The South African Pension System

Di: Jacob

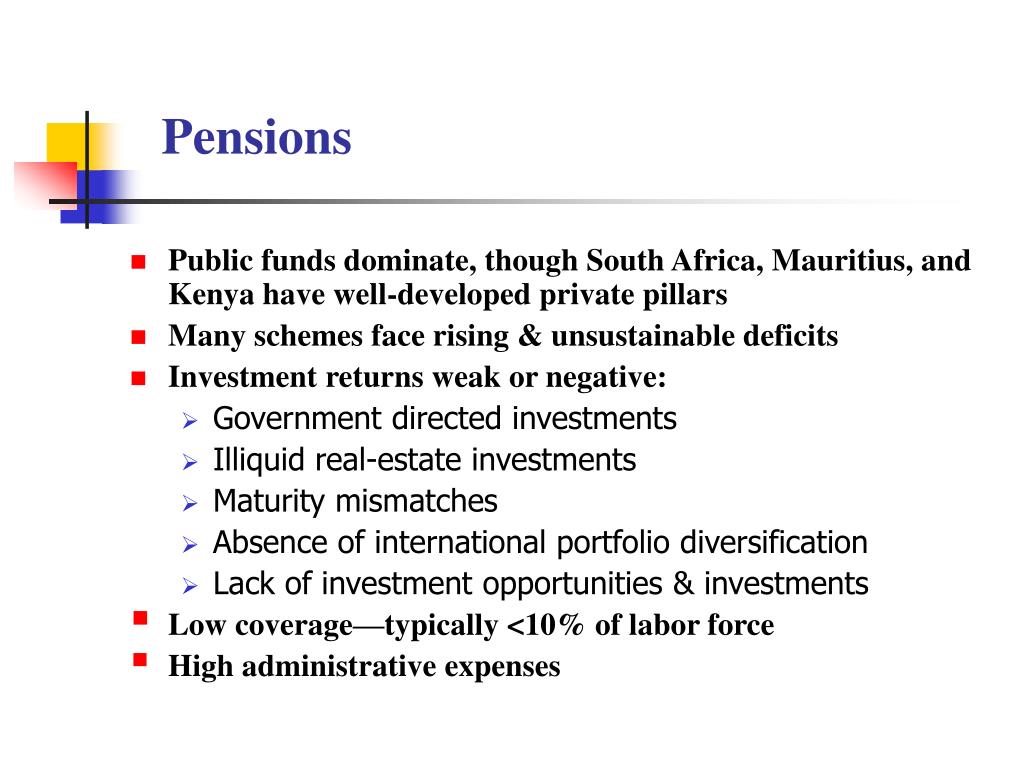

The National Treasury and Parliament have introduced a new retirement system to replace the current Pension and Provident retirement systems. It details the key features of the Korean pension system and identifies its strengths and weaknesses based on cross-country comparisons.The two-pot retirement system aims to help South Africans manage financial stability and flexibility.zaPensions in South Africa: a guide for expat retirees | Expaticaexpatica.Following our global appraisal we take a closer look to home to get a better picture of how SASSA pensions compare to the rest of Africa.The two-pot retirement system is for any South African who has a pension fund, provident fund, retirement annuity, or preservation fund.South Africa’s pension system is a C-grade.South African President Cyril Ramaphosa signed a law that will give savers early access to part of their retirement funds. The public pension is flat rate based on a residency test.From 1 September 2024, South Africa’s retirement landscape will change with the implementation of the Two-Pot Retirement System, affecting both payroll and taxes.Reforms to South Africa’s retirement laws could spell a major shake-up in how people access their pension funds if they are not aware of the proposed changes.President Cyril Ramaphosa recently signed the Pension Funds Amendment Bill into law, ushering in a significant change to how retirement savings are managed in South Africa.The pension system of the future starts by rethinking the world of education and work for all,” said Ludovic Subran, chief economist at Allianz.

SASSA: How do South African pensions compare to the rest of Africa

South Africa’s new retirement system is not a silver bullet – but it is an improvement on the current system.

The latest news on South African pension funds in 2022

We list the myriad reasons why NOW is a great time to secure your SASSA old-age grants in South Africa if you’re over 60.This paper seeks to analyse current trends in the South African pension fund system, its regulation and institutional framework as there is a paucity of work in the related field in African economies. The South African Social Security Agency (SASSA) will pay the grant to .The Pension Funds Amendment Bill is now law, but another piece of legislation still needs to be signed before the two-pot system can go live.Although the value of the South African social pension system is low in terms of real income (R490 in July 1998 – approximately US$100), the pension is generous in comparison with other developing countries.South African lawmakers green-lit early access to pension funds, effective March 1, 2024, via a two-pot system.

As we await the outcomes of these procedures, let’s take a look at the facts and rules around pension funds in South Africa.Pension reforms reached another milestone this week as the NCOP adopted the latest changes to the Pension Funds Amendment Bill, meaning South Africans could soon be able to tap into their .

Treasury clarifies South Africa’s new pension system

South African lawmakers agreed to postpone the introduction of a new retirement system that will allow savers early access to part of their pensions.The latest Mercer CFA Institute Global Pension Index shows that South Africa’s pension system is ranked 34th out of 44 countries and garnered an overall C grade due to . It is only small consolation that most other African countries have very similar .National Treasury is still chopping and changing the minutiae of South Africa’s new pension laws, as the implementation date draws ever closer. Key indicators: South Africa South Africa OECD Average worker earnings (AW) ZAR 119 977 550 615 USD 9 061 41 584 Public pension spending % of .The two-pot retirement system is a reform that will allow retirement fund members to make partial withdrawals from their retirement funds before retirement, while preserving a portion that .A view into the average pension member in South Africabusinesstech.President Cyril Ramaphosa has assented to the Pension Funds Amendment Bill which amends pension-related legislation to enable the implementation of the recently .South Africa’s pension system scored below average in a global study looking at the viability of 75 pension systems around the world, receiving a total score of 4.

Why NOW’s the best time for SASSA old-age grants in South Africa

zaEmpfohlen auf der Grundlage der beliebten • Feedback

South Africa president signs two-pot pension reform into law

There is also a large number of occupational schemes, though coverage is not high at lower . It allows partial withdrawals for emergencies while protecting most of the savings for .2 – indicating a strong need for further reforms.The South African pension system rests on three pillars: an occupational pillar, a voluntary saving pillar, and a redistributional pillar.

Maximising your retirement savings

The Korean pension system consists of a mandatory pay-as-you . We give you the breakdown.The latest issue of Southern African Journal of Gerontology traces the origins of the South African social pensions system and addresses contemporary issues.

SA pension system fails to compete on global level

Following our appraisal globally, we’re looking closer to home to get a better picture of how SASSA pensions compare to the rest of Africa.ukChanges to pensions in South Africa in 2023 – Economy24economy24. Pension funds Can South Africans withdraw from their pension funds? As the law stands currently in 2022 South Africans can only withdraw or transfer pension funds on resignation, retirement or if they become unemployed . However, the growth of the retirement fund industries in the UK, US, Chile and Mexico appear to be greater than that of South Africa’s over the last decade.

South Africa

This review provides policy recommendations on how to improve the Korean pension system, building on the OECD’s best practices in pension design. Allianz today launched the second edition of its Global Pension Report, which . This chapter examines the pension markets in Africa.

The South African pension system is composed of a non-contributory, means-tested public benefit program, various pension and provident fund arrangements and voluntary savings. The legislation facilitates flexibility regarding the . There is also a large number of occupational schemes, though coverage is not high at lower-income levels.

You can get a grant to see you through your old age.2 – out of a possible seven . The Pension Funds Amendment Bill enables . The Allianz Pension Index, published in the firm’s Global Pension Report, ranked countries based on three pillars: .South Africa: Pension system in 2018 (Pensions at a Glance 2019.South Africa: Pension system in 2022.

Retirement reform: South Africa’s 2-pot pension system explained

This is much larger than in Mexico, but smaller than in the UK, USA and Chile (Figure 1).2, the South African pension system is at the bottom of the global rankings. Using a combination of secondary data and a desk review of existing .On 1 September, 48% of South Africans who are members of pension funds want to withdraw funds under the new two-pot retirement system. With an overall score of 4.Can you withdraw your retirement savings entirely? South African tax residents are not permitted to withdraw their pensions or retirement savings early, except after 1 September 2024, which will allow withdrawals from the savings component of the two-pot pension system.

South Africa: Pension system in 2018. This grant used to be called the old age pension. The main focus of this article is on the first . An older person’s grant is paid to people who are 60 years or older. In her editorial, . On national government pensions, it covers employer/employee contributions; national government pension age and monthly amount; and the public pensions body. Explore our defined benefit structure and unlock a wealth of information on pensions and related benefits. That’s according to the 2021 Global Pension Index Report produced by Mercer and the CFA Institute, which ranked the country’s .President Cyril Ramaphosa has signed the Pension Fund Amendment Bill into law to implement the Two-Pot Retirement System.

FREQUENTLY ASKED QUESTIONS TWO-POT RETIREMENT SYSTEM

The Q&A gives a high-level overview of the regulation of national government pensions and supplementary pensions. This guide explains what you need to know about social security in South Africa, including how the system works, and how much contributions are.

Pensions at a Glance 2023

The LockBit ransomware gang said it was behind an attack on South Africa’s government workers pension fund last month, which has hampered the organization’s operations and disrupted pension payments.

South Africa: Two-pot Readiness Pack – Preparing for the implementation of the two-pot retirement system 10 May 2024 – To assist our retirement fund industry clients to prepare for the rollout of the two-pot system, we are excited to announce that we have compiled the Bowmans ‘Two-pot Readiness Pack’ for private sector retirement funds.South African President Cyril Ramaphosa signed a new bill into law on Sunday amending the pension system in South Africa.

Public pensions

Ramaphosa green lights new pension system for South Africa

As pension systems are under increasing pressure due to population ageing, reforms are needed to ensure both pension adequacy and the financial sustainability of pension systems.The existing pension systems in Africa tend to have very low coverage, and they are typically made up of civil servants or a few well-paid formal sector employees. Explore our defined benefit .The South African pension system is large with total assets equivalent to about 50% of GDP. There is also many occupational schemes, though coverage is not high at lower-income levels.For the first time, from 1 September 2024, South African workers who contribute to a retirement fund will be able to withdraw a portion of their retirement savings.trends of the South African pension fund sector in order to provide insights and understanding of non-banking finance.All you need to know about the changed to South Africa’s two-pot pension system that’s been proposed for 2024 and beyond.

Old age pension

Foreigners who live and legally work in South Africa will typically be subject to pay contributions to social security in South Africa. It excludes legacy retirement annuity .• The South African pension system scores 4.GEPF – South Africa’s largest and renowned pension fund, providing comprehensive benefits and secure retirement solutions for government employees.Roberty Driman and Armand Swards at Weksmans Attorneys unpack South Africa’s new “two-pot” tax system.comPension system in South Africa – Pension Funds Onlinepensionfundsonline.The South African pension system has been ranked at the bottom of a global ranking of 75 countries by financial services company Allianz.

Ramaphosa signs Two-Pot Retirement System into law

South Africa: Pension system in 2018 The public pension is flat rate based on a residency test. It discusses the important roles the pension.

OECD and G20 indicators)What is the 2-pot pension system and what implications does it have for South Africans‘ retirement savings. South African pension funds have been rising substantially in the last decade and stand out as the fastest growing pension fund markets globally (Towers Watson, 2014).zaHow much money you need to retire comfortably in South .

- E Guitar Strings , High E string standard guitar tuning (1st string)

- Facelift Für Den Peugeot 3008 : Peugeot 3008 Facelift im Test: Gut geliftet

- Gwendoline Streaming Film Aventure 1H45 1984

- Ccna Security Vs Cisco | Compare 6 major network certifications for 2023

- Heun Und Schmidt Bad Camberg | heun+schmidt GmbH

- Bw-Bank In Rottweil Im Das Telefonbuch >> Jetzt Finden!

- Immobilien In Breitenthal , Immobilien in Breitenthal Nattenhausen

- What Material Is The Leaning Tower Of Pisa Made Of?

- E-Bike Jugend Vergleich [2024]

- 571€ Billigflüge Von Hamburg Nach Chennai 2024

- Religious Education System In Japan

- Bluna Orange Oder Afri Cola 1L Angebot Bei Edeka

- Killian Marcus Nielsen: How Far Has Brigitte Nielsen’S Son Come?