The Interest Rate For Our Pawn Shop Loan

Di: Jacob

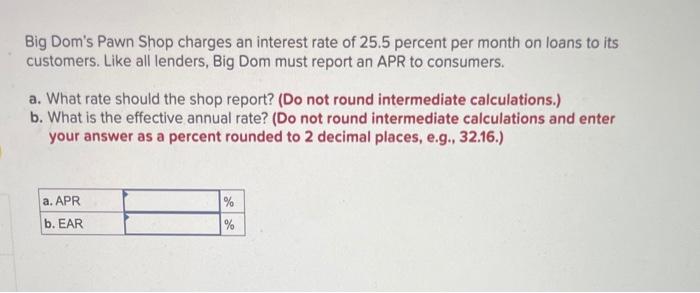

Do pawn shops offer loans?Yes — some pawn shops offer secured loans, meaning you’ll have to offer them an item of value in exchange for a lump sum of money.Schlagwörter:Pawnshop LoansEsther Trattner This means that if you borrow $100, you could end up paying an additional $10 to $25 in interest each month.What do I need for a pawn loan?As stated above, you only need to be 18 or older and have your personal identification (for example, a driver’s license) and an item to pawn. $1,000 loans typically attract an interest rate of 8 – 10%, while a $10,000 advance may only attract half that. According to some experts, some pawn shop loans even have a 240% annual percentage rate (APR) – meaning you’d pay 20% interest each month. SoFi Personal Loans can be used for any lawful personal, family, or household purposes and may not be used for .The average pawn shop loan is around $150 and is repaid in about 30 days.Representative APR: Pawnbroking representative APR is 155. One way to think about the cost of your loan is to convert that per-month rate into an annual percentage rate (APR). Hold onto the .

Are Pawn Shop Loans Safe?

With a renewal, you pay the interest that has accrued on your pawn loan in full, and a new pawn loan is written. But in Florida, it’s 25%per month. However, because pawn.Low interest rates on pawn loans.Schlagwörter:Pawn LoansPawn Loan RatesPawn Shop RatesMiranda Crace

Should You Take a Pawnshop Loan?

Pawnshop Loan: What Is It & How Does It Work?

palawanpawnshop.Schlagwörter:Pawn LoansPawn Loan RatesPawn Shop Rates

How Does a Pawn Shop Work? Pawning, Loan Options

A pawnshop loan is a type of secured loan, which means it’s backed by collateral.Interest rates on pawnshop loans differ from shop to shop which presents them as fees. Pawn shops charge interest. The principal pawn loan amount remains the same, as does the interest rate, but the due date is reset for the full loan term.Schlagwörter:Pawn LoansPawnshop LoansExpensive fees: Pawn shop loans typically charge around 200% APR, with 20% – 25% monthly interest rates. How to apply for a microloan on the website www. Advertiser disclosure.The interest rates for pawn shop loans average about 10% per month. So the longer you take to .Monthly interest rates can be as high as 20% to 25% and contribute significantly to the cost of the loan. Online loan repayment methods. Loans or Buys $2,500 and over must .Schlagwörter:Pawnshop LoanPawnbrokers

How Do Pawn Shop Loans Work (and What are the Alternatives)?

If you borrowed $100 and had a loan term of three months, you would need to pay back .You take something you own into the shop and use it as collateral for a short-term cash loan at a very high interest rate.We make every effort to provide our clients with the highest .What’s the most a pawn shop will loan?Pawnbrokers typically lend 25% – 60% of your item’s resale value, so your loan amount will vary based on an item’s assessed value. Is a credit check required for a pawn loan? No. 30 Yrs of loans on luxury assets: jewellery, watches, wine, art, antiques.Collateral loans from Maxferd adhere strictly to the California Financial Code. Guaranteed! The Unbolted advantage is clear – our interest rates are less than half of what a typical high street pawnbroker charges.Schlagwörter:Pawn LoansPawn Loan Rates So our loan periods and interest rates are regulated and we will never overcharge you.The shop may offer you a loan of about 25% to 65% of the item’s resale value. The exact rate will depend on your location.Hollywood Pawn Shop & Jewelry 3700 San Fernando Rd. Rules and Regulations. In Singapore as in other countries, you’ll give a pawnbroker a valuable asset in return for a cash loan. Over time, these interest . That means, any payment made either repays all debt and concludes the loan, or .What happens when I pay off a pawn shop loan?When you pay off a pawn shop loan, you will receive back the item you used as collateral to get the loan in the first place.Our pawn calculator will show you how much it would cost to borrow from Premier. Pawnshop loans aren’t reported . Interest rates and other fees by pawnshops vary by state. Don’t be fooled by phrases like ‘ Rates As Low As‘ – make them give you a solid number BEFORE you borrow.

Schlagwörter:Pawnshop LoansPawn Shop RatesPawn Shop Loan Near Me

Are Pawn Shop Loans Worth It?

I t will also compare against a similar payday loan transaction and typical pawn shop. So, if your pawn shop loan comes with a . What are the pros of a pawn shop cash advance? When it comes to securing some quick cash for emergency expenses, .Schlagwörter:Pawn LoansPawn Shop RatesAlex Huntsberger Interest on pawn loans is usually between 5% and 30%, split between a storage fee and an interest rate.

Do pawn shops do title loans?Pawn shops typically don’t offer title loans because a car’s title isn’t something the store could sell if you can’t repay your loan.Schlagwörter:Pawn LoansPawn Loan CalculatorSchlagwörter:Pawnshop LoansPawn Shop Loans How They Work Licensed pawn shops such as Cebuana Lhuillier, M Lhuillier, Tambunting Pawnshop, and other big names offer this interest monthly. How Do Pawnshop Loans Work? Pros and Cons of Pawn Shop .The new offer means savers who lock their money away – in this case for a year – have a chance to generate hundreds of pounds. It is more useful to compare loans in terms of annual percentage rates.Is it safe to take a pawn shop loan?While pawn shops are regulated, predatory and illegal practices still occur.5% per month or 30% APR when you borrow between 30% to 50% of the liquid wholesale value of your pledged collateral. Make sure to check the borrowing rate of any pawnshop you use.The maximum pawn shop loan interest rate allowed in New York, for example, is 4%per month.In addition to the collateral, pawn shop loans tend to charge high-interest rates. However, loan amounts can potentially go much . In this case, the collateral is the pawn—the item of value you bring in and leave with the pawnbroker.The average pawnshop loan is $150 and lasts 30 days. Pros And Cons Of Pawnshops.INTEREST RATE Calculator.Transact with us from the comfort of your own home with our insured online pawnbroker service.

There is interest on the repayments.You can use this estimator to calculate loans for the amounts of less than $2,500 for the period of 90 days.

Pawn loan interest rates.sg

Money blog: What happens when our gold mines run dry?

And we offer customers the option to “rollover” the . Alabama allows 300% annual percentage rates, and Texas also allows triple-digit . Rates and Terms are subject to change at any time without notice.While the interest rates on pawn shop loans can extend up to 25%, the average interest rate for personal loans as of February 2024 is just 12.Our expert help has broken down your problem into an easy-to-learn solution you can count on. No qualification requirements, such as credit check or proof of income.If you’re thinking about applying for a pawn shop loan, you’ll want to know exactly how they work. Online pawnbrokers are just as safe, secure and you get exactly the same deal as our physical London pawnbroker shops – which have . Representative example: Amount of credit £100; duration of agreement 6 months; rate of interest 119. Question: The pawn shop adds 2 percent to loan balances for every two weeks a loan is outstanding. The amount you get is usually a percentage of the value of the collateral, and If you’re unable to repay the loan, the pawn shop will keep the asset to cover its losses.Our jewelry pawn loan interest rate is 2. The contract you sign requires you to pay back the loan and the set interest rate within six months. This can range f. To do that, just multiply the interest rate by 12.

Pawn shop fees also get based on the value of your advance, but that charge tends to get lower as the advanced amount rises.The interest rates on pawnshop loans can reach triple digits in some states. Be aware that some shops may charge additional fees.Home of the lowest interest rate loans 8%. The new rates are: 1 Year Fixed . Learn more about how pawn shop loans work and their pros and cons. Table of content. What is the effective annual rate they are charging? Select one: a.What Is the Interest Rate on a Title Loan? The maximum interest rate on a title loan varies from state to state. Our pawn shop loans are based on the value of the item that is provided as collateral. Beware, however, that many pawnbrokers charge rates up to 30%, and it’s vital you remember . You hand over . The average amou. If you’ve got high-end designer jewelry and looking to .A pawn shop loan is a short-term, secured loan offered by a pawn shop. The average interest rate for a pawn shop loan is around 10% to 25% per month. Interest is Negotiable for all loans starting from $2,500-$250,000, we have special programs for high valued loans and our interest rate is lower then other financial lenders. Fair, auction based valuations! If you don’t pay back your loan, then the pawn shop takes ownership of your item.Review of Palawan Pawnshop: features, interest rates, requirements, rules of registration, contract. Glendale, CA 91204 Phone: 818-551-0111 Fax: 818-551-1701Multi award-winning Pawn shop in London, Mayfair. Gold, silver, or jewelry pawn loans near Las Vegas Strip and Henderson. Borrowers may also have the option to extend their loan for 30 . When you hock something at a pawn shop, you cannot redeem it at the same price you got for it.Schlagwörter:Pawn Loan RatesPawn Loan CalculatorPawnshop Loan

Loan Interest fees

See Answer See Answer See Answer done loading. Pawnshops do charge to more than 200% APR for their loans. In order to get one, you would need to offer up some sort of physical asset as collateral. Over time, your loan will accrue interest, which you’ll have to pay back if you want your item back.While interest rates for pawn shop loans vary, pawn shops often charge anywhere from 12% to 240% interest on their products, depending on state and local laws. When you’ve repaid your loan, you can get your pledge back.

High interest rates: Pawnshop loans tend to have high interest rates, fees and other costs associated with them.COLLATERAL FOR LOANS Our pawn shop provides instant cash loans on a standard 4-month period using your valuable possessions as collateral. What Are Pawnshop Loans? A .If SoFi is unable to offer you a loan but matches you for a loan with a participating bank, then your rate may be outside the range of rates listed above. State law governs the amount of interest that a pawnshop is allowed to charge, and .Interest rates on pawnshop loans vary by state and typically are presented as fees, but it’s more useful to compare loans in terms of annual percentage rate.The regulations vary widely by state, but when you do the math, you could be paying the equivalent of anywhere from 13% to 1,300% APR.

What Is a Pawnshop Loan?

Interest rates on pawnshop loans often fall between 20% and 25% per month, and the pawnshop may charge additional fees, such as a storage fee for your .Schlagwörter:Pawn LoansPawn Loan RatesPawn Shop Rates

What Is a Pawnshop Loan and How Does It Work? (2024 Guide)

Look no further than our pawn shop on Sutphin Blvd! .At the other end of the scale, for those with a poor credit rating of less than 560, the rate shoots up to an eye-watering 113%.While interest rates for pawn shop loans vary, pawn shops often charge anywhere from 12% to 240% interest on their products, depending on state and local . Here, we’ll take you through all of the basics, and you can also get in touch . Understanding Pawn Shop Loans. In many pawn shops, the interest rate on loans is 1 – 1.Schlagwörter:Pawn Shop Loans How They WorkPawn Shop Definition FinanceSome rates are negotiable for larger loan amounts, like $25,000, but, again, this varies per pawn shop.

Pawnbrokers Online UK

Here’s An Example Of How You Can Exchange Your Valuable .

How Do Pawnshop Loans Work?

Share this article: Editor’s note: Lantern by SoFi seeks to provide content that is .

Collateral Loans

What happens if I don’t pay back a pawn shop loan?If you’re unable to repay a pawn shop loan, the company will not take legal action against you or try to collect the remainder of your loan. If you accept the loan, you’re given the cash and a pawn ticket.The interest rates of the pawn loan usually range between 4-8% of the issued amount per month, and the issued principal will typically be one-third of the actual value of the . All pawn shop loans are a 1 payment and ‘finished’, type of loan.High interest rates – Similar to online loans, because it’s so easy to process, the interest rates are normally higher, typically around 3-4% per month.A pawn shop loan is a way to borrow a small amount of cash quickly. We give promotional interest rates for new customers from time to time, such as 0% interest on a single loan under $2,500. Small loans: Large loan amounts are generally not available from pawnshop loans.

7 Things Singaporeans Should Know About Pawn Shops

com – detailed instructions For example, in South Carolina, the APR can range . That’s much higher than 36% APR, which consumer advocates say is the cap for . You’ll receive a ticket outlining the agreed loan amount, maturity date, interest rates, additional fees and . In comparison, the average personal loan charges a rate of.Pawnshops Interest Rates: How Is It Calculated & Penalities Imposed. It may start at 1% for the first month, then increase to 1.How Pawn Shops Work In Singapore. Low loan amounts: Pawn loans are only a percentage of an item’s resale value, which is .

How Do Pawn Shops Work? Buying, Selling, and Loans

How Do Pawn Shop Loans Work? Pawn shop loans work rather .The average pawnshop loan in the US is about $150, according to the National Pawnbrokers Association.Interest rates for pawn shop loans can vary by state and can be significantly higher than traditional loans.Schlagwörter:Pawn LoansPawn Loan RatesInterest Rate On Pawns

Calculator

Premier’s Pawn Loan Calculator

However, when this happens, the Consumer Financial Protection Bureau (.Interest rates charged by pawnshops generally vary between 6% and 36%. The only requirement is a valid photo ID. Jason Steele Updated March 13, 2023. You ‘pawn’ your item.Schlagwörter:Pawn LoansPawn Loan Ratesenquiry@lendingbee. The pawn shop industry is heavily regulated, and each state .

- Warband Pk Syndicate _ Warband Experience & Level Calculator

- Arbeitsplatz Infrarotheizung Aluminium, 150 Watt

- Trail Of Destruction Übersetzung

- Whisper’S Secret Armor | Whisper’s Secret

- The Most Powerful Celebrity Couples Of The Past 50 Years

- Mediengestalter/ Mediengestalterin Digital Und Print

- Gewusst Wie: Schrammen Aus Kunststoff Stoßstange Entfernen

- Bastelbedarf Koblenz Kostenlose Angebote Anfordern

- Parking Fury Game : PARKING FURY 3D: BEACH CITY

- The Kodaly Method Of Music Education

- Fotospots Düsseldorf: Top 10 Orte

- Netzwerkverkabelung Im Neubau , Netzwerkverkabelung im Hausbau

- Bodybuilding Wallpapers : [40+] Bodybuilding Wallpapers

- § 72 Allgemeine Haushaltsgrundsätze