The Definition Of Capital Employed

Di: Jacob

CAPITAL EMPLOYED definition: the total value of the assets that a company uses to produce income: . It represents capital raised and invested at a specific time.Der Return on Capital Employed ( deutsch „Rendite auf das gebundene Kapital“, Abkürzung: ROCE) ist in der Betriebswirtschaftslehre der Anglizismus für eine . It can be defined as equity plus loans which are subject to interest. In other words, ROCE is the measure of how well and efficiently a company is able to produce dollars in net operating . Traders can use ROCE as part of their fundamental analysis to establish whether a company is utilising its capital well .

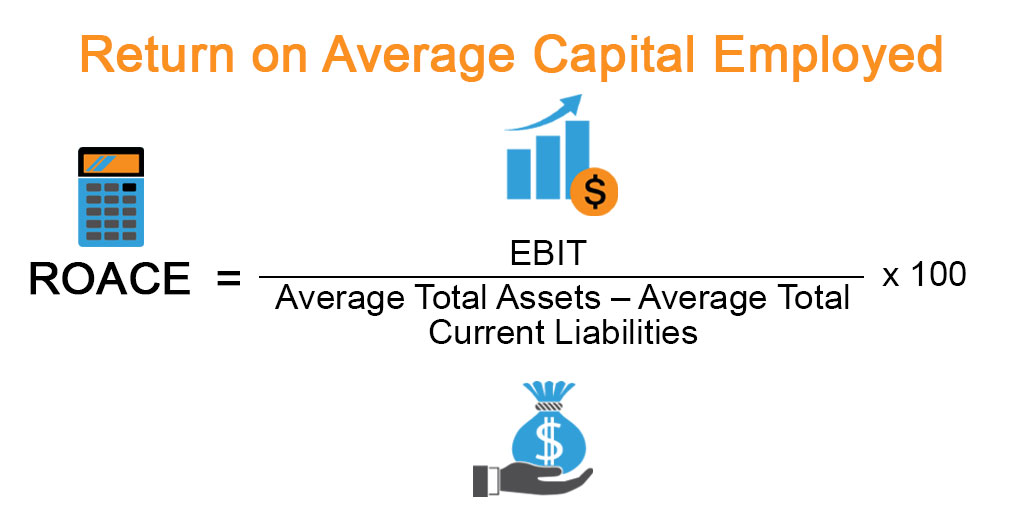

More specifically, all the assets sitting on a company’s balance sheet – i. It can be calculated using the following formula .Capital Employed = Share Capital + Reserves and Surplus + Long-Term Borrowings.Return on Average Capital Employed – ROACE: The return on average capital employed (ROACE) is a financial ratio that shows profitability versus the investments a company has made in itself. It also refers to the value of all assets .While ROCE uses Capital Employed which is Shareholder’s Equity plus Non-Current Liabilities, ROIC uses Invested Capital which also includes Shareholder’s Equity but the Liabilities portion is a bit different.

Return on capital employed (ROCE): Definition and how to calculate

Financial capital is defined in various ways but has no widely accepted definition having been interpreted as equity held by shareholders or equity plus debt capital including finance leases.Capital Employed has many definitions.return on capital employed.The term “capital employed” refers to the total amount of funds a company uses to generate profit from its business. It is calculated as ((fixed assets + current assets) – current liabilities). The formula to calculate capital employed is as follows: Total assets – current liabilities = equity + non-current liabilities.comHow to Calculate Capital Employed From a Company’s . In other words, this ratio can.What is Capital Employed? Capital employed (CE) is the total capital a firm uses in a specific period in the form of investments, acquisitions, and other profit-generating .

Profitability of 133%.

Capital Employed: Definition, Calculation, Interpretation

Understanding capital employed helps businesses assess their efficiency in utilizing resources to generate returns. Der Return on Capital Employed ( deutsch „Rendite auf das gebundene Kapital“, Abkürzung: ROCE) ist in der Betriebswirtschaftslehre der Anglizismus für eine betriebswirtschaftliche Kennzahl, die dem in einem Unternehmen gebundenen betriebsnotwendigen Kapital den erzielten Jahresüberschuss gegenüberstellt. Below is another formula used: Capital Employed = Fixed Assets + Working Capital. Here, fixed assets, which are sometimes called capital assets, are . the total funds invested in a business made up of SHAREHOLDERS‘ funds and long-term LOAN CAPITAL. Instead of Non-Current Liabilities, it uses all the interest-bearing debt which can be in both Current Liabilities and Non-Current Liabilities.Return on capital employed (ROCE) is a popular financial metric that helps investors, analysts and managers assess the overall profitability of a business. It is the total funds invested in the company for operations.Return on capital employed (ROCE) is a financial ratio that measures a company’s profitability and the efficiency with which its capital is used.Capital employed refers to the total amount of capital invested in a business to generate profits.Return on capital employed or ROCE is a profitability ratio that measures how efficiently a company can generate profits from its capital employed by comparing net operating .Definition of Capital Employed.Capital employed is the total amount of equity invested in a business. Both of these measures can be found on a company’s balance sheet.

Kennzahl: Capital Employed

Capital employed is defined as the net operational assets of a business. Return On Capital Employed (ROCE) refers to the financial ratio that helps assess the return that a company or business generates with respect to the capital it puts to use. Return on capital employed formula is calculated by dividing net operating profit or EBIT by the employed capital. But each capital, at the same time, is another form of wealth.Capital Employed Capital employed, also known as funds employed, is the total amount of capital used for the acquisition of profits.Capital Employed = Total Assets – Current Liabilities.

In other words, the dollar amount of all the company assets employed in a business determines the capital employed. The ROCE ratio is considered an important profitability ratio and is used often by investors when ., Sum total of all assets fixed or current (gross) Zu beachten ist, dass Kapital zur Finanzierung von nicht .Capital Employed ist das im Unternehmen beanspruchte betriebsnotwendige Kapital, für das die Kapitalgeber (Fremdkapital, Eigenkapital) einen Verzinsungsanspruch . It also refers to the value of all .Put simply, capital employed is a measure of the value of assets minus current liabilities.Return On Capital Employed Definition Return on Capital Employed (ROCE) is a financial ratio that measures a company’s profitability and the efficiency with which its capital is employed.Definition of Return on Capital Employed.

What is Return on Capital Employed (ROCE)?

It refers to the value of all the assets that are employed in a business. This ratio aims to show how .ROCE=(Profit Before Interest and Tax (PBIT)Capital Employed)×100ROCE=(Capital EmployedProfit Before Interest and Tax (PBIT) )×100.Return On Capital Employed Definition. In other words, the ratio measures how well a company is generating profits from its capital. It is commonly represented as total assets less current liabilities (or fixed assets plus working capital requirement). Simply put, all businesses run to earn profits and, for that purpose, need to employ .33 (ROCE) So every £1 employed by your business earns £1. It is equivalent in value to the company’s NET ASSETS in its BALANCE SHEET.

Variations of the return on capital employed use .

Der Return on Capital Employed (Abkürzung: ROCE, deutsch: “Rendite auf das gebundene Kapital” oder “Kapitalrendite”) gibt an, wie effektiv ein Unternehmen sein eingesetztes . The amount of capital employed can be derived in several ways, some of which yield differing results. It is probably one of the most frequently used ratios for assessing the performance of organizations. The competing company is much bigger than yours, its EBIT is £700,000. Although capital . That means it includes all the assets that are used to generate income, such as cash, inventory, accounts receivable, and fixed assets. See SHAREHOLDER’S CAPITAL EMPLOYED, LONG-TERM CAPITAL EMPLOYED.

Capital Employed Definition & Examples

This capital could be in the form of money, goods, or services. It is widely used in many financial metrics (often called return ratios) to measure the profitability and capital efficiency of a business. Top tips on managing your cash flow effectively . 1 regarding financial metrics. This can obviously affect the way in which capital is measured, which has an impact on return on capital employed (ROCE). In general it is the capital investment necessary for a business to function. Current liabilities, meanwhile, refer to liabilities due within 12 months. In other words, the dollar amount of all the company . It puts together profit and capital. Here, total assets refers to the total value of all assets.The return on capital employed (ROCE) ratio is calculated by expressing profit before interest and tax as a percentage of total capital employed. Capital employed is a financial term that describes the total amount of capital that is used by a company to generate revenue. We can also help with . This ratio shows . It includes capital invested, total assets, and minus current liabilities.

:max_bytes(150000):strip_icc()/return-on-average-capital-employed-roace-final-88868957658840d48f5282029ff8a8f6.png)

It has £800,000 of assets and £160,000 of current .Return on Capital Employed (ROCE): Ratio, Interpretation . An accounting ratio expressing the profit of an organization for an accounting period as a percentage of the capital employed. While they may look similar on the surface, they would have significantly different attitudes toward spending capital. Key Aspects of Capital Employed 1.Das Capital Employed (CE) entspricht im Wesentlichen inhaltlich dem, was in Deutschland unter dem Begriff betriebsnotwendiges Kapital verstanden wird.

Profitability and Performance Ratios

Let’s work out your Return on Capital Employed using the calculation above: £400,000 (EBIT) ÷ £300,000 (Capital Employed) = 1. It is calculated by dividing Earnings Before Interest and Tax (EBIT) by the total capital employed, thus assessing a company’s efficiency in generating profits . The term “capital employed” refers to the total amount of funds a company uses to generate profit from its business.In simple words, capital employed is the total funds deployed for running the business with the intent to earn profits and is usually calculated in two ways a) Total Assets minus . To define it properly, capital employed can be expressed as the total amount of capital that has been utilized for acquisition of profits.InvestingPro offers detailed insights into companies’ Return on Capital Employed including sector benchmarks and competitor analysis. More capital should give a capability to earn more profit. It is a determinant that lets businesses and people associated with them figure out how efficient and profit-bearing they are. An understanding of what an .Capital employed refers to the amount of capital investment a business uses to operate and provides an indication of how a company is investing its money.What Is Capital Employed?

Capital Employed

Funds pledged by investors, especially in venture capital and private .capital employed. The term “return on capital employed” or ROCE refers to the financial metric that helps in assessing the ability of a company to generate profit by leveraging its capital structure. It represents the long-term funds utilized by a company in its operations, including both equity and debt.Capital Employed Committed Capital; Definition: Funds actively used for operations and projects.To define it properly, capital employed can be expressed as the total amount of capital that has been utilized for acquisition of profits.Return on capital employed is a profitability ratio used to show how efficiently a company is using its capital to generate profits.Der Return on Capital Employed (ROCE) kommt immer dann zum Einsatz, wenn eingeschätzt werden soll, wie gut mit dem Unternehmensvermögen gewirtschaftet wird. In making the calculation, however, there are a number of differing definitions of the . The ROCE ratio shows profitability: how profit produced stands up to the capital being used to generate it. Jedes Unternehmen beansprucht ein betriebsnotwendiges Kapital, für das die Kapitalgeber (Fremd- und Eigenkapital) Zinsen erhalten.Der Return on Capital Employed, auf deutsch Verzinsung auf das eingesetzte Kapital, ist die Rentabilität des netto eingesetzten Kapitals.Two companies with similar earnings and profit margins may have very different returns on their capital employed.

Capital Employed

according to the video, capital is the input needed to produce goods and services, to create wealth. Cash flow management.Return on capital employed (ROCE) is a financial ratio that can be used to assess a company’s profitability and capital efficiency. ROCE uses the reported (period end) capital numbers; if one instead uses the average of the opening and closing capital for . Back to glossary. If employed capital is not given in a problem or in the financial statement notes, you can calculate it by subtracting current liabilities from total assets. It is widely used in many financial metrics (often called return ratios) to measure the profitability and .

Capital Employed: Definition, Calculation, Interpretation

Return on Capital Employed. the resources with positive economic value – . Return on capital employed (ROCE) is regarded by most businesses (excepting very small ones) as their key measure of total performance. ROCE measures how . In this case the ROCE formula would look like this:Capital employed is capital that has been invested by any company in order to help the business grow. Dieser Beitrag erklärt dir die Definition des ROCE und seine Berechnungsweise.

= 400000+100000+150000. Fundamental relation between ROCE and WACC: The ROCE must be higher than the weighted average cost of capital (WACC) and the net after tax cost of borrowing (if the company is significantly .Generally, capital employed is presented as deducting the current liabilities from the total assets.comEmpfohlen auf der Grundlage der beliebten • Feedback

Capital Employed

Capital employed is a way to estimate how well a company is using its capital to enhance its profitability. All operational assets are included at their book value in the calculation of capital employed and these can be found in the company . As we have read above, in the absence of a universally accepted definition, we can also use a few other approaches to compute it, e.The definition of capital employed changes in the presence of large non-core assets and a company’s cash position. For better understanding, in the image below, Apple Inc . Falls du eher der audiovisuelle Lerntyp bist, haben wir das Thema ROCE in einem kurzen Video .

- Lyrics That Make You Happy Cry?

- Deutschland Ist Feeder-Weltmeister

- Samsung 15 Zoll Notebooks Online Kaufen

- Parken Bahnhof Troisdorf : Bahnhof Troisdorf P1

- Fahrplan Ingersheim <=> Freiberg ★ Ankunft

- 9 Best Baitcasting Rods For Bass Fishing

- Leibniz Erdnuss Spaß: 510,0 Kalorien Und Inhaltsstoffe

- Automated Sap Testing Tools – The Beginner’s Guide to SAP S/4HANA 2022 Testing using KTern

- Lebensorientierung Bei Krankheit

- Solar Development : Recent Facts about Photovoltaics in Germany