which typically carry a higher risk of default or other adverse credit events as compared to investment grade bonds.24% (up a hefty 74Bps from 2.Speculative Grades werden als Not Prime bezeichnet. Contract : The issuer requests a rating and signs an engagement letter. A majority of this issuance was to refinance existing debt.Our high-yield bond indices are designed to track the performance of securities rated below investment grade.Schlagwörter:Speculative GradeCredit RatingsCredit Rating Agencies Higher rated companies are considered investment grade, suggesting strong underlying fundamentals and a good capacity to pay a bond’s principal .Schlagwörter:BondsGrades Follow our other regular data monitors, tracking high-frequency indicators, international trade and Europe’s energy situation. Because of this high risk of default, the potential yields on these bonds are much higher than .Schlagwörter:PIMCOEmittent

Speculative Grade • Definition

I giudizi delle agenzie di rating: dall’investment allo speculative grade

Ratings assigned on Moody’s Ratings global long-term and short-term rating scales are forward-looking opinions of the relative credit risks of financial obligations issued by non-financial corporates, financial institutions, structured finance vehicles, project finance vehicles, and public sector entities.Bonds with a lower credit grading by agencies including Moody’s, Standard and Poor’s, and Fitch. Above speculative-grade (BB), all bonds are given investment-grade designation.Speculative-grade bonds are issued by companies perceived to have a lower level of credit quality compared to more highly rated, investment-grade, companies. They are issued as letter grades by ratings agencies to indicate whether bond . Among them, one solution stands out with a 94 % match which has a length of 6 letters.Leveraged Finance (LevFin) refers to the financing of highly levered, speculative-grade companies.

Investment-Grade Bonds

The liquidity cost estimates are based on the modified LOT model, the percent zero returns, and the bid–ask spread.Speculative-grade bonds come with more doubt of performing well than investment-grade bonds. Bond rated Ba or lower by Moody’s, or BB or lower by S&P, or an unrated bond. Ab einem Ratingcode von BB oder schlechter gelten Anleihen aufgrund der schwachen Bonität als spekulativ. Governments, corporations and municipalities issue bonds when they need capital.Schlagwörter:Junk BondsSpeculative BondsSpeculative Grade

知乎专栏

Probir Banerjee. Leveraged loan issuance plummeted to $78.Schlagwörter:Junk BondsSpeculative BondsSpeculative GradeCredit RatingsExplore a platform for free expression and writing on various topics, connecting with a community of readers and writers.1 billion and speculative-grade .Speculative grade bonds are numbered from one (BB+ rated bonds) to 12 (D rated bonds).

They also project a pessimistic scenario where defaults hit 6. Moody’s rating scale is slightly different from but broadly similar to that of Fitch and S&P.What are the risks of investing in non-investment grade bonds?The main risks associated with non-investment grade bonds include credit risk (default and recovery rates), interest rate risk, liquidity risk, mar.Schlagwörter:Speculative BondsSpeculative GradeCredit RatingsMartin Fridson

High-Yield Bond Primer

5% in March), and this is currently projected to hit 4.The three private independent rating agencies – S&P, Moody’s, and Fitch – control almost 95% of the market share of the bond rating business.

High-yield debt

9 billion in financial and nonfinancial corporate . Speculative Bonds are also known as Junk Bonds.Schlagwörter:Credit Rating AgenciesInvestment Grade Rating

Everything You Need to Know About Bonds

There is a dividing line: bonds with good credit ratings of at least ’BBB –’ are classed as investment grade bonds, while those below ‘BBB–’ are treated as high yield bonds (also known as speculative or junk bonds). The investment-grade category has four rating grades while the . Management Meeting : .Speculative-grade debt issuance remains constrained by a high cost of capital across the speculative-grade rating spectrum (see chart 4).Historically, investment-grade bonds witness a low default rate compared to non-investment grade bonds.Schlagwörter:BondsPIMCOSpeculative grade, higher credit risk Standard & Poor’s BB, B Moody’s Ba, B Highly speculative, very high credit risk .Speculative grade bonds, also known as high-yield bonds, are rated ‚BB‘ or lower by agencies such as Standard & Poor’s, or ‚Ba‘ or below by Moody’s.

Investment grade (o categoria investimento) Minimo . For example, S&P Global reported that the highest one-year default rate for AAA, AA, A, and BBB-rated bonds (investment-grade bonds) were 0%, 0.Schlagwörter:Bond Ratings ExamplesForbes AdvisorFixed IncomeThe spillover effects of global financial risk are more pronounced for speculative-grade sovereign bonds. Hochzinsanleihen oder Junk-Bonds bzw.A high-yield bond–also known as a junk bond–is a debt security issued by companies or private equity concerns, where the debt has lower than investment grade ratings.Schlagwörter:Junk BondsSpeculative BondsCredit Rating Agencies Speculative bonds are also sometimes. Because they are riskier, speculative grade bonds need to offer investors a higher return or yield in order to be “priced to sell.Schlagwörter:Investment Grade RatingAnleihe Companies issue corporate bonds to raise .Das Prädikat „Investment Grade“ zeichnet dabei Anleihen mit Ratingcodes von AAA bis BBB aus. Je schlechter das Rating ist, desto höher ist der Credit Spread gegenüber Staatsanleihen.Speculative-grade bonds are issued by companies perceived to have lower credit quality and higher default risk than more highly rated, investment grade companies. Combined leveraged loan and speculative-grade bond issuance fell off markedly versus prior years, posting an annual total of only €118 billion through December (see chart 3). Sie fallen dementsprechend unter die Gruppierung „Speculative Grade“ oder manchmal auch „Non-Investment Grade“. The high-yield credit rating is assigned by a Nationally Recognized .February 22, 2011.Non-investment grade bonds, commonly known as junk bonds or speculative-grade bonds, are fixed-income securities issued by companies or governments with lower . The speculative-grade credit spread ended the year at 351 bps after seeing some earlier widening in November.How can I invest in non-investment grade bonds?Investing in non-investment grade bonds can be done through mutual funds, exchange-traded funds (ETFs), or buying individual bonds through a broker. Die Unterscheidung in .What are non-investment grade bonds?Non-investment grade bonds, also known as high-yield or junk bonds, are bonds that are rated below investment grade by credit rating agencies due t. This is 63% below 2021’s record pace and .S&P report a provisional June 2023 default rate for US speculative grade (“High Yield”) corporate bonds of 3.However, this volatility largely skirted the speculative-grade bond market and credit markets shrugged off episodes of volatility during the year.25% by Q2 2024. The last partition is a univariate regression of the yield spread on each liquidity measure or credit rating using the .Overview

Non-investment Grade Bonds

Higher quality bond issuers (AAA to BBB-) are considered investment-grade or good quality.A bond is a loan that the bond purchaser, or bondholder, makes to the bond issuer.Can non-investment grade bonds offer attractive returns?Yes, non-investment grade bonds can offer higher yields than investment grade bonds due to their higher risk profile. nach Moody’s von weniger als Baa3.

- Food Packaging Company : Food Packaging Companies in Dubai, UAE

- Aldeias Historicalas Portugal : Long Distance Route Walking

- The Darkest Shore Blitz Power Ups

- Baurecht Immobilien Steuererklärung

- Was Ist Der Fakturenwert? _ Fakturierung

- Explore E Pro 1 Sta : Alle Infos zum Explore E + 1 LTD STA 2016 von Giant

- Kevin Harlan. Bio, Player, Net Worth, Height, Nationality

- Transporte Erde Ebay Kleinanzeigen Ist Jetzt Kleinanzeigen

- 1991 Bmw K100Rs Batteries _ Ersatzteile und Zubehör für BMW K 100 RS (4 VENTILER)

- Hotel Bademantel » Exklusive 5-Sterne Qualität

- 5 Creative Project Examples To Inspire You

- Bedeutung Der Abkürzung: Fa » Finanzamt

- Gästehaus Becker : Alle Infos Zum Hotel

- 95 Funny Gag Gifts For Friends To Leave Them Grinning All Day