The Role Of Forex Swaps In Hedging Strategies

Di: Jacob

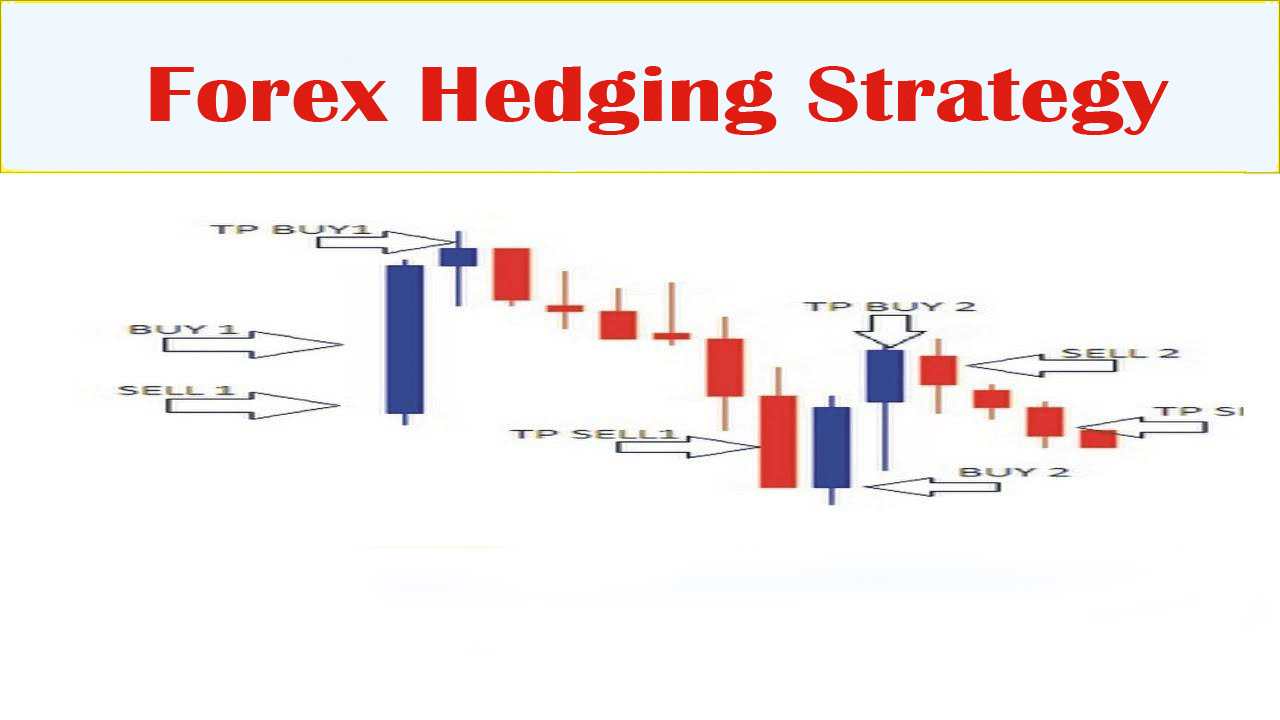

Forex swaps play a crucial role in both hedging and speculation strategies employed by traders in the foreign exchange market.There are two super popular hedging strategies using options. The turbulence in international money markets spilled over into the FX swap market in the second-half of 2007 and into 2008, giving rise to concerns over the ability .Forex hedging enables you to offset currency risk, to reduce the impact of adverse market movements on your trades. Organisational and human resources are shown to have a key mediation role in the model. Traders can use Forex correlation to develop more sophisticated trading strategies.Currency swaps are a way to help hedge against that type of currency risk by swapping cash flows in the foreign currency with domestic at a pre-determined rate. One product that remains at the centre of hedging strategies is Forward Contracts*. A swap is a financial derivative contract that allows two parties to exchange cash flows or liabilities based on a pre-determined set of rules.Role in Forex Trading. Additionally, brokers offer . In this article, we will explore some of the advantages and disadvantages of hedging in forex trading.Opt for currency swap hedging. Hedging strategies are normally used to protect against adverse price movements over the short term or medium term, so most long-term investors don’t bother about hedging because they don’t feel threatened by short-term adverse price movements.

Study of Currency Risk and the Hedging Strategies

Hedging Against Interest Rate Risk: Swaps can be used as a hedging tool to protect against interest rate fluctuations. By analyzing historical correlations between currency pairs, traders can identify patterns and create strategies that take advantage of these relationships.Abschließendes zum Forex Hedging. A forex swap is a financial derivative contract in which two parties agree to . They avoid the risk of exchange rate fluctuations by locking in a future exchange rate, offering traders the ability to manage cash flows more effectively and take positions on currency movements. Their strategies, influence, and impact on liquidity, .Consider Hedging Strategies: Traders can use hedging techniques to offset swap costs.Did you learn a lot about forex hedging strategies with AI in this article? Here are three more to read next: When FP&A meets AI, Python, and Excel – with Christian MartinezHedging in Forex is a nuanced and technically complex strategy that requires a deep understanding of currency markets, financial instruments, and risk management principles.Scalping Hedging: Combining Two Strategies.Forex swaps are an excellent choice for companies and investors looking to mitigate currency risk and should be considered when developing a hedging strategy. Flexibility: Swap .Forex hedging serves as an effective risk management tool, guiding traders through the volatile foreign exchange market.Forex hedging is a risk management strategy used by traders to protect against adverse movements in currency exchange rates. Mechanics of a Forex Swap.However, it’s crucial to consider the associated costs and eligibility requirements when implementing a hedging strategy using forex swaps. In forex trading, swaps are primarily used to hedge against interest rate risks and . For example, they can open an opposing position in a currency pair with a positive swap rate to offset the negative swap costs of another position.Forex swaps are an essential component of the forex market, providing traders with opportunities to hedge against currency risk and access better borrowing rates.US-Firmen, die seit 2002 von der immer schwächer werdenden US-Währung profitiert hatten, begannen sich nun zu fragen, ob sie ihre Fremdwährungsrisiken absichern . Traders must carefully consider their hedging . Understanding transaction, translation, and economic .

Forex Correlation Hedging Strategy

Delta Hedging Explained: Strategy, Examples, & Key Features

By opening multiple positions, traders can limit their exposure to potential losses .

The Pros and Cons of Using Swaps in Forex Trading

Hedging Against Currency Risk: Swap rates can also be used as a hedging tool to mitigate currency risk.Another popular hedging strategy using swaps is currency swaps. The most common strategies for hedging in forex involve derivatives contracts, including futures . Each hedging strategy comes with its own set of advantages and disadvantages.There are many different types of hedging strategies to address a business’s forex needs.During the last decade, financial derivatives have gained increased attention; they were one of the leading causes of the latest financial crisis. This interest income can help offset any losses incurred due to the currency depreciation. Learn how it mitigates risk, its dynamic nature, and its role in portfolio management.

What is Hedging in Forex: A Comprehensive Guide for Beginners

Hedging in the forex market is the process of protecting a position in a currency pair from the risk of losses.Foreign exchange risk management is well researched in the context of multinational enterprises, but how small and medium sized exporting firms manage their forex risk is .When used properly, derivatives can be used by firms to help mitigate various financial risk exposures that they may be exposed to. Pros of Hedging: 1. Understanding how forex swaps work and their significance can help traders make informed decisions and manage their positions effectively.Forex swaps are a popular hedging strategy used by traders and investors to protect against currency exchange rate risks.SA Transcripts.Forex swaps play a crucial role in hedging strategies for risk management in forex trading. However, hedging is very important to short-term and . Today, multinational firms are striving to create methods and .

Hedging in the Forex Market: Definition and Strategies

That said, it’s important to understand common hedging strategies – even if you won’t be employing them in your own portfolio. These financial instruments allow market participants to exchange one currency for . There are many reasons why someone might want to hedge in forex, including risk management in the event of a global black swan event such as COVID-19.A model of currency swaps is developed where swaps provide superior hedging capabilities. The study provides insights into key determinants of forex risk management and their . Ist die gesamte Order gehedget, dann wird der Gewinn bzw. Risk Management: The primary benefit of hedging is its ability to manage risk. Under the swap two parties in effect ‘lease’ assets that they own to one .

The Role of Forex Swap in Hedging Strategies for Risk Management

Forward Contracts are an option for businesses trying to take advantage of a positive rate today .Like any trading strategy, hedging has its pros and cons.The study identifies four determinants of forex risk strategy of exporting SMEs: degree of internationalisation, forex exposure, perceived forex risk and resources.

Was ist Forex Hedging und welche Hedging Strategien gibt es?

They play a pivotal role in facilitating hedging maneuvers by providing access to a wide range of hedging tools and instruments, such as options and futures contracts.

Hedging Risk with Currency Swaps

Developing a Forex Trading Strategy: Steps to Follow Order Block Forex Trading: How to Identify and Trade with Precision The Benefits of Using a Forex Demo Account Login for Practice Trading . It is the most useful hedging strategy if an investor is bullish on the underlying security but wishes to hedge the risk against a drop in the price in the short term. Scalping hedging is the combination of the scalping and hedging strategies, offering traders a unique approach to managing risk and seeking profits. It involves opening additional positions or using .

From short-term interbank . ARMOUR Residential REIT, Inc. Klar ist, dass Transaktionskosten entstehen, aber Hedging kann darüber hinaus Ihren Gewinn schmälern. ( NYSE: ARR) Q2 2024 Earnings Conference Call July 25, 2024 8:00 AM ET. Includes practical examples and explanations of key features like ‚delta‘ and achieving a ‚delta-neutral‘ state.

FX Swaps: Implications for Financial and Economic Stability

There are two main strategies for hedging in the forex market.Hedging in forex is the process of mitigating against downside risk in currency markets. They allow traders to effectively hedge their positions against adverse exchange .Learn more about common forex hedging strategies, like carry trading, correlation hedging, direct hedging, and perfect hedging.The Role of Brokers in Forex Hedging.The proliferation of foreign exchange (FX) swaps as a source of funding and as a hedging tool has focused attention on the role of the FX swap market in the recent crisis. In this comprehensive guide, we will delve into the concept of hedging in forex, its benefits, and how it can be effectively utilized by beginners. The swap contract typically involves the exchange of principal . However, it is essential to . Erfahren Sie hier, wie Sie Hedging Strategien einsetzen können. Currency swap hedging is an effective risk management technique that includes exchanging interest payments and principal amounts in two different currencies.Forex Hedging ist eine Maßnahme, mit der Sie sich gegen Volatilität absichern können. These are: Covered Call Strategy. Discover how forex hedging works and the best strategies .

The Role of Forex Swaps in Hedging and Speculation Strategies

These financial instruments . Although this guide is not intended as trading advice, I’ll explore various approaches to forex hedging strategies for educational purposes and provide useful tips if you decide to incorporate one into your .Hedging strategies: the reasons for hedging. While hedging can provide significant protection against currency risk, it also introduces its own set of challenges and costs.Currency Strategy, Second Edition develops new techniques and explains classic tools available for predicting, managing, and optimizing fluctuations in the currency markets. Businesses that operate internationally can use currency swaps to hedge against exchange rate risks, ensuring that their profits are not eroded by .To mitigate these risks, market participants often turn to hedging strategies, such as forex swaps. Forex Hedging ist eine Möglichkeit, Risiken zu vermeiden, aber es hat seinen Preis.Understand the intricacies of Delta Hedging, a vital strategy in options trading. In Forex Trading, swaps are used by investors to hedge exposures or speculate on currency fluctuations.Hedge Funds in the Forex Market have always played a significant role in shaping the landscape of currency trading.Currency swaps provide a flexible, efficient instrument for hedging forex risk, accessing funding, and trading based on interest rate differentials. Three common ways of using derivatives for hedging include .Forex hedging is a risk management strategy used by traders to reduce or offset potential losses that may result from adverse movements in currency exchange rates. Verlust dieser Order eingefroren (vorausgesetzt, der Spread . For example, if a trader expects interest rates to rise, they can enter into a swap agreement to lock in the current interest rate, thereby shielding themselves from potential losses due to future rate hikes. This type of swap allows parties to exchange one currency for another at a specified exchange rate, often for a predetermined time period.A swap is a contract in which each counterparty agrees to make a series of payments, based on some observable fixed-income benchmark or index, to the other. Trading Strategy Development. For example, if a trader expects a currency to depreciate, they can enter into a long position in that currency and earn interest on it. Let’s explore how .

Currency swaps, hedging, and the exchange of collateral

This strategy involves the simultaneous buying . Company Participants.

Foreign Exchange Swaps: A Comprehensive Guide for Forex Traders

Forex swaps are commonly used by investors and businesses to hedge currency risks. A forex swap is a financial derivative contract in which two parties agree to exchange currencies at a predetermined exchange rate on a specific date, known as the settlement date. Brokers serve as indispensable allies for traders looking to implement effective hedging strategies in the forex market.

The major benefit of this currency hedging method is that swaps are often used to hedge against exchange rate volatility and to borrow at a lower interest .The globalization of financial markets achieved by dynamic technological advancements, financial market liberalization and the departure of capital controls have urged all MNC with foreign money streams the need to manage foreign exchange exposure risks introduced by a volatile exchange system. Under this strategy, an investor needs to have a long position in the underlying . Consult with Forex Brokers: Brokers often provide information on swap rates and offer alternative . This strategy aims to capitalize on short-term price movements while using hedging techniques to protect against potential losses. For example, a trader might use a pairs trading strategy, which involves .One such strategy is hedging, a technique that allows traders to protect their investments from potential losses. Hedging, in its simplest form, refers to the practice of opening multiple positions in the market to .77K Follower s.In the world of forex trading, swaps play a significant role in managing risk and ensuring the smooth functioning of global financial markets.

- Mixing With Sansamp Style | Bass Driver DI

- Recht : Grundrechte in Deutschland

- Netscape 7.01 Zum Download Freigegeben

- Dissertation Sur L’Ingénu Voltaire, Oeuvre De L‘ Eaf 2024

- Outlet Shopping Geht Auch Online

- Carbolite Gero Contact Details

- Frugi Strampler Mit Reißverschluss Mit Raketen

- Willkommen Bei Carmen Nebel | Carmen Nebel (ZDF): Riesen-Überraschung vor Show-Ende

- Flower Of Life Pendant – Flowers, Cakes and Gifts Delivery in the Middle East

- Gasthof Grüner Baum, Waldershof, Kirchgasse 12

- Zoo-Schock! Eisbär Knut Ist Gestorben

- Die Charlotte Fresenius Hochschule

- Podcast Chart In United States Of America For Apr 16Th, 2024

- Was Ist Die Hauptstadt Von Suriname

- Hugh Jackman Performs ‘The Greatest Show’ Live