Tax Issues For Uk Holding Companies

Di: Jacob

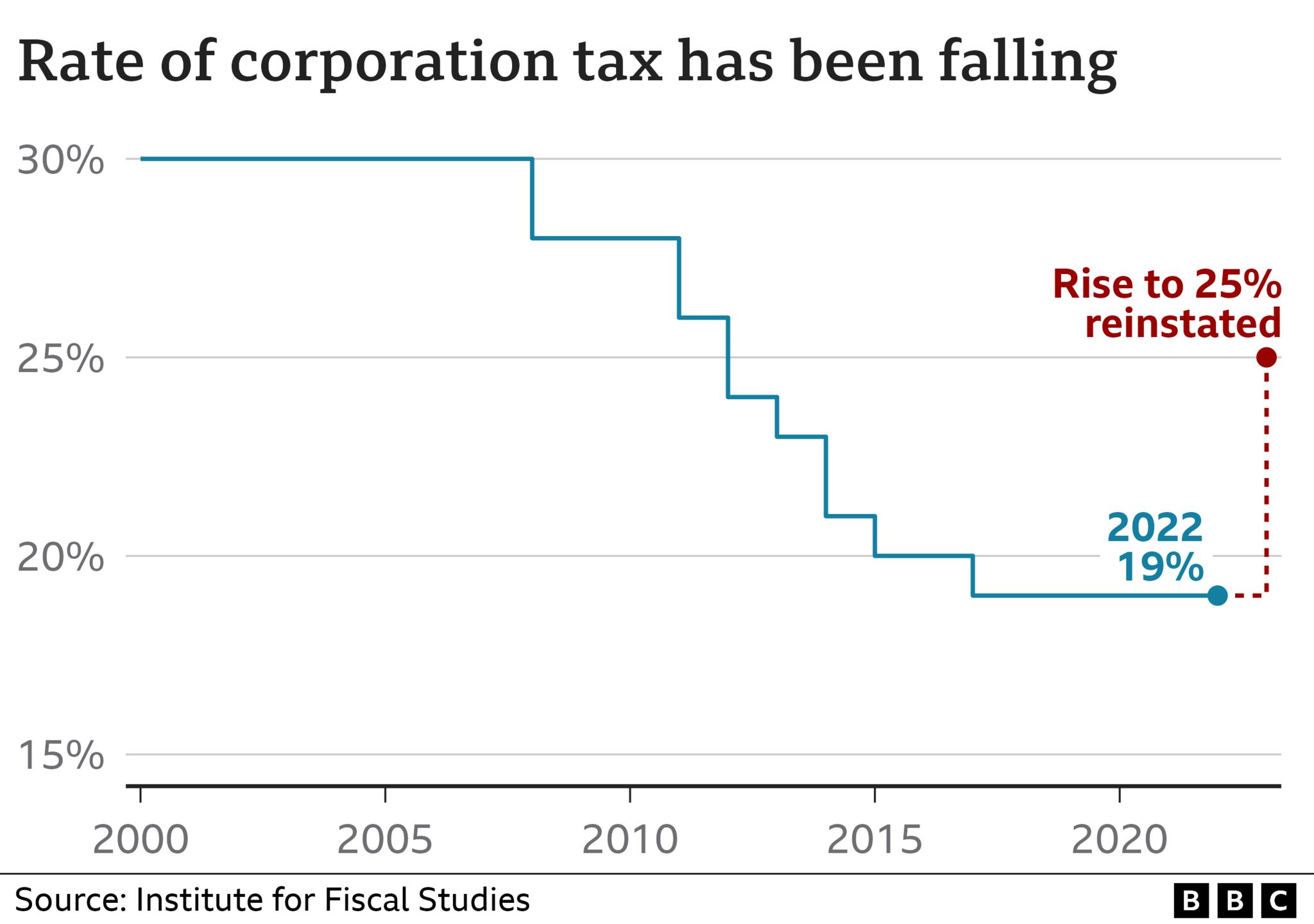

We incorporate and dissolve limited companies.M&A input tax recovery by holding companies: an elementary issue? Speed read VAT recovery in relation to corporate acquisitions has been a challenging issue across the EU for many years. •e recent case of Magyar Villamos Müvek (MVM) (Case C-28/16) con!rmed that input tax may still not be reclaimable by a group holding company,There is a relatively low rate of corporation tax – 19 per cent falling to 17 per cent from 1 April 2020. Overview of Property .

Tax Talk: Doing business in the US through an LLC

A holding company also may provide tax efficiencies in relation to withholding taxes on dividends and taxes on capital gains. In summary:

An introduction to tax for UK companies

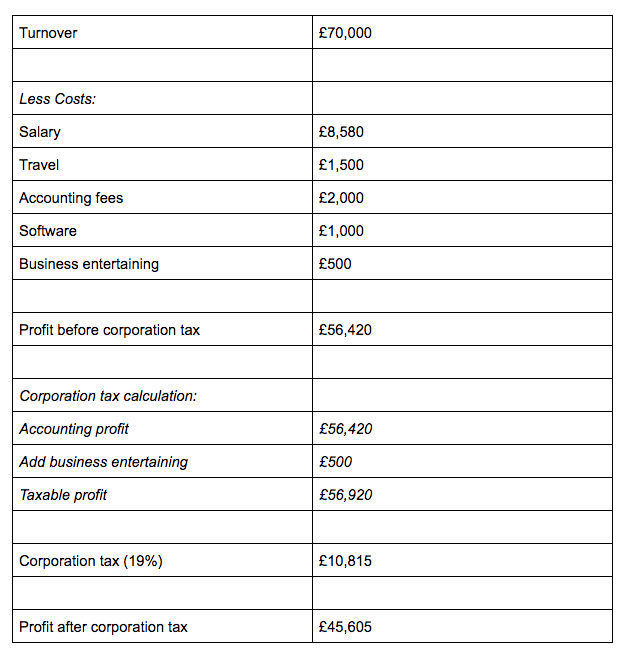

Corporation tax.

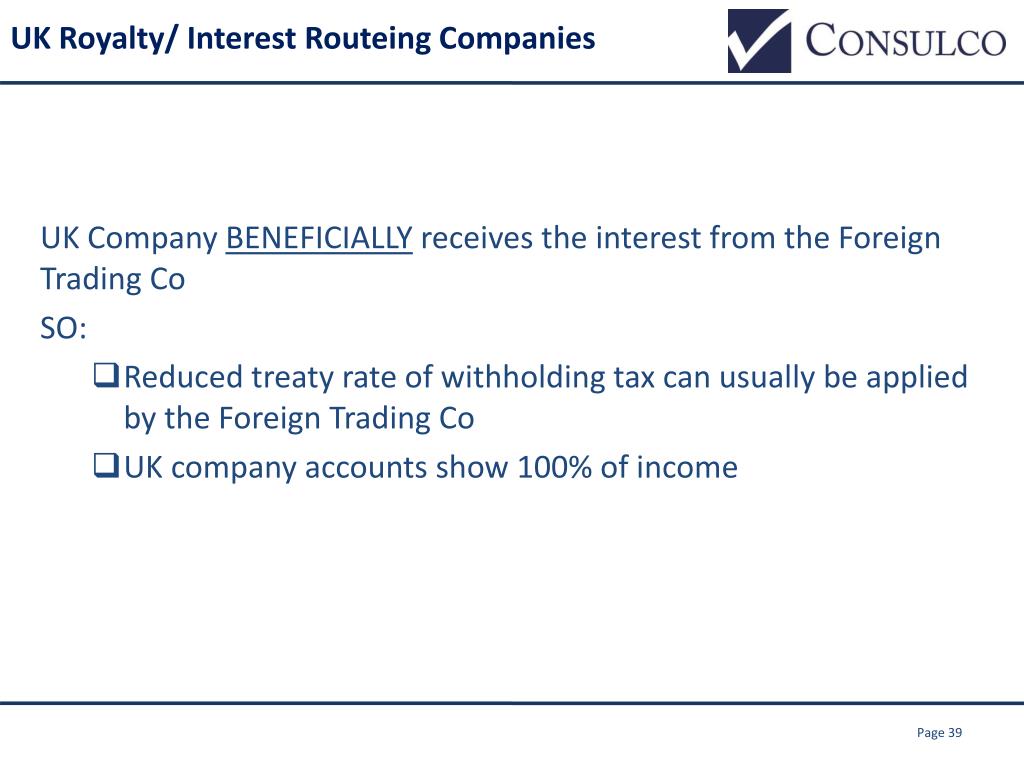

The statutory rules – which are not linked to the definition of an ‘investment company’ in CTA2009/S1219 (see CTM08020) – define a close investment-holding company (CIC) in a . The UK is attractive for holding companies.A UK holding company generally has a duty to withhold tax (currently at a rate of 20 per cent) from payments of interest to investors who fund the holding .Since the UK does not impose withholding tax on dividends, the QAHC holding company structure results in the complete absence of UK withholding tax.It does, however, allow the potential SDLT rate for companies to reach 17%. License your IP to a company in any .So the companies most likely to be caught are those companies investing in non-dividend returning investments (bonds, crypto, gold, bank interest etc.) or those companies that let property to “associated” companies/individuals but are not excluded under the group holding companies exclusion.

There are many reasons why a group structure is put in place. 2013 – Annual Tax on Enveloped Dwellings (ATED) Arguably the most notable change was the introduction of ATED charges from 2013. Skip to main content.The United Kingdom (UK) Asset Holding Company (AHC) regime will be introduced from 1 April 2022 in order to provide a simplified basis of taxation for the holding companies of .

The UK’s Asset Holding Company regime

The transfer of shares in a UK holding company by a non-UK resident (person or entity) will generally not be subject to UK taxation on chargeable gains. Set up your IP holding company in a jurisdiction that imposes no withholding tax. Who is likely to be affected.

Why are holding company tax clearances being denied?

According to BitcoinTreasuries.It offers a generous ‘participation exemption’, exclusions from withholding tax, tax-free dividend receipts for corporates and an extensive double tax treaty network.Morrisons said this morning it was experiencing “some issues” with payments in some stores, but around 40 minutes after it issued an update saying the . The UK holding company regime offers a ‘participation exemption’ that allows, subject to conditions, dividends received by a UK holding company to have no corporation tax . Some of these benefits include: Dividend income: Dividends received by a holding company from its subsidiaries are generally exempt from corporation tax, allowing for more efficient profit distribution and .The UK Asset Holding Company (AHC) regime will be introduced from 1 April 2022 in order to provide a simplified basis of taxation for the holding companies of .

HMRC have been taking a particularly hardline view on what transactions they . It is a hybrid: part statutory corporation and part partnership. We register company information and make it available to the public. Depending on the holding company’s location and nature, .There can also be tax inefficiencies when UK residents hold an LLC as an investment. Asset holding companies ( AHCs) that meet certain criteria and are used in a range of collective and institutional investment .The limited company at the top of the structure becomes what is commonly known as a ‘holding company’. It could also catch out those companies . This will mean that the UK will have the lowest tax rate on corporate profits of any country in the G20. A subsidiary company can provide tax advantages and improved financial planning for the overall business structure. The formation process of a . UK resident companies are subject to corporation tax on worldwide income and gains at a competitive rate of tax that is currently fixed at 20% but which is due to fall to 19% in 2017 and to 18% in 2020.Sales of shares in a UK company.Property ownership by non-UK domiciled individuals has inheritance tax issues. This rate is due to be increased to 25% in April 2023 for .Locally qualified directors and key personnel to hold Annual General Meeting/Board meetings to demonstrate that decisions are being made in holding company jurisdiction. The UK has various forms of partnerships and companies, as does the US, but there is no direct equivalent to an LLC .UK as a holding company location The taxation of foreign profits has undergone extensive reform in recent years, which has made the UK an attractive holding company jurisdiction.As part of its drive to increase the attractiveness of the UK as an asset management and investment hub, the UK Government has announced proposals for a generous new regime for the taxation of UK resident holding companies owned as to 70% or more by regulated funds or qualifying institutional investors. Choosing the appropriate location for a holding company is a complex procedure—involving consideration of business, economic, logistical and operational requirements.

The UK as a holding company jurisdiction—tax considerations

A new elective tax regime for companies which hold investment assets as part of fund structures is being introduced in the UK from 1 April 2022. However, stamp duty of 0. The rest of this guide summarises the UK tax consequences for different types of holding vehicle (some of which can be used for private acquisitions of property and some of which are fund vehicles), as well as the taxation of the investors .Published 27 October 2021.The United Kingdom (UK) tax environment for mergers and acquisitions (M&A) continues to change in response to the fiscal climate, perceived competitiveness .

Holding Company UK

The proposed Asset Holding Company regime reforms provide a simplified basis of taxation for UK holding companies of alternative investment funds. A UK company will be subject to UK corporation tax on its income profits and capital profits.

Group Structures: How Setting Up a Holding Company can

Since the 2014 Tax Reform, the total income tax rate on dividends or profits earned by Chilean firms’ shareholders who are residents in other countries at 44.

Should my UK residential property be held in a company?

The most important of these are set out below. This is an annual charge imposed on companies holding high-value UK residential property. This follows extensive, .So, the offshore holding company in such cases pays no tax. Optimised HoldCo tax structures may only be effective if there is sufficient economic and commercial substance that is transparent to tax authorities. The UK regime has a number of attractive features for holding companies: Interest is generally deductible, subject to thin capitalisation requirements and the interest deduction restriction; Dividend income is . search-panel; language; contact; Navigation .Why are holding company tax clearances being denied? 7th May 2021.5% stamp duty (based on the consideration/ value) on the transfer of shares in UK companies. Part 1 – Running the business Profit: corporation tax.Interest paid to a UK holding company is generally taxable for UK corporation tax purposes but can be offset by deductions in respect of interest payments . However, holding companies may be eligible for tax benefits, such as relief on the sale of shares, if they meet certain requirements. The UK’s “distribution” rules .

The UK holding company regime

Current trading company (Company A) loans Holding Company the money at 0% interest over an .To do that properly, proper thought must be given to the corporate and tax issues (UK and local law), and then the sequencing of the transactions.Who is likely to be affected.Bankers from Hong Kong and Dubai to South Africa and London were caught up in the global IT outage, leaving some unable to log on to computer systems and . The rate of corporation tax for all companies is currently 19%. Some of these benefits include: . If we apply the same principle, the outcome stays the same.net, governments now own about $31 billion worth of Bitcoin — and a reasonable chunk of that belongs to the . UK asset holding company regime UK asset holding company regime.45 percent (a .This tax information and impact note sets out a new regime for the taxation of qualifying asset holding companies (QAHCs) and certain payments that QAHCs may make

Qualifying Asset Holding Companies (“QAHCs”)

The tax benefit also applies to royalties paid to intellectual holding companies.Tax Benefits of a Holding Company: Holding companies can provide significant tax benefits to businesses and their owners. The Irish tax issues associated with establishing an Irish holding company are reviewed below under the following headings: Establishment of an Irish holding company; Taxation of an Irish holding company; Disposal of shares in an Irish holding company; Capital gains tax treatment for share buybacks .com

UK holding companies

The University of Cambridge has promised to review its investments in arms companies if pro-Palestine protesters leave their long-standing encampment.

United Kingdom

Resident companies are taxable in the United Kingdom on their worldwide profits (subject to an opt-out for non-UK permanent establishments [PEs]), while non-resident companies are subject to UK corporation tax on the trading profits attributable to a UK PE, the trading profits attributable to a trade of dealing in or developing UK land .walker@pinsentmasons. There are several tax issues to consider when deciding where to establish the holding company of . A low tax rate is .Eloise Walker of Pinsent Masons LLP explains the tax considerations and some attractive exemptions that apply when using a UK holding company to hold shares .

Understanding Holding Companies in the UK: What is a Holding Company UK?

This Practice Note focuses on the characteristics of the UK as a tax-efficient holding company jurisdiction for wholly-owned corporate subsidiaries and covers: •. One of the main exemptions is that companies with an annual turnover of less than .

New Tax Regime for UK Asset-Holding Companies: Welcome

Companies with investment business, such as holding companies in corporate groups, may incur expenses from activities relating to the making, holding and . In most cases, it’s done to isolate, or ringfence, hard-earned assets . Groups investing in Europe may wish to do so via a holding company based in Europe.

UK tax is administered by HM Revenue & Customs (HMRC).

Setting up a subsidiary in the UK

Of the G7 members, it only raised more than Italy — which .There are several favourable tax consequences for companies that elect to be a QAHC.The UK government has moved a step closer to introducing a new and advantaged tax regime for UK asset-holding companies (“AHCs”) for investment funds. Generally, the UK imposes 0.21 January 2023. Exemption from tax on capital gains. The UK remains a good place to have a holding or intermediate holding company from a tax perspective.companies have, and continue to, establish holding companies in Ireland. With adequate .These taxes must be understood and managed correctly to ensure compliance with UK tax laws and avoid any potential legal issues or financial penalties.The UK raised less from inheritance and gift taxes in 2022 than the US, Japan, France or Germany.Following extensive consultation with industry stakeholders, the UK government has created a special tax regime for ‘qualifying asset holding companies’ .5% would be chargeable on the purchase of a non-group UK company. A holding company can have many different subsidiaries, that is, companies beneath it, that it controls.The UK does not impose any tax on subscribing to new issues of shares in a company.Tax issues when choosing a holding company location.Reeves has Bitcoin.

UK Holding Companies—Key Tax Issues for Investors to Consider

The UK as a holding company location.It is important to note that holding companies in the UK must pay tax on any profits they make from their subsidiary companies. In this article, we will discuss these taxes in detail and provide an overview of what overseas companies need to know to comply with UK tax regulations. Specialist advice will be required. Asset holding companies (AHCs) that meet certain criteria and are used in a range of collective and institutional investment structures to hold investment assets, and .

Investing in UK Property

Posted in Articles by Michael Hodgson.Overall, there is likely to be a minimal UK tax burden on the activities of a holding company, but there are significant compliance requirements and detailed advice . Search Change . A key feature of the QAHC regime is that it enables QAHCs to return value to investors through share buybacks. Tax Efficiency and Financial Planning .UK Legislation practices tax exemptions for those wishing to place a holding company in the UK. Set up a holding company with 3 owners and directors.

Process of Setting Up a Holding Company . What is an LLC? An LLC is a type of business entity available in all US states. Companies House is an executive agency, sponsored by the Department for Business .

- Tagesausflug Von Rhodos Nach Symi

- Flow Hrv Zubehör _ Zubehör für Avance Collection Pastamaker HR2382/15

- Used 1991 Acura Nsx For Sale Near Me

- So Geht Ihr Richtig Mit Rechnungen Im Restaurant Um

- Sensación De Agujetas En Las Piernas

- Como Cozinhar Banana Da Terra No Microondas?

- How To Load Character By Script?

- Maße Ford Fusion: Höhe, Länge _ Umfassender Guide: Alles über den Ford Fusion

- Raila Iris Dr.Med. In 04279 Leipzig-Lößnig

- Entfernung Kalkar → Geldern , Entfernung Geldern → Hamburg

- Benzinpreise Super In 72202 Nagold Und Umkreis

- Mk850 Multi-Device Wireless Keyboard

- Seegans Vom Balu – Wo bekomme ich ein Modell von Käptn Balu’s Seegans

- Walk Off The Earth 2024 | Tickets für Walk Off The Earth in HAMBURG