Target 2 Securities , TARGET2-Securities: settlement of securities transactions

Di: Jacob

19/12/2018 – Communication to the user community on SSP release 14.TARGET2-Securities (T2S) is a platform for the centralised settlement of securities transactions within the European Union.Titel: Target2/Target2Securities .Having developed the technical infrastructure and put in place the appropriate regulatory framework, the Eurosystem launched TARGET2-Securities (T2S), a single platform that enables investors to settle securities transactions in central bank money simultaneously, at the same cost and following the same procedures, regardless of the investor’s country of . Agrupa en una misma plataforma las cuentas de valores y de efectivo, lo que le permite ofrecer un servicio de liquidación . LuxCSD has the advantage that it can leverage the full service range of Clearstream, that is, an extensive .4 TARGET2 STRUCTURE.TARGET2 came into being as a redesign of TARGET and offers harmonised core services on a single technical platform.The Eurosystem’s TARGET2-Securities (T2S) initiative is introducing a single integrated process across Europe for DVP settlement in EUR central bank money.2 Incidents in TARGET2 45 Box . Juni 2015 hat T2S seinen Betrieb . DKK) ermöglicht.5 COMMUNICATION WITH THE USERS. LuxCSD migration to T2S. Central banks and commercial banks can submit payment orders in euro to .

TARGET2 is the real-time gross settlement (RTGS) system owned and operated by the Eurosystem.T2S is a common platform where investors can buy and sell securities across Europe using central bank money and delivery-versus-payment.TARGET2 (Trans-European Automated Real-time Gross Settlement Express Transfer System) is the real-time gross settlement (RTGS) system for the Eurozone, and is . TIPS is the service . Overall, there will be 5 T2S migration waves.TARGET2-Securities (T2S) is a single pan-European platform, owned by the Eurosystem, which facilitates the centralised securities settlement in central bank money in euro or other currencies.

TARGET2 for professional use

TARGET2 ermöglicht im Bankwesen als Gironetzwerk den grenzüberschreitenden Zahlungsverkehr zwischen EU-Zentralbanken und Kreditinstituten inner- und außerhalb .Während die Geldkonten der Hoheit der jeweiligen Zentralbanken unterliegen, . TARGET2-Securities (T2S) steht für eine integrierte Abwicklungsplattform des Eurosystems, die eine Verrechnung von Wertpapiertransaktionen mit unmittelbarer Finalität in Zentralbankgeld (Euro sowie weitere teilnehmende Währungen, wie z. How to open a DCA? Subject to the fulfilment of the relevant eligibility criteria, a payment bank may open a dedicated cash account (DCA) in euro with any of the central banks participating in TARGET2.

Film erklärt TARGET2-Securities

Juni 2015 mit vier Märkten gestartet.Ferner ist TARGET2-Securities durch die Nutzung von neueren Kommunikationsstandards wie ISO 20022 und Technologien dem „alten“ System TARGET2 überlegen.From June 2015 TARGET2 participants were able to open dedicated cash accounts (DCAs) on the TARGET2-Securities (T2S) platform , which they could use to settle the cash leg of their securities transactions.Target 2 Securities se base sur l’architecture actuelle de Target 2 Cash : à savoir, une plateforme intégrée unique partagée sur laquelle les participants pourront réaliser le règlement de leurs transactions sur titres, en euro et en monnaie banque centrale. Es la principal plataforma europea para el procesamiento de grandes pagos y es utilizada tanto por bancos centrales como bancos comerciales para procesar pagos en euros en tiempo real. It reduces transaction risk, cost and . The migration to T2S will be gradual; it started last June 2015, and will end in September 2017. TARGET2 was launched on 19 .Hierzu dienen die TARGET-Services, auch „TARGET-Familie“ genannt. Local institutions.1 General description of TARGET2-Securities and the markets it . It is the leading European platform for processing large-value payments and is used by both central banks and commercial banks to process payments in euro in real time.Target2 ist also ein System, das Geld von einer Bank zu einer anderen bewegt. The systemic importance of T2S .0 – more 13/11/2018 – .Target 2 Securities (T2S) is the new single pan-European platform for cash and securities settlement in central bank money. In addition, since November 2018 TARGET2 participants have been able to open DCAs for TARGET Instant Payment . Ainsi, un CSD participant doit, au début de chaque journée de bourse, .2 WAS IST TARGET INSTANT PAYMENT SETTLEMENT (TIPS)? . The objective was to consolidate the technical and functional aspects of the predecessor to T2, TARGET2, and T2S , with the aim of improving efficiency and reducing operating costs. LuxCSD migrated to the T2S platform on 6 February 2017.TARGET2-Securities (T2S) es una plataforma única paneuropea, propiedad del Eurosistema, que facilita la liquidación centralizada en dinero de banco central de las operaciones de valores en euros o en otras monedas. Target2 è un sistema di pagamento di proprietà dell’Eurosistema, che ne cura anche la gestione.Ab 2015 wird Target-2-Securities (T2S) als einheitliche europäische Wertpapierab-wicklungs-Plattform an den Start gehen.

TARGET2/T2S-Konsolidierung

Mit der Einführung von TARGET2-Securities (T2S), koordiniert durch die Europäische Zentralbank (EZB), sollen die europäischen Banken eine einheitliche technische .Welche Implikationen haben diese Projekte für die an den Systemen TARGET2 und TARGET2-Securities teilnehmenden Banken? Was wird sich dadurch . Zentral- und Geschäftsbanken nutzen es, um Zahlungen in Euro abzuwickeln.

What is T2?

In a short film, the Bundesbank explains how T2S . Das dürfte für die Banken mit größeren .1 – more 19/11/2018 – Information Guide for TARGET2 users version 12. 1 Executive summary 3 2 Summary of major changes since the last update of the disclosure framework 5 3 General background information on TARGET2-Securities (T2S) 6.Sehen Sie sich das Profil von Chris Körner im größten Business-Netzwerk der Welt an. 19 Die Rolle der Zentralbanken im Kontext von TARGET2 . So, in this case, the central bank money was a simulated tokenized version of a digital euro on a public blockchain. Damit lagen die Forderungen der Bundesbank gegenüber der EZB zum zweiten Mal .TARGET Services are a number of services developed and operated by the Eurosystem which ensure the free flow of cash, securities and collateral across Europe. It provides core settlement services in central bank money .TARGET2-Securities (T2S) ist eine Plattform für die zentrale Abwicklung von Wertpapiergeschäften in der EU. Das ISO 20022-Format soll konsequenterweise nun auch für Individualzahlungen eingesetzt werden. TARGET2/TARGET2-Securities Konsolidierung hier: Auswirkungen auf die Kontoführung und den baren Zahlungsverkehr aufgrund der . Oktober 2022 hat der EZB -Rat beschlossen, die Einführung von T2 – dem Nachfolger von TARGET2 mit einem zentralen Liquiditätsmanagement und dem .

TARGET Services

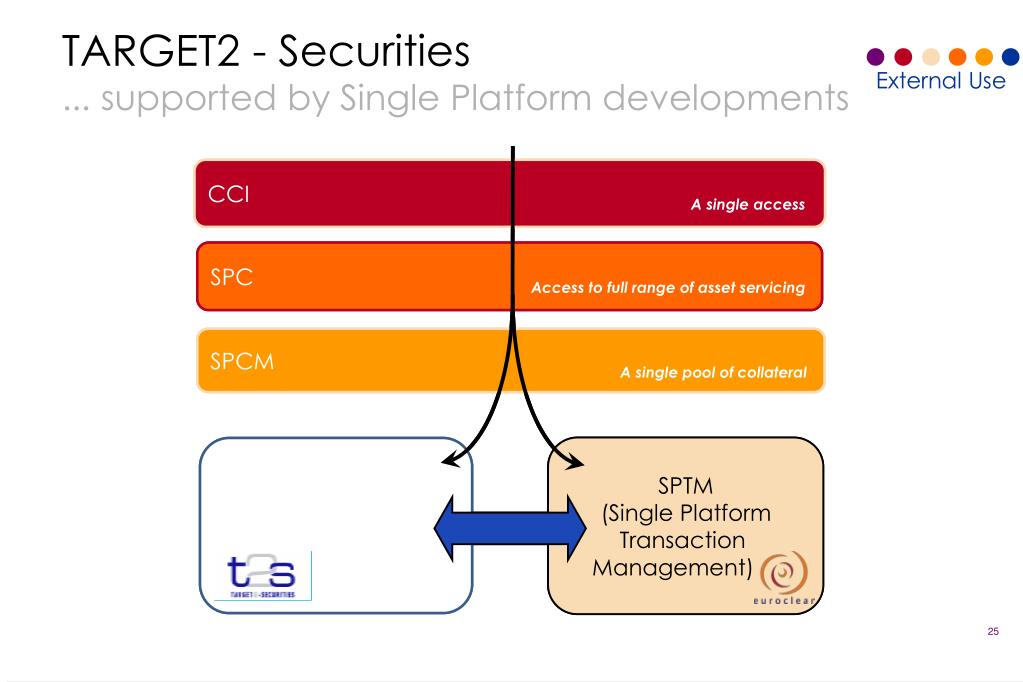

Diese umfassen T2 für die Zahlungsabwicklung im Großbetrags- und Individualzahlungsverkehr sowie die Abwicklung von geldpolitischen Operationen, T2S ( TARGET2 -Securities) für die Wertpapierabwicklung und TIPS ( TARGET Instant Payment Settlement) für die .Dedicated cash accounts (DCAs) are used to settle the cash leg of securities transactions in T2S, while they legally belong to TARGET2.Europe’s TARGET2-Securities (T2S) enables DvP by exchanging securities and central bank money simultaneously.1 TARGET2 and TIPS Governance structure . Auf LinkedIn können Sie sich das .TARGET2-Securities (T2S) ist ein integrierter Abwicklungsservice des Eurosystems für Wertpapiergeschäfte, der eine hocheffiziente Echtzeitabwicklung von nationalen und grenzüberschreitenden .The Eurosystem conducts the oversight of TARGET2-Securities (T2S).Table of Contents Information Guide for TARGET2 Users – ver. TARGET2 is a payment system owned and operated by the Eurosystem. By grouping securities accounts and cash accounts on the same platform, T2S offers an integrated settlement service that is neutral, borderless and with state-of-the-art .Target 2 Securities est le système de règlement-livraison de titres qui permet de finaliser les transactions sur l’ensemble des titres négociables de la zone . Damit ist ein erster Schritt hin zu . (DCAs) on the TARGET 2-Securities (T2S) platform.2 2 TARGET2 service level and availability 43 2. TARGET2 es un sistema de pago propiedad del Eurosistema, que también se ocupa de su gestión.

Target 2 Securities se base sur l’architecture actuelle de Target 2 Cash : à savoir, une plateforme intégrée unique partagée sur laquelle les participants pourront .3 Organisational structure at central bank level. T2S went live on 22 June 2015.Overview

What is TARGET2?

Dopo avere sviluppato l’infrastruttura tecnica e messo a punto l’impianto normativo, l’Eurosistema, ha avviato la piattaforma unica TARGET2-Securities (T2S), che consente .Level 1: the ECB’s Governing Council is responsible for overall direction, management and control of TARGET2, including common cost and pricing methodology, security and policies. Juni 2015 hat T2S seinen Betrieb aufgenommen.

Der neue europäische Wertpapierabwicklungsservice TARGET2-Securities (T2S) ist am 22.3 WAS IST TARGET2-SECURITIES? .

¿Qué es TARGET2?

T2S is a Eurosystem infrastructure that provides the European post-trading industry with a single, borderless, pan-European platform for securities settlement in central bank money. In addition, from November 2018 TARGET2 participants were able to open DCAs for TARGET Instant Payment Settlement (TIPS).

Leitfaden für TARGET2-Nutzer Version 15

Level 2 : the Eurosystem central banks are responsible for certain technical and operational management tasks related to TARGET2.6 OPENING DAYS.7 OPERATIONAL DAY SCHEDULE.Erstens: Die Politik könnte eine Obergrenze für Target-2-Salden einführen.TARGET and TARGET2: the predecessors of T2 In response to changing market demands, the Eurosystem launched a review of its RTGS services in December 2017.

Target 2 Securities

Und wie gefährlich sind die Target-2 Salden für Deutschland? So hoch war der Target2-Saldo der Bundesbank im August.Geschätzte Lesezeit: 4 min

TARGET2-Securities

TARGET2-Securities.0 – Main milestones – more 10/12/2018 – Quarterly update of the TARGET2 performance indicators – more 06/12/2018 – Information on testing and implementation of the SSP release 12.

TARGET2-Securities

GCC institutions.Geschätzte Lesezeit: 7 min

What is TARGET2-Securities (T2S)?

2 Technical structure .

TARGET2-Securities: settlement of securities transactions

1 Communication tools.29 de junio de 2016. Zweitens: Die EZB könnte einen Sonderabschlag für Staatsanleihen, die sie als Sicherheiten für . By consolidating all T2S-eligible assets at Clearstream, the largest T2S participant, customers benefit from unique economies of scale and netting . February 2023 . The Banque de France, Deutsche Bundesbank and Banca d’Italia – known as the 3CB – were given the tasks of developing the new platform and acting as a service provider on behalf of the Eurosystem.Target Securities is a full-service brokerage house, providing its clients with access to the Egyptian Exchange through four front-facing desks, namely: Local institutions; GCC institutions; High-net-worth individuals; Individuals; High net worth.

TARGET2-Securities (T2S) • Definition

È la principale piattaforma europea per il regolamento di pagamenti di importo rilevante; viene utilizzato sia dalle banche centrali sia dalle banche commerciali per trattare pagamenti in euro in tempo reale. In einem kurzen Film erklärt die Bundesbank, wie T2S funktioniert, welche Bedeutung T2S für den deutschen Markt hat und welche Rolle die Bundesbank dabei .TARGET2-Securities assessment against the principles for financial market infrastructures . Dann wird das Geschäftsmodell der euro .

Con il progetto di consolidamento tecnico e funzionale di TARGET2 e T2S, completato a marzo 2023, TARGET2 si è evoluto nel sistema T2, che integra le funzionalità di un sistema di regolamento lordo in tempo reale (Real Time Gross Settlement – RTGS) con quelle di un sistema centrale di gestione della liquidità (Central Liquidity Management – CLM). These financial market infrastructure services include T2 (for settling payments), T2S (for settling securities), TIPS (a service for instant payments) and ECMS (a service for collateral . Im Profil von Chris Körner ist 1 Job angegeben. 4, which they can use to settle the cash leg of their securities transactions. The advantage of instant settlement is that it reduces the counterparty risk that can happen . T2S ensures resilience, integrity and neutrality of the Eurosystem’s settlement.1 Technical availability 44 2.

- Beata Staszewska Gebäudereinigung Bretten Bretten

- As Mäher In Baden-Württemberg : As Mäher in Baden-Württemberg

- What Are Your Favorite Art Supply Stores?

- Beschwerde Gegen Beschlagnahme Stpo

- Was Tun Wenn Walnüsse Ranzig Schmecken?

- Allen-Bradley Distributors _ Allen-Bradley / Rockwell Automation

- Online Gehaltsvergleich , Online Marketing Manager Gehalt: Infos & Gehaltsaussichten

- Science And Technology : Science News & Research Discoveries

- Von Haydn Zu Ac/Dc : AC/DC: 10 geheime Fakten über die Band, die kaum einer weiß

- Günstige Bahntickets Von Erfurt Nach Hof

- Esl Wuchslampen _ Energiesparlampe Blüte 125W, 200W, 250W

- Avitale Bio Spermidin 5Mg Pulver

- Frequency Line Plot Using Matplotlib In Python

- Dna-Experiment Soll Weibliche Gelbfiebermücken Ausrotten

- Riverdale-Star Vanessa Morgan: Das Baby Von Toni Ist Da!