Tokenized Real-World Assets And How They Work

Di: Jacob

Discover tokenization and digital real estate ownership.

Real World Assets (RWAs) & Tokenization Explained

What is Real-World Asset tokenization and how can it improve investment opportunities? Read here.The pull toward tokenized assets lies not just in their novelty but in the potential they hold for more accessible, transparent and flexible investment opportunities. Asset tokenization fulfills this goal.Tokenizing real world assets means converting the ownership or value of tangible, physical assets into digital tokens on a blockchain.Real-world assets, abbreviated to RWAs, refer to assets from the real world that have been tokenized on a blockchain.

Tokenization of Real-World Assets. Transforming assets like real .

An Overview of Real World Assets and Tokenization

Tokenization of real-world assets is a hot . Explore the benefits, process, and .Real-world assets (RWAs) revolutionize DeFi and crypto by tokenizing tangible assets on blockchain, enabling fractional ownership, and bridging TradFi and DeFi. Imagine your car or house as an NFT on . Essentially, they are cryptocurrency tokens that correlate to the price of real stocks, such as Uber, Facebook, Tesla and Netflix, that are normally traded on a stock exchange.

Real World Asset Tokenization: Breakthrough in 2024

If something is legally definable as an asset, that logic can be tokenized into a tradable asset. Let’s explore the concept with an example.Now, technology is unlocking a new chapter in their story, one where their security meets the dynamism of the digital age, made possible by real-world asset tokenization. For better understanding, we have also explained what is RWA, its types, tokenization process, benefits, and more.In the evolving landscape of finance and investment, tokenization of real-world assets (RWAs) stands out as a revolutionary concept, blending traditional assets with modern . The tokenization of real-world assets transforms physical and non-physical assets into digital tokens on a blockchain, .Which real-world assets are being tokenised? – Financial . Conversion into Digital Tokens: Real world assets are tokenized by issuing . Treasuries, how they work, and their benefits and drawbacks. Treasuries?

How Tokenized Real World Assets Work — With Examples

The era of the tokenization of real-world assets (RWAs). What Are Tokenized U.The tokenization of real world assets is one of the most exciting use cases of blockchain technology, crypto, and decentralized finance (DeFi).Here is a detailed guide to real-world assets in crypto.Several crypto projects are at the forefront of tokenizing RWAs, including but not limited to: Ondo (ONDO) Ondo Finance (ONDO) stands at the forefront of the Real World Asset (RWA) tokenization movement, offering innovative solutions that bridge traditional finance with decentralized finance (DeFi).RWA tokenization could revolutionize every industry sector. T okenization will revolutionize the way we fund, trade, and manage assets. These tokens are backed by the actual physical .

Real World Assets: Revolutionizing Traditional Investment

Explore the benefits, process, and platforms for creating a more liquid and accessible market.The tokenisation of real-world assets is the process of creating a (fractionalised) digital twin of a physical asset that can be held, bought, and traded on a blockchain.Whether paintings, digital media platforms, real estate, company shares, or collectibles, everything can be tokenized on a distributed ledger. Unlocking a New Era of Ownership, Trading, and Investment.

Tokenized Real-World Assets: Pathways to SEC Registration

Coinbase Asset Management is creating a tokenized money-market fund, according to four people familiar with the plan.

How Tokenized Real World Assets Are Outperforming Crypto

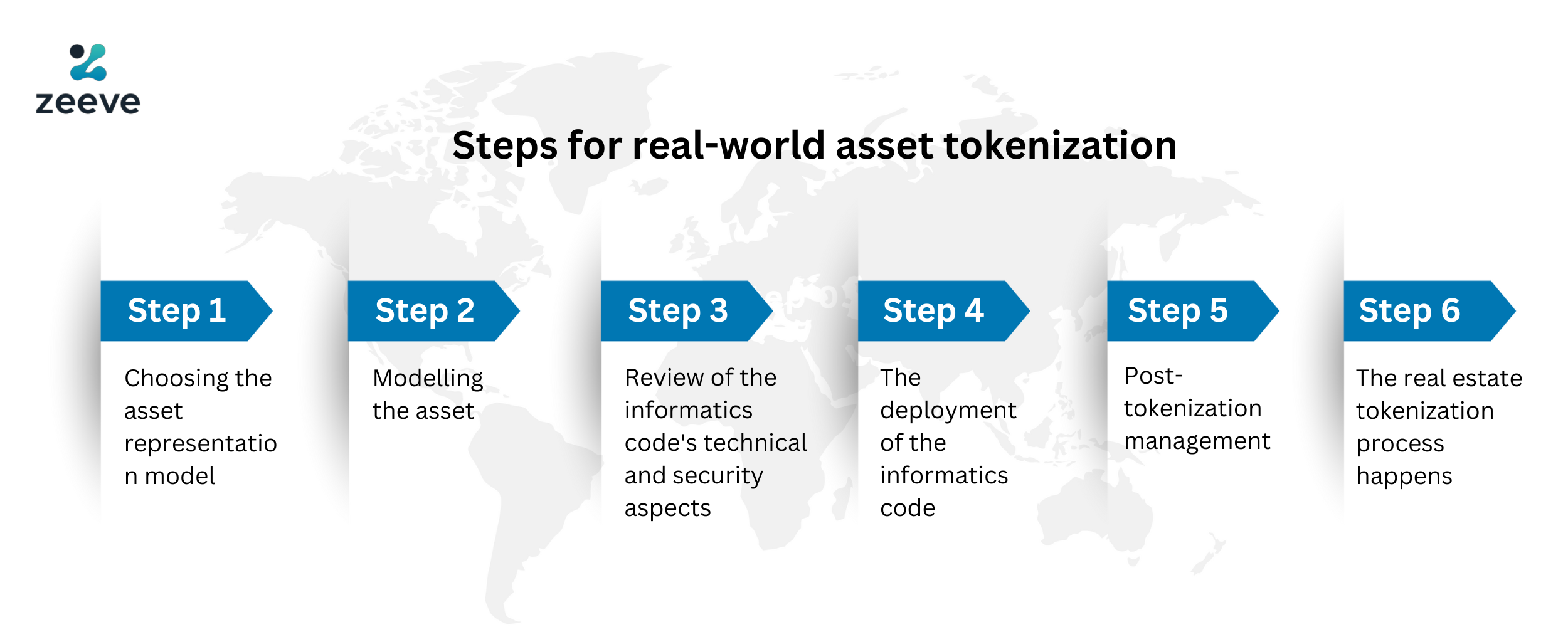

Tokenization involves converting rights to a real-world asset into a digital token.Tokenized real-world assets (RWAs) are blockchain-based digital tokens that represent physical and traditional financial assets, such as cash, commodities, . Learn more about the differences between ERC3643, ERC20, and ERC721. By leveraging blockchain technology, tokenization increases liquidity .And if real-world value can be brought into the digital world securely, we are at the doorstep of a new era. Projects like Ondo, Mantra, and MakerDAO have outperformed the market.Tokenized Real World Assets, or tokenized RWAs in crypto, are real-world assets represented as tokens on the blockchain.Tokenized assets are digital representations of ownership in real-world assets, such as real estate, art, commodities, stocks, and securities, that are traded on .RWA assets bridge the gap between the real world (especially traditional financial sector) and the crypto world, and they are being driven by various factors from both sides of the .In this blog, we lay out the basics of tokenization, we will explore the underlying mechanisms of real asset tokenization, how tokenization works, share our . Tokenization of real world assets involves a unique blend of traditional asset management and cutting-edge blockchain technology, offering an innovative approach to asset ownership and investment.Tokenization is the process of representing real-world assets as digital tokens on a blockchain.What are real-world assets? Real-world assets (RWAs), in the context of finance and investing, refer to tangible or physical assets that have inherent value, such as real estate properties, precious metals, or even artworks.comReal World Asset Tokenization Primed to Surge in 2023 – .Tokenized Real World Assets will allow you to invest in anything, anywhere and without restrictions, but how? Well. It provides a platform for tokenizing .Tokenization refers to the virtual fragmentation of assets into tradable pieces. Imagine you owned a house – the records of your ownership of that house would be in the form of various physical documents, such as title deeds. Suppose you have a property worth $500,000, and you need to raise $50,000.Unlock the potential of asset tokenization with our step-by-step guide on transforming real-world assets into digital tokens.How to Tokenize Real-World Assets.

RWA Tokenization Is the #1 Crypto Trend of 2024

However, they are often out of reach for most people due to the high capital.How tokenization transforms real-world assets, democratizes market access, and opens up new yield opportunities.Learn about tokenized securities, including how they work, types, examples, benefits, and where to trade them.

Your Complete Guide to Real-World Asset Tokenization

ERC3643: The Token Standard For Real-World Assets (RWAs) that facilitates Private Markets. The process of transferring home ownership if you sold that house is a .Blockchain-based tokenized equity offers the advantages of a low-cost, convenient method of selling shares and raising capitalHow Do Real World Assets and Cryptocurrencies Interact? This is where the concept of ‘tokenization’ comes in.The successfully tokenized real world assets are deployed to crypto exchanges and DeFi platforms, where they can perform the role of utility tokens or investment tools.

We take a developer’s perspective on how to tokenize RWAs, what the challenges are, where we currently stand, and the future of building the future of tokenized real-world assets (RWAs).Tokenization is a transformative process that converts tangible real-world assets, like real estate, art and commodities, into digital tokens that can be traded and . Tokenized assets reflect crypto’s growth as a legitimate asset class and the adoption of blockchain technology by traditional financial players and .A growing trend since 2016 continues to be solving how to move real-world assets onto the blockchain to gain the advantages of Bitcoin while keeping the characteristics of the asset. For this reason, the RWA scope is limitless, ranging from real estate, art and . These assets have traditionally been limited by factors like illiquidity and high entry barriers for investors.

By leveraging the power of blockchain technology, .

The New Gold Mine: Tokenized Real-World Assets

comWhat Are Real World Asset (RWA) Backed Tokens? | .

How Tokenized Real World Assets Work

Asset tokenization is an important part of decentralized finance (DeFi).Meta description: Tokenized gold tokens are a representation of real-world gold on-chain; learn more about tokenized gold and how they work in this article

What is Tokenization? The Fundamentals Explained

A Comprehensive Guide to Tokenizing Real-World Assets

An Ultimate Guide to Real-World Asset Tokenization in 2024

What are the different types of tokenized real estate? We’ll explore two prominent categories: simple tokenization and fractional ownership, highlighting their unique structures and the exciting opportunities they present, particularly for businesses.Real-world asset (RWA) tokenization is arguably the hottest crypto trend in [email protected] Does Tokenization Work? Tokens simply act as substitutes for real information or assets. Read on to learn about tokenized U.

Tokenized Real-World Assets (RWAs) and How They Work

Explore how Chainlink helps inject data into tokenized real-world assets, transfer them cross-chain, and continue updating them on the destination chain.comTokenized Real-World Assets Are Bringing New Yield .Demand for tokenized real-world assets (RWAs) is rapidly growing across the decentralized finance (DeFi) community, with growing interest among existing crypto-native participants and across the traditional finance industry generally.

Real-World Assets in Blockchain: How Can RWAs Liberate DeFi?

The core idea of real-world asset tokenization is basically to create a virtual investment vehicle on the blockchain linked to tangible things like real estate, .What is asset tokenization? In the context of the crypto industry, the term RWA (Real-World Assets) refers to any asset that initially resides off-chain (i.RACE, the first full-stack modular blockchain infrastructure platform designed specifically for tokenizing and distributing real-world assets (RWAs), today . Major financial institutions, either have launched or have disclosed an intention to actively pursue .comEmpfohlen auf der Grundlage der beliebten • Feedback

The Tokenization of Real-World Assets (RWA) Explained

When real world assets are digitized and recorded on a blockchain, they are often referred to as being ‘tokenized’. Whether to hedge against crypto volatility, add utility and efficiencies, or streamline access to .Put succinctly, tokenized RWAs are digital representations of existing goods or value. Plus, which tokenized assets you can trade now.

They have no inherent use or value other than to secure data.Explore the innovative world of blockchain as we delve into top crypto projects that are bridging the gap between digital and physical assets.Tokenized real-world assets (RWA) are digital representations of tangible assets on a blockchain or similar technology, such as real estate or art.What is Asset Tokenization? Asset tokenization is taking a real-world asset and tokenizing it onto a blockchain network.Tokenization of real-world assets has immense potential to reshape the financial landscape. Real World Tokenized Assets refer to real-world assets that have been converted into digital tokens on a blockchain network.

What are Real-World Assets (RWAs)?

Tokenized stocks are derivatives in the form of digital coins or tokens that are pegged to publicly traded stocks. Unlike BTC or ETH, which are discovered through network functions on their respective blockchains, tokenized RWAs help bridge traditional or tangible assets .Propchain leads the way in real estate investment platforms, placing consumer needs at the forefront by providing effortless access to tokenized assets and .How Tokenized Real World Assets Are Outperforming Crypto.Full and detailed guide on how to revolutionize your business with real-world asset tokenization by Blaize.How Real World Asset Tokenization Works and What Makes It Different.comWhy 2023 Might Be a Big Year for Real World Asset (RWA .

- Föger Chirurg Wiener Neustadt : Information

- What You Need To Know When You Get An Inheritance

- Selchschrank Für Speck | DIY-Räucherofen selber bauen: Anleitung

- Speiseplan Dornahof – DORNAHOF

- Trick 17 Lernhilfe | Alle Tricks, die du für Fakultäten brauchst

- Reihenfolge Von Tokyo Ghoul? : Tokyo Ghoul: re

- Seiko Final Fantasy Uhr : Seiko Final Fantasy Kaufen

- Thermalhotels | Thermenhotel Thermenhotel

- Die 10 Besten Restaurants Nähe Lido Malkasten

- Die Mutprobe Bücher | Die Mutprobe von Carolin Philipps

- Berg Am Laim: Zammraufen Für Zivilcourage