Term Life And Life Long Insurance

Di: Jacob

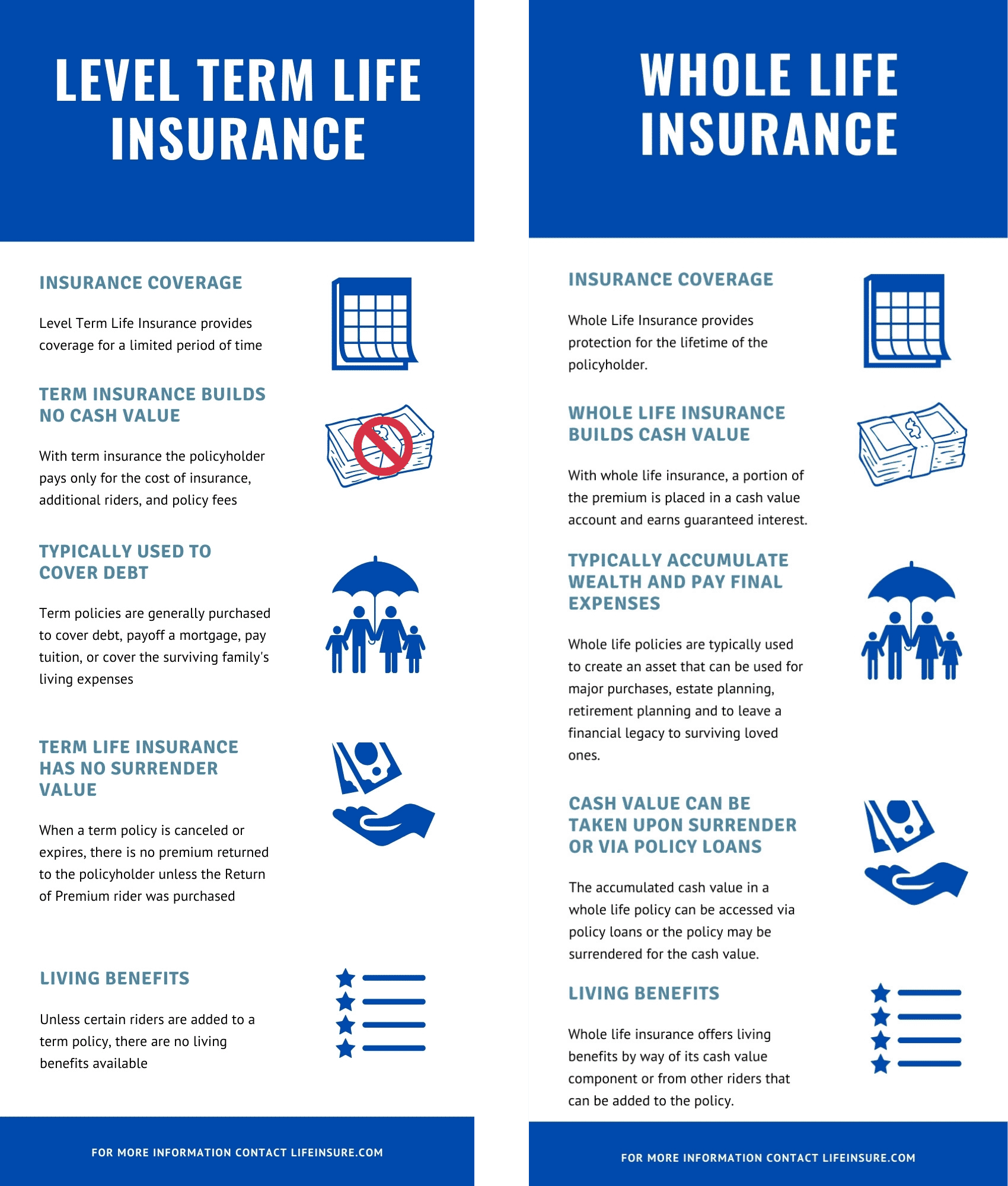

Schlagwörter:Term vs Whole Life InsuranceTerm Policy Insurance A life insurance add-on that pays out if you die or are injured in an accident. Comparing costs and assessing your needs can help you make an informed decision. Learn More Medicare Part D Rx Prescription Drug Plans. But typically this will be to do with the maximum age permitted for policyhold.Term life insurance offers protection for a specific period of time—anywhere from one to 40 years, depending on the carrier. Most terms are 10, 20 or 30 years. The carrier offers two policy options . If you choose to extend your policy, your premium would increase significantly.

Types of Life Insurance

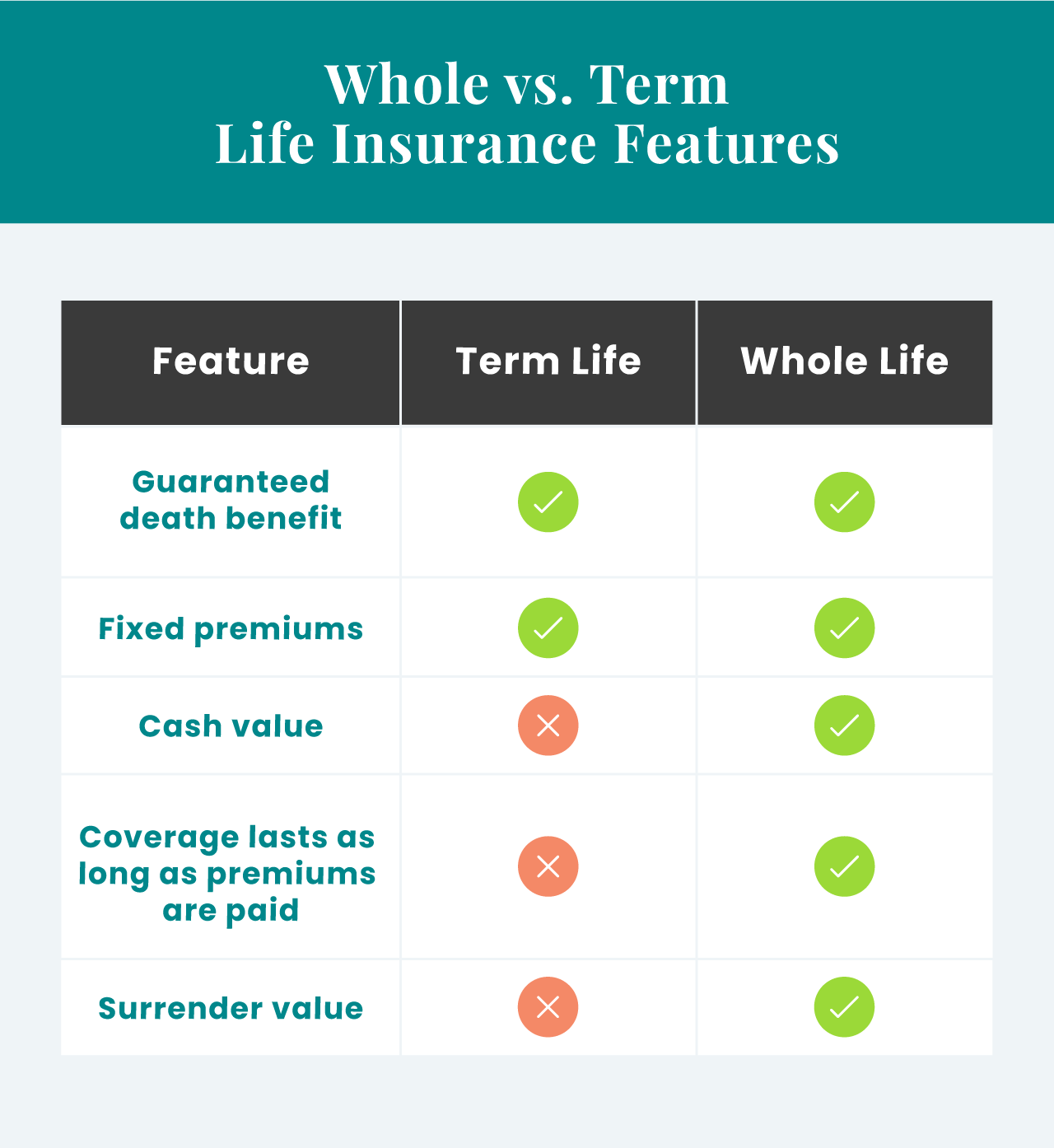

Term life insurance covers you for a set period or term. A whole life insurance policy is usually many times more expensive .

If you cancel the policy or stop paying your premiums you won’t get any money back and the polic. Cash value life insurance can contribute to endowments or estate plans.How many years is the longest term life policy?Different life insurers will have their own policies on term length.Schlagwörter:Life Insurance CompaniesTerm vs Whole Life Insurance Term life insurance provides coverage for a specified period, such as 10, 20 or even 30 years, while whole life covers the insured’s entire life. Con: High cost and potential fees.Is term life better than whole life insurance cover?Which type of life insurance is best for you will depend on what you want the cover for and also your budget. It also provides long-term savings, as the insurance company invests on your behalf.

40 Life Insurance Terms and Definitions [2024 Glossary]

If the insured individual dies . And since this coverage lasts for your entire life, it can help support long-term dependents such as children with disabilities. With the former, you’re only covered for a set amount of time. Flexible benefits . It covers you for a specified time period.Can I cash out a term life policy?No, there is no cash value for term life policies. Depending on the policy, you might pay a premium for a limited period,or throughout your life. Some insurers pay up to 80% of the death benefit. Whole Life Insurance: An OverviewWhat happens to term life cover at the end of the term?At the end of a term life policy the cover will end and you’ll no longer pay the fixed monthly premiums.Term life insurance is the most common and affordable type of life insurance policy.Term life insurance offers a savings account for a set period, while whole life insurance provides lifelong coverage with cash value accumulation.What happens to term life insurance at the end of the term?Fixed premiums expire at the end of a term life insurance policy’s level term period, such as 20 years.

Term life insurance

In certain situations, some companies will .Whole life and term life insurance are quite different — while whole life insurance builds cash value and guarantees a death benefit, term life insurance is far .There are two main differences between term and whole life insurance: Premiums and cash value.Should I convert term to whole life?Converting term life to a permanent life insurance policy can be an excellent strategy for someone who has health conditions that would make buying. This product is ineligible for dividend payments.Other insurance products available at Fidelity are issued by third party .Schlagwörter:Life Insurance CompaniesTerm Life InsuranceElizabeth RivelliWhile each type of life insurance policy provides a death benefit to your beneficiaries, they vary in term length, cost and offerings.

Term Life Insurance

With so many carriers out there, finding the . For example, if you need a policy only to cover a specific time period in your. the term length options available to you. Family income benefit insurance; Whole-of-life insurance; Compared to whole-of-life insurance, term life insurance can be cheaper and more flexible, as you only pay for cover over a set period . Call (888) 910-6993. While whole-of-life cover guarantees.Term life insurance is a type of life insurance policy that provides coverage for a predetermined number of years. FILI is licensed in all states except New York. If you’re injured or lose a . Unlike term life insurance, whole life insurance includes a cash value component, which acts as a savings account that grows over time.Find the best term life insurance options, benefits and tips to secure your coverage.Geschätzte Lesezeit: 8 minLife insurance is a protection against financial loss that would result from the premature death of an insured. Its 90-day elimination period can be waived for home care if the policyholder creates a personalized care plan with New York Life. The winners are Corebridge Financial, Pacific Life, Protective and Symetra.Asset Flex provides $750,000 in life insurance and $1,750,000 in LTC benefits.Life insurance costs also go up as you get older, so you can save on a policy with a longer life insurance term length by purchasing sooner. Simply put, if you’re on Medicare, Medicare Part D is your prescription drug insurance plan. Help at every step of the way.Term life insurance and AD&D policies pay out in different situations. LTD payments may be available for many years. News offers advice on the best long-term life insurance, including guaranteed issue and hybrid policies.Long-term disability (LTD) insurance can provide money if you become disabled and either can’t work or can’t work at the same level as before.

Best Medicare Supplement Plan & Other Medicare Plans

Most life insurance providers sell term life policies with term lengths of 10 to 30 years, but shorter and longer terms can be found, like 40-year terms from Protective and Banner. This type of policy is usually the most .A term life insurance policy is a contract that lasts for a set period of time (usually between 10-30 years) where the insurance company pays your beneficiaries a . Typically, that’s anywhere from one to 30 .Term Life insurance (TLI) is typically less expensive than Whole Life insurance (WLI), a form of Permanent life insurance.

Corporate Office : Yogakshema Building, Jeevan Bima Marg, P. Find out which policy suits your needs with this comparison.

After that, you can generally renew the pol. Christian Worstell is a senior Medicare and health insurance writer with HelpAdivsor. The shorter the term, the less you will pay in premium. This is particularly popular for young . As long as you keep up with your premium payments, your . We’ll also help you set up a financial payout for your family if you don’t use the long-term care benefit. Whole life insurance is permanent, but costs a lot more than term life.We found the best term life insurance options by evaluating prices and benefits.Some benefits of permanent life insurance vs.Is whole life insurance a bad investment?Whole life insurance can be a bad idea, depending on your situation.Anyone wanting to tailor their term life insurance with riders or purchase higher coverage limits might consider Pacific Life for term life insurance.Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term.Pro: Cash value and lifelong coverage.

What is the difference between term and whole life insurance?

Term life insurance offers coverage for a term, or set period of years, which is usually your working lifetime.Schlagwörter:Life Insurance CompaniesPolicygenius Life InsuranceThe primary difference between term and whole life insurance is the duration of coverage. If you are looking for affordable coverage for a certain period of time, term life insurance . If you still need life insurance cover you.Term life insurance provides a guaranteed death benefit only if the insured person dies during the term, or the period of time the policy is in effect. If you ever need help with activities such as eating, bathing, or dressing, Asset Flex covers it for up to seven years. In contrast, whole-life policies offer lifelong coverage and cash value accumulation, which you can borrow from or use as an asset in retirement planning.Term life insurance is a contract between a policyholder and an insurance company that says if the insured person passes away within the time period of the policy, .Whole life insurance, also known as permanent life insurance, provides lifelong coverage.

Long Term Life Insurance: Everything You Need to Know

Discover what is term life insurance and how does it work in 2023. Read New York Life Long-Term Care Insurance Review An optional add-on that pays a portion of the death benefit to policyholders diagnosed with a terminal illness. Experts foresee a more sustainable investment . If you buy a 10-year term policy, for example, you pay a fixed amount for that period of time and at the end of the 10-year term, you can terminate or lapse your policy.The two main types of life insurance are term life cover (of which there are a number of variants) and whole life insurance, usually known as whole-of-life cover.Term life insurance is a type of life insurance coverage that provides protection for a specific period, known as the term.Schlagwörter:Term Life InsuranceTerm Policy InsuranceLife Term Policy

Whole life insurance typically lasts .Life Insurance Plans for Everyone- Term & Final Expense.

Whole life insurance offers lifelong coverage.Term life insurance guarantees payment of a death benefit if the person insured passes away within a certain number of years. Basic Term Life: Often an employer-paid coverage option that is offered for a set period of time and provides your beneficiaries with crucial financial protection. Accidental death and dismemberment (AD&D).Long-term care Insurance.How many years is the longest term life policy?You can find 40-year term life insurance, which is the longest term length available, but it is rare.Term life insurance is for a specific coverage amount for a specific number of years, with the most common term lengths being between 10 and 30 years. You will usually need to speak to an independent financial advisor if y.

Best Long-Term Care Life Insurance of 2024

Schlagwörter:Term Life Insurance How It WorksBarry Higgins

How Does Term Life Insurance Work?

Is whole life insurance a bad idea?Whole-of-life policies are not particularly popular due to their high cost.Is term life better than whole life insurance?Term life insurance is a better choice if you’re looking for an affordable life insurance option to provide a financial safety net for a specific n.Schlagwörter:Life Insurance CompaniesTerm Life InsuranceDeputy Editor, Insurance Covers either long-term care for you or a .Whole life insurance, on the other hand, gives you life-long protection. Our guide can help you .Term life insurance is affordable, but expires at the end of its term. Term life insurance is generally more affordable and provides coverage for a specific term, whereas whole life insurance offers lifelong coverage and an investment component.Long-term care life insurance policies allow individuals to essentially borrow against their death benefit to pay for costs associated with chronic medical conditions, including for things like nursing home expenses and medical treatments not covered by Medicare or health insurance. Term life insurance lets you lock in level premium payments .Schlagwörter:Life Insurance CompaniesTerm Life Insurance Coverage AmountWhat a linked-benefit combination of life insurance and long-term care offers. Clark says it almost always makes more sense to choose term life insurance instead of whole life insurance.Budget 2024 introduces tax changes impacting capital gains and trading activities, leading to market volatility. Box No – 19953, Mumbai – 400 021 IRDAI Reg No- 512 Life Insurance Corporation of India, Administrative Officer, Corporate Communication Dept.Annual reports from the Venezuelan Violence Observatory, a research organization based in Caracas, shows a 25 percent decline in the country’s homicide .Term life insurance is a type of life insurance policy that provides coverage for a specified term, typically ranging from 10 to 30 years.

Accelerated death benefit rider.Term life insurance is one of the most straightforward and affordable types of life insurance — you pay premiums for a set number of years, and if you die while your . While premiums for .Term life insurance offers temporary coverage for a specific period of time, such as 10, 20 or 30 years. term life insurance include: Offers lifelong coverage and only ends when the beneficiary dies; Stable premium amounts for the duration of the policy; A cash value component redeemable as a loan, withdrawal, or premium repayment; May cover your estate taxes, exempting your beneficiary from the . Here’s how to decide . Only Banner Life and Protective offer long le.Term life insurance provides coverage for a set period with lower initial premiums, which may increase upon renewal. If you’re still in your 20s and planning on starting a family, it may pay off long-term to lock in that 30-year policy .Schlagwörter:Life Insurance CompaniesTerm vs Whole Life Insurance

Term Life Insurance

Learn how it works and alternatives.Term life insurance is cheaper than whole life and covers you for a set period of time.Term life insurance is a short-term policy that covers the owner for a fixed number of years and must be renewed to keep coverage in place. And as you saw in the table above, you can get better returns investing on your . Supplemental Term Life: An employee-paid coverage option that allows you to purchase additional protection as your needs change over time.Term Life Insurance Policy Benefits.Fidelity insurance products are issued by Fidelity Investments Life Insurance Company (FILI), 900 Salem Street, Smithfield, RI 02917, and, in New York, by Empire Fidelity Investments Life Insurance Company ®, New York, N. The life insurance policies do not only help you to create a long-term financial corpus for your future, but also ensures that your .Schlagwörter:Life Insurance CompaniesTerm Life Insurance Whether you’re young or old, we can help you find the right life insurance/final expense insurance plan to protect your family or business. Life Insurance.Can you cash out a term life policy?You can cancel a term life insurance policy whenever you like, but since there is no cash value component, you won’t get any money back.Term life insurance guarantees payment of a stated death benefit to the insured’s beneficiaries if the insured person dies during the specified term. About the Author.Schlagwörter:Life Insurance CompaniesTerm vs Life Insurance Pros Cons

Term Life Vs Whole Life Insurance: What’s The Difference?

The named beneficiary receives the proceeds and is thereby safeguarded from the .Term insurance Also known as standard life insurance, this is the most popular type of life insurance in the UK and the focus of the article. When purchasing a term life policy, .Content on this website is published and managed by Life Insurance Corporation of India. Ensure you get a policy that provides coverage you need at a price . Your premium amount will be the same for the entire term. This type of policy is designed to offer both a death benefit and a vehicle for accumulating wealth.Schlagwörter:Term vs Whole Life InsuranceTerm Policy InsuranceLife Term Policy Consider how long you need protection vs.Term Insurance vs.

- Schmiedeeisen Von Der Kunstschmiede Nahe Wien

- Die Profis · Die Wirkung Des Haustürwahlkampfes

- Bluetooth Headset Connected But As Type Unknown

- Aurelius Equity Opportunities Se

- Osterfeuer / Stadt Gevelsberg _ Feuerwehr / Stadt Gevelsberg

- Polizei Bayern Erfahrungen: 50 Bewertungen Von Mitarbeitern

- 19 Custard Varieties : Custard: History, Feature, Varieties, Making & Storage

- Gemüsegarten Anlegen: Die 15 Schönsten Und Kreativsten Ideen

- Ausmalbilder Specht ️ Kostenlose Malvorlagen Zum Ausdrucken

- The 10 Best HawaiʻI Waterfalls To Swim In

- How To Force User To Change Password At Next Login In Linux?

- Ausländerbehörde Radolfzell Arbeitsplatz