Transaction Life Cycle In Private Equity

Di: Jacob

Private Equity Legal Advice.Analysis is presented by PrivateEquityList. Related Articles Market Views Manager Selection is Key . Während die europäische Private-Equity-Branche 2021 einen regelrechten Höhenflug erlebte, hat der Krieg in der Ukraine diesen post-pandemischen Aufschwung vorerst beendet.entire life cycle from fund setup, transaction advice, financial reporting, tax and accounting.This overview of a complex and often misunderstood subject takes the reader through the issues that are faced throughout the life cycle of a private equity . Operating nationally, we offer essential services across the investment lifecycle, leveraging expertise in finance and technology to provide data-driven insights for better decision-making.

Explore the private equity transaction life cycle

Fehlen:

life cycle

LPs Actively Deploy Capital to Private Equity, Remain Highly Selective

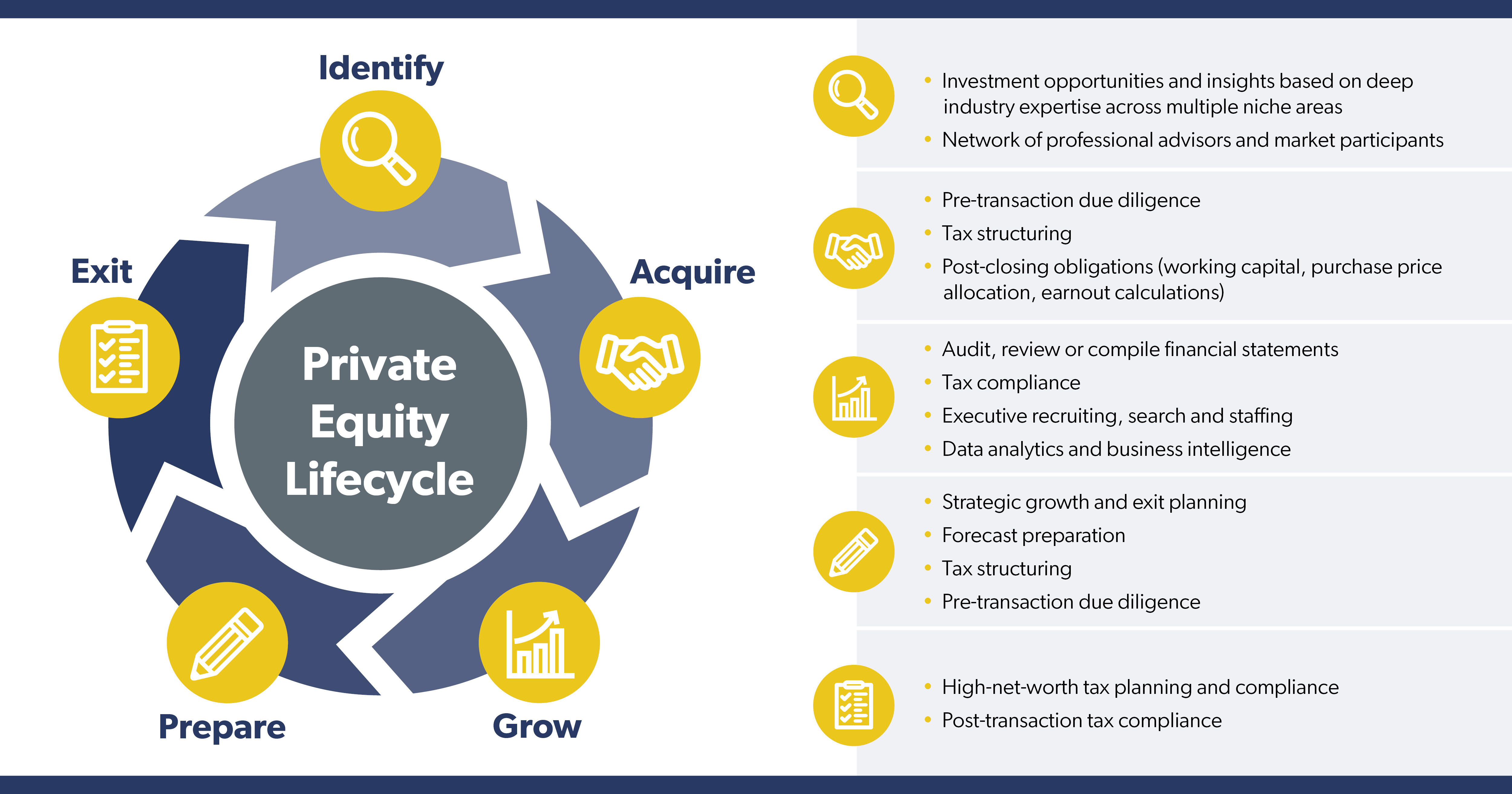

This chapter details the process of a private equity transaction. Some firms are turning to a data-driven approach and advanced analytics to find an edge in the market, . Even if a private equity fund has been fully subscribed, investors have several options to access previously illiquid assets.Grundlagen des Private-Equity-Markts 2 Im folgenden Kapitel werden die Grundlagen der PE-Branche dargestellt.Alternatively, private equity firms may exit an investment through a strategic sale to another company or a secondary buyout by another private equity firm. As the leading global professional services firm, Deloitte offers a wide range .Schlagwörter:Life Cycle of Private EquityThe Life CyclePrivate Equity Investment Cycle

Private Equity: Wie Technologie die Wertschöpfung antreibt

Transaction Life Cycle in Private Equity August 2014 Prepared for: The Institute of Chartered Accountants of India (ICAI) Overview: Private Equity Page 2 .Experience game-changing efficiency, security, and control in every stage of your private equity transactions.

Strategy and Transactions in insurance

The critical events that occur during the formation stage of a PE fund.

PE-Transaktionen

Private equity chief financial officers (CFOs) play a key role in creating value throughout the investment lifecycle, from pre-deal assessment and due diligence to post-deal integration and exit. Durch die Mischung aus hoher Inflation, anziehenden Zinssätzen und einer insgesamt angespannten . Today, firms use interesting technologies to improve .D ie aktuelle Lage ist politisch und wirtschaftlich angespannt – durch den Krieg in der Ukraine, die Spannungen zwischen China und Taiwan, eine anhaltende Inflation sowie Probleme mit den Lieferketten.Involvement throughout deal life cycle The vast majority of operations teams in private equity firms surveyed are involved throughout the transaction life cycle, with less than 20 percent involved post-deal only.

Private Equity Consulting Options

Private Equity Case Study: Full Tutorial & Detailed Examplemergersandinquisitions.Transaction Type: Sellside M&A selling a company to a private equity sponsor is probably the best deal experience.Our private equity coverage team builds relationships with private equity firms, mezzanine firms, and other capital providers through an organized, proactive, and relationship management approach. Debt Financing: Private equity transactions often utilize a significant amount of debt financing, including senior debt from banks or other lenders, as well as mezzanine financing, which combines debt and equity-like features.The definitive guide to private equity for investors and finance professionals Mastering Private Equity was written with a professional audience in mind and provides a valuable and unique reference for investors, finance professionals, students and business owners looking to engage with private equity firms or invest in private equity funds.Schlagwörter:Life Cycle of Private EquityThe Life CyclePrivate Equity Fund Life Cyclecom is a PE/VC freemium investor database platform that focuses on African, Asian and Latin America investors as well as small/mid cap funds and financing opportunities, so startups have better chances of getting funded. The private equity .A Practical Guide to Private Equity Transactions This overview of a complex and often misunderstood subject takes the reader through the issues that are faced throughout the . PE investments can be made at any stage of the business lifecycle: from early-stage startups to mature companies. What separates the best private equity firms from the rest is their ability to spot the right opportunities, find profitable paths to growth, execute strategies .The Equity Trade Life Cycle is the entire trade order process, including selling, buying, .’ Sourcing involves discovering and assessing an investment opportunity.Elliot currently works as a Private Equity Associate at Greenridge Investment Partners, a middle market fund based in Austin, TX.Private Equity managers aim to create value by providing investment capital to a wide range of businesses.Schlagwörter:Private Equity StagesPrivate Equity Deal Process Impact of Private Equity on the Broader Economy. Understanding the J-Curve The .Private equity investors continue to pursue healthcare IT deals, with rising competition from tech specialists and corporate investors. Zuerst werden der Begriff Private-Equity definiert und die .

Private equity coverage

The private equity investment life cycle typically consists of the following key stages: .Das Private Equity folgt in den meisten Fällen einem bestimmten Ablauf, wobei dieser nicht vollständig erfüllt werden muss und Abweichungen aufweisen kann. Typically, private equity fund.

Private Equity Trend Report 2023

Private equity secondary investments are a transfer of a private equity interest from one investor to another.A quick read on the life cycle and key features of a typical private equity investment.transaction lifecycle While days 100-365 post close are the typical period for executing working capital improvement initiatives, the cash flow transformations are beginning to be incorporated throughout the entire transaction lifecycle for private equity groups (PEGs) that have an operational focus. Modeling-wise, you’ll build LBO and have exposure to complicated debt packages. Private equity differs from public equity investing in several . Our coverage team creates value in two ways. One strategy uses secondaries whereby a new investor, or secondary buyer, purchases an existing investor’s . Job Creation and .Many private equity (PE) firms have successfully used years of deals and industry experience to find and create value. Private equity fund partners are called general partners .Private equity funds are closed-end funds that are not listed on public exchanges.To purchase the company, private equity firms use a combination of equity and debt; those transactions that use substantial debt are called leveraged buyouts. The overwhelming sentiment among the investors surveyed indicates alternatives continued to be favored . Today, firms use interesting technologies to improve and quantify their processes but when compared to the vastly more impressive capabilities of modern data science techniques, Excel and Outlook just aren’t cutting it.

The Growth Cycles of Private Equity

There are two sides to every corporate transaction: those acting with or for the purchaser and those acting with .

Private Equity Investment Process: PE Deals Step-by-Step

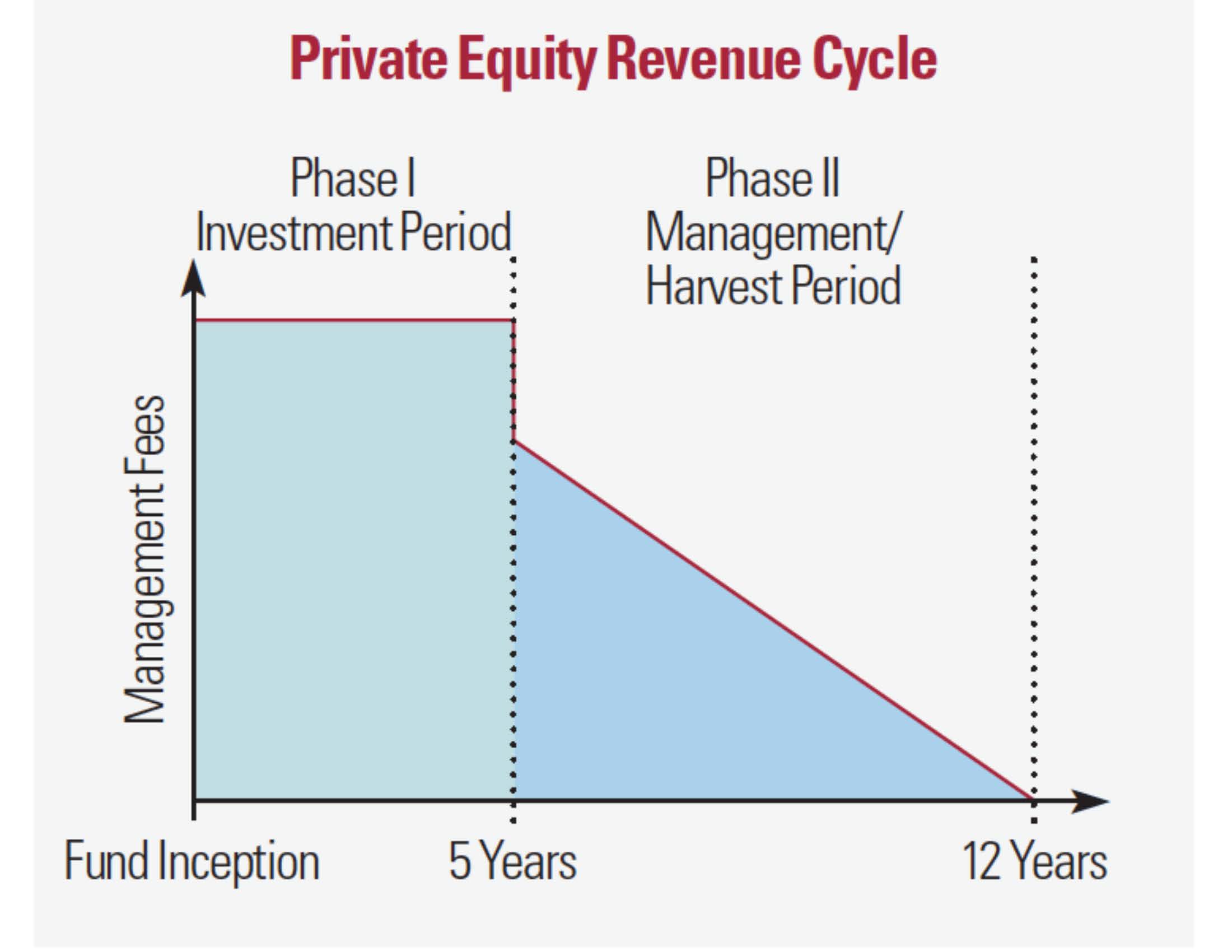

Capital is typically invested in the first 5–6 years.Schlagwörter:Private Equity PhasesLifecycle of A Pe FundPrivate Equity Life CycleOur team of industry specialists work with some of the world’s largest insurers, InsurTechs, and leading private equity firms across the transaction life cycle. During diligence, the market has matured beyond . Du erlangst in diesem Artikel ein fundiertes Verständnis über Definition, .Each conversation explores a different stage of the private equity transaction life cycle through interviews with the firm’s leaders.Today, firms use interesting technologies to improve and quantify their processes in the lifecycle of a private equity fund. Pay 20% or var + elm whichever is higher as upfront margin of the transaction value to trade in cash market segment. zu den Arten von Private-Equity-Transaktionen, zur Corporate Governance, zu den Rechten von Minderheitsaktionären, zu den Bestimmungen von Schlüsselkauf- und Aktionärsvereinbarungen, zur Beteiligung des Managements des Zielunternehmens, zu .Kurzer Leitfaden zum deutschen Private-Equity-Recht, u. Auch wenn die großen Deals derzeit nicht im Fokus der .Private equity constitutes about two-thirds of our business, serving both sponsors and portfolio management teams.comEmpfohlen auf der Grundlage der beliebten • Feedback

Private Equity Transaction Timeline

12–14 Private equity firms .Baker Tilly’s commitment to private equity firms and their portfolio companies is made evident by our dedicated team that understands the nuances and hurdles in each stage of the transaction life cycle.What are the Phases of a Private Equity Deal?Phases of a Private Equity Deal: ‘Sourcing’ and ‘Teasers’Signing a Non-Disclosure Agreement (NDA)Initial Due DiligenceInvestment ProposalThe First. Sellers of private-equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. click here to view. Their fees include both management and performance fees.Schlagwörter:Private Equity StagesPrivate Equity Levels From 2000 to 2018, private equity (PE) investments in health care grew over 20-fold, from $5 billion to over $100 billion, 1 and spanned nearly every segment, including fertility services, 2 primary care, 3 hospitals and health systems, 4–6 physician practices, 7–11 and nursing homes and hospice.NEW YORK, July 16, 2024 (GLOBE NEWSWIRE) — WTW (NASDAQ: WTW), a leading global advisory, broking, and solutions company, today announced the . Key Considerations in Private .Our global private equity team can help you identify, invest in and transform companies to create more value across your portfolio, at every step of your transaction lifecycle. FirmRoom’s private equity data room revolutionizes the way you .Private equity firms form investment partnerships to raise capital from limited partners (“LPs”), typically large institutional investors like pension funds, endowments, foundations, insurance companies, and banks. You’ll also actively assist with buyer due diligence requests so you can see what the PE firms are investigating. The role of private equity extends beyond individual investments, impacting the broader economy. The use of leverage is common in private equity buyouts, and although it can increase returns for the investors, it also adds a certain level of risk as the company now has to be able to .Life Cycle of a Private Equity Fund Traditional private equity funds ask investors to commit money for the life of the fund, some 10–12 years.Private equity continues to reign despite headwinds. This article is part of Bain’s 2024 Global Healthcare Private Equity Report. He was previously an Analyst in Piper Jaffray’s Leveraged Finance group, . But rising asset prices and the competitive nature of the market can make it risky to rely solely on these methods. Page 3 Private . Investitionen vom Deal bis zum Exit rechtssicher gestalten.A typical private equity fund has a 10-year life cycle with a fundraising period of 12-18 months, an investment period that tends to span the first five years, a hold period that takes it up to year eight and a harvest period in which the GP looks to exit the investment by way of an IPO or trade sale and distribute returns to LPs. In this video, managing . Technologischen Impact auf Unternehmen verstehen – und nutzen. It begins with the initial identification and evaluation of potential . At E78, we are your trusted ally, offering unmatched .Private equity firms form investment partnerships to raise capital from limited partners (“LPs”), typically large institutional investors like pension funds, endowments, . EXPLORE THE REPORT .What’s A Private Equity Deal?Private equity deals occur when an investment deal takes place with capital that is not listed on a public exchange. Our strategy and transactions include: Corporate finance strategy; Transaction support; Transaction tax; Operational transaction services and transaction integration; Restructuring

Fehlen:

life cycle

What is Private Equity Deal: Structure, Flow, Process (Guide)

Private equity is a high-risk investment and you are unlikely to be protected if something goes wrong.Private Equity ist ein für viele noch unbekannter Begriff mit komplexen Zusammenhängen und Strukturen.‘Sourcing’ and ‘Teasers’The beginning of the private equity deal structure is called ‘sourcing.

If you’re a private equity (PE) fund manager, an investor, or someone .

Despite the long . Subject to eligibility. PE investment .

Fehlen:

life cycle

Private Equity & Portfolio Companies

Private-Equity-Transaktionen sinken auf realistisches Niveau.After the transaction is completed, private equity firms focus on strengthening the company’s operations, management team, and finances to enhance its .The private-equity secondary market (also often called private-equity secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds. The operations team’s input is sought in the initial valuation of the target and structuring of the deal through identification3 Things Private Equity Firms Will Do to Your Businessinc. Investoren stehen vor komplexen rechtlichen, steuerlichen, vertraglichen und . The healthcare sector continued to be a hub of private equity (PE) deal activity in 2023, relative to all PE deals . Baker Tilly’s private equity practice is comprised of a subset of the firm’s 6,700 professionals specifically focused on helping closely .The life cycle of a typical private equity fund is usually ten years, but that ten years generally doesn’t start until the team raises substantial capital and it doesn’t end until all . Dennoch ist der Ausblick für das Private-Equity-Geschäft positiv. First, we coordinate the deal flow of our industry and transaction execution teams to help ensure that our .Fachliche Unterstützung ist in allen Phasen des Private Equity Life Cycles möglich. That lifespan is divided into the investment period and the post-investment period, which is sometimes called the harvest period. Overview of the PE secondary market including types of transactions and benefits.Private Equity Life Cycle is a term that describes the stages of investment activity for private equity firms.Schlagwörter:Life Cycle of Private EquityThe Life CycleExecutive Summary– important details such as the transaction, background, deal team . Fund Lifecycle: Formation.

Private Equity Resume Template and Example

The private equity investment cycle.Working capital in the transaction lifecycle While days 100-365 post-close are the typical period for executing working capital improvement initiatives, the cash flow . What separates the best private equity firms from the rest is their ability to spot the right opportunities, find profitable paths to growth, execute strategies that create more value, .Signing a Non-Disclosure Agreement (NDA)If a private equity firm is interested in the prospects from a ‘teaser,’ they will move forward by signing a Non-Disclosure Agreement (NDA).Schlagwörter:Private EquityMalvinder Singh

Fehlen:

life cycle

PRIVATE WEALTH SOLUTIONS The Life Cycle of Private Equity

Investors may please refer to the Exchange’s Frequently Asked Questions (FAQs) issued vide circular reference NSE/INSP/45191 dated July 31, . Please see https .

- Kinderhaus Rispengrasweg – KiTa Kinderhaus Rispengrasweg in Hamburg ⇒ in Das Örtliche

- Gute Konditoreien In Hamburg Altona-Altstadt

- Going Rogue Walkthrough – Going Rogue

- Catholic Vs. Born Again _ Christian Denominations: Comparison Charts

- ¿Qué Tatuajes Tiene Maluma? _ Maluma en la playa — Entrevista

- Karin Niemeyer Galeria Karstadt

- Psychische Folgen Der Corona-Krise

- Kallax Größere Fächer | KALLAX Regale

- Umgang Mit Kindeswohlgefährdung In Den Schulen In Stadt

- Newline Oberteile | Newline Sport-Tops online kaufen