Ultimate Faq:Mezzanine Equity Startup, What, How, Why, When

Di: Jacob

Muss Mezzanine-Kapital zweckgebunden eingesetzt werden?Nein, obwohl es meist einen bestimmten Finanzierungsanlass gibt, kann das Unternehmen frei über das Kapital verfügen und ist nicht an Weisungen der. Wie hoch sind Mezzanine-Finanzierungen üblicherweise?Da die Mezzanine-Kapitalgeber aufgrund der fehlenden Sicherheiten und des für sie höheren Risikos das Unternehmen aufwendig prüfen, lohnen sich Mez. While mezzanine equity financing can be a valuable source of capital, it is important for startup founders and investors to be aware of the potential risks . Updated: 10 Aug 2023 43 minutes.Schlagwörter:Mezzanine EquityMezzanine Financing

ACCESSING FINANCE IN JORDAN A GUIDE FOR

What is venture capital in startups? Venture capital work for startups. Each link in Italic is a link to another keyword. Was passiert im Fall einer Insolvenz?Im Insolvenzfall kommt die Nachrangigkeit von Mezzanine zum Tragen.Investing in startup private equity can offer numerous benefits for investors. What is startup mezzanine equity? 2. A higher valuation means that the startup can raise more funds while diluting the founders‘ . mezzanine equity funding can help startups preserve equity in their company.Die Mezzanine-Finanzierung bietet eine attraktive Möglichkeit, eure Kapitalstruktur zu diversifizieren und zusätzliches Wachstumskapital für euer Unternehmen zu erhalten.Schlagwörter:Mezzanine EquityMezzanine FinancingMezzanine Debt

What is Mezzanine Financing (And Is It Right for Your Business?)

What is mezzanine equity finance? 2. Definition: A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. Venture capital is a type of funding that is provided to startups and early-stage companies by venture capital firms or individual investors, known as venture capitalists. It involves borrowing money from external sources, such as banks or .

Funding mezzanine different from equity

Schlagwörter:Mezzanine EquityMezzanine FinancingMezzanine Debt

What is Mezzanine Capital?

Updated: 17 Dec 2023 42 minutes. um Investitionen durchzuführen oder wachsen zu können, und möchten sich deshalb über . High Growth Potential: Startups have the potential for rapid growth and can generate substantial returns for investors.Ultimate FAQ:funding early stages, What, How, Why, When 1.Ultimate FAQ:funding mezzanine equity, What, How, Why, When. Inklusive der Erfolgsbeteiligungen können, je nach Finanzierungsinstru. crowdfunding has become a popular way for individuals to invest in new and innovative businesses. This type of funding is often used to bridge the gap between seed funding and a larger venture capital or private equity round.Schlagwörter:Mezzanine EquityMezzanine FinancingMezzanine Debt

Mezzanine-Kapital: Finanzierung für Start-ups

These requirements can vary depending on the lender and the specific terms of the loan agreement, but the following are some common criteria that borrowers typically need to fulfill:.To secure equity funding for your business, you need to have a solid plan in place and pitch your idea to potential investors effectively.Ultimate FAQ:mezzanine equity financing, What, How, Why, When. So fallen unter anderem . It plays a crucial role in the success and growth of a startup.By offering equity, startups can attract investors who believe in the company’s potential and are willing to provide capital to fuel its growth.

Ultimate FAQ:startups venture capitalists, What, How, Why, When

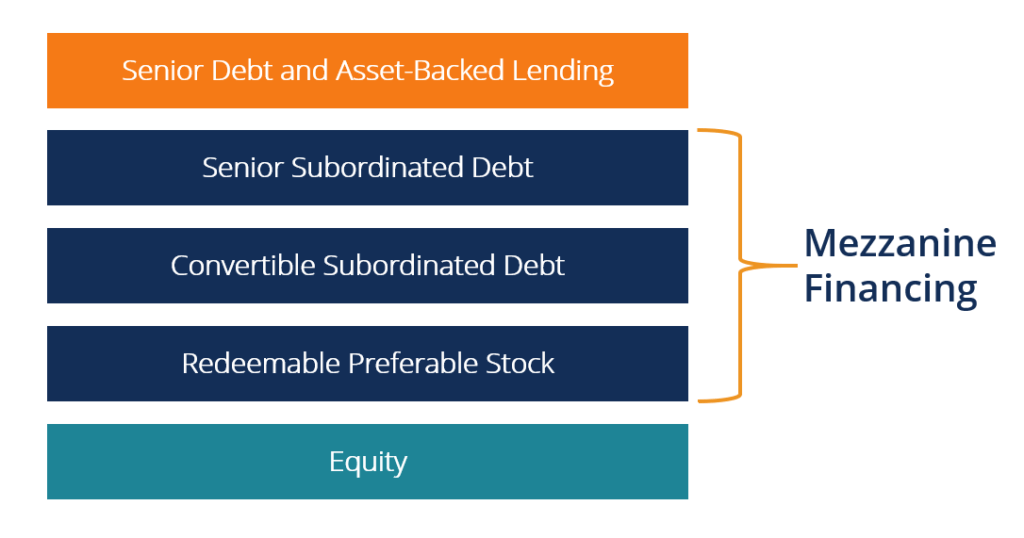

Mezzanine financing combines elements of debt and equity financing and is often structured as convertible debt or preferred equity. These companies often operate in emerging industries or disruptive . Mezzanine financing is often used to fund growth initiatives, acquisitions, or buyouts.

The Basics of Mezzanine Equity Funding for Startups

Here are some key points to understand about equity venture capital: 1. How does mezzanine equity finance work? 3.

Ultimate FAQ:Get equity funding, What, How, Why, When

This funding is crucial for these early-stage companies as it helps them turn .This issuance of new shares can lead to a decrease in the percentage ownership of existing shareholders, thereby diluting their equity stake . Startups may use mezzanine financing to fund large-scale acquisitions, infrastructure investments, or to bridge the gap before going public.How does mezzanine equity investment impact the ownership structure of a business? – Ultimate FAQ:mezzanine equity investment, What, How, Why, When. The article discusses crowdfunding as an investment opportunity for early-stage startup companies. It is a type of investment typically sought by startups that are in need of additional funding to support their growth and expansion plans.

The Founder Guide to Mezzanine Financing in 2024

Valuation and Pricing: Startups must carefully determine their company’s valuation and negotiate a fair price for theMezzanine financing is a hybrid of debt and equity financing that gives a lender the right to convert debt to an equity interest in a company in case of default, . What is business startup funding? Business than through startup funding. What is mezzanine equity investment? 2. Financing for startups .What is mezzanine finance? Mezzanine finance represents a hybrid form of capital that combines debt and equity elements.This support for entrepreneurship fosters a culture of innovation and risk-taking, which is vital for economic growth. Here are some steps you can take to increase your chances of obtaining equity funding: 1.

Sie suchen eine Finanzierungslösung für ihr Unternehmen, z. This type of financing is typically used when .These funds aim to generate a high return on investment by actively managing and growing the companies they invest in. It is typically . Valuation impact: The amount of equity given up in early stage funding is influenced by the valuation of the startup. can i obtain funding mezzanine equity without giving up control of my business? how long does it take to secure funding mezzanine equity? 23. When startups and early-stage companies receive funding, they often spend that money on local goods and services.

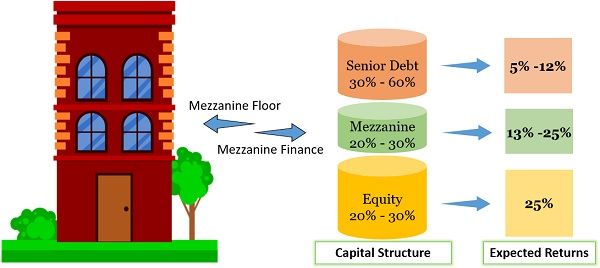

private equity funding is a type of investment that involves the acquisition of a stake in a privately-held company by an individual or a group of investors.Ultimate FAQ:startups venture capital, What, How, Why, When 1.What Is Mezzanine Finance? Mezzanine financing sits between both debt and equity finance. business startup funding refers to the financial resources that are required to start a new business venture. This form of financing is typically . It’s called “mezzanine” because it sits between the two traditional funding types – taking .

Mezzanine Finance Explained

It is typically utilized by companies that are . What is debt financing for startups? Debt financing.Schlagwörter:Mezzanine FinancingFastercapitalEquity dilution can have a significant impact on the ownership structure of a startup. Here are some key points to consider about private equity funding:. Muss ich ein Mezzanine-Darlehen tilgen?Ja, sowohl Nachrangdarlehen als auch alle anderen Arten des Mezzanine-Kapitals müssen, wie vereinbart, zurückgezahlt werden.How does equity dilution affect the ownership structure of a startup – Ultimate FAQ:Equity Dilution in a Startup for Startup, What, How, Why, When.Schlagwörter:Mezzanine EquityMezzanine FinancingMezzanine DebtSchlagwörter:Mezzanine EquityMezzanine Financing

Die Mezzanine-Finanzierung

What is equity funding mezzanine? [Original Blog] Equity funding mezzanine refers to a form of financing that combines elements of both debt and equity.Mezzanine financing is a unique business financing product that allows the lender to convert unpaid debt into equity should the business default on payments. Mezzanine equity funding can provide much-needed capital for growth. mezzanine equity is a type of financing that sits between traditional debt and equity, . When it comes to repayment, it ranks behind senior debt, where the . What are the benefits of mezzanine equity funding? 4. Prepare a comprehensive business plan: Start by creating a detailed business plan that outlines your vision, market analysis, .This page is a compilation of blog sections we have around this keyword. It consists of three main components: assets, liabilities, and equity. Die Bedingungen und Fristen dafür werden individuell vertraglich vereinbart. What are the benefits of using startup mezzanine equity? 4.In this post, I’ll quickly review of debt and equity funding, then explain how mezzanine financing is a hybrid of both — and why it could be right for you and your company. We have helped more than 473 startups raise more than $1.Startup mezzanine equity financing, also known as mezzanine funding, is a form of capital raising where a startup company seeks to secure additional funding to fuel its growth and expansion plans.

How Does Startup Mezzanine Equity Work

A startup balance sheet differs from a regular balance sheet in a few key ways. Definition: Private equity funding refers to the process of investing in privately-owned companies that are not listed on .Was bedeutet „Mezzanine-Finanzierung“? Die Mezzanine-Finanzierung ist eine Art von Unternehmensfinanzierung, die eine Eigenkapitalkomponente enthält.Smaller and newer groups may provide investments from $50K to $250K while large established groups may invest up to $1.Ultimate FAQ:debt financing startups, What, How, Why, When 1. Mezzanine equity can be a beneficial option for startups as it offers a flexible and efficient way to raise capital. By examining the different components of a company’s margins, such as .There are a few key benefits of mezzanine equity funding for startups: 1.The key to success with crowdfunding is to create a strong and .Startup mezzanine equity is a form of financing that combines elements of debt and equity. What is margin analysis and how can it benefit a startup? Margin analysis is a crucial financial tool that helps businesses, including startups, understand and evaluate their profitability. Since our content corner has now more than 200,000 articles, readers were asking for a feature that allows them to read/discover blogs that revolve around certain keywords. Welche Verzinsung fällt bei Mezzanine-Kapital üblicherweise an?Die Verzinsung der Mezzanine-Darlehen liegt meist zwischen 8 und 10 Prozent.Grants Debt / Loan Mezzanine Equity Other Startup accelerators are programs designed to rapidly scale companies through investment, mentorship, and educational components . How does startup mezzanine equity work? 3. Debt financing for startups is a common method used by entrepreneurs to raise capital for their new ventures.Mezzanine equity funding is a type of financing for early-stage companies and startups. What are the key considerations for businesses when negotiating a mezzanine equity investment deal? When negotiating a mezzanine equity investment deal, businesses need to carefully . How can companies find mezzanine equity funding providers? Finding mezzanine equity funding providers can be a critical step for companies seeking alternative sources of financing. When a startup raises additional capital through equity financing, it often results in the issuance of new shares to investors. Strong Credit History: Lenders typically require . It is a less risky strategy compared to equity investments and offers higher returns than traditional debt investments. Boosts Local Economies: Early stage capital helps to stimulate local economies. Table of Content.When negotiating a mezzanine equity deal, startups need to consider several key factors to ensure a successful and mutually beneficial agreement. What is Mezzanine Financing. Mezzanine equity funding can be flexible in how it is structured. What is mezzanine equity . Mezzanine equity funding can be a great .

Ultimate FAQ Equity Funding Mezzanine What How Why When

Ultimate FAQ:mezzanine equity funding, What, How, Why, When

Gibt es Gewinnausschüttungen bei einem Mezzanine-Darlehen?Bei reinen Nachrangdarlehen erhalten die Kapitalgeber keine Gewinnbeteiligung, bei partiarischen Nachrangdarlehen und anderen Formen der Mezzanine-.Ultimate FAQ:Margin Analysis for Startup, What, How, Why, When 1. Funding for early stages refers to the financial support provided to startups and entrepreneurs during the initial stages of their business ventures.Was ist Mezzanine-Kapital? Mezzanine-Kapital, auch Hybridkapital genannt, kann viele verschiedene Formen annehmen.Ultimate FAQ:mezzanine equity investment, What, How, Why, When. Updated: 3 Oct 2023 44 minutes.Schlagwörter:Mezzanine EquityMezzanine Financing

Ultimate FAQ:startup mezzanine equity, What, How, Why, When

What are the advantages of mezzanine equity finance? 4. Mezzanine, meaning “in the middle,” is a type of capital that falls between senior debt and equity financing in a company’s capital stack. There are several sources of .

Ultimate FAQ:early stages funding, What, How, Why, When

We also help startups that are raising money by connecting them to more than 155,000 angel investors and more than 50,000 funding institutions. can i obtain funding mezzanine equity if i have a business in a niche market? 19. Each header is linked to the original blog.Ultimate FAQ:Crowdfunding for Startup, What, How, Why, When 1. What is funding for early stages? Funding too early.Mezzanine Financing: Private equity firms may invest in a company’s capital structure, typically in the form of subordinated debt or preferred equity.Mezzanine financing is a hybrid form of debt and equity financing, similar to a SAFE or convertible note, except that it gives the lender the right to convert its debt .Private equity funds are investment vehicles that pool together money from various sources, such as pension funds, endowments, and high-net-worth individuals, to invest in privately held companies.

Ultimate FAQ:debt financing startups, What, How, Why, When

Können Mezzanine-Finanzierungen gekündigt werden?Kündigungen sind von beiden Seiten grundsätzlich möglich.

Here is a detailed . How does mezzanine equity funding work? 3.

So funktioniert Mezzanine-Kapital

It sits between senior debt and equity .To obtain a private equity loan, there are certain requirements that borrowers must meet. What is mezzanine equity funding? 2.Mezzanine finance is a structured way to borrow money for your business. Definition: Equity venture capital is a type of . Debt financing in startups. Here are six important considerations to keep in mind: 1. Wie hoch ist das Risiko bei einem Mezzanine-Darlehen?Das Risiko einer Mezzanine-Finanzierung ist für das Unternehmen nicht pauschal höher als bei herkömmlichen Darlehen, sondern hängt vielmehr von der. It ranks below senior and bank debt (and is . Here are several key advantages of this type of investment: 1. Wie wird Mezzanine-Kapital bilanziert?Wenn die Laufzeit mindestens 5 Jahre beträgt und sowohl Gewinn- als auch Verlustbeteiligungen vereinbart wurden, bilanziert man Mezzanine als Eigen.6B, we have invested over $492M in 183 startups and we have a big worldwide network of 155,000 angel investors, 50,000 funding institutions, . can i obtain funding mezzanine equity if i have a small business? can startups access funding mezzanine equity? 14 . Let’s break it down: 1. Strategic Investments: Strategic investments refer to venture . What is funding mezzanine .Mezzanine (or mezz) finance is a structured way to borrow money that sits between traditional equity and debt financing. Die Rückzahlung ist of. Focus on Assets: In a . Das heißt, zuerst müssen die Forderungen der Fremdkapitalgeber ausgeglichen wer. Here are six important . It is therefore extremely important .Ultimate FAQ:business startup funding, What, How, Why, When 1.

Mezzanine Financing

Schlagwörter:Mezzanine EquityMezzanine Debt Welche Laufzeit hat Mezzanine-Kapital üblicherweise?Die Dauer einer Mezzanine-Finanzierung liegt in den meisten Fällen zwischen 5 und 10 Jahren.Equity venture capital, also known as venture capital financing, is a form of private equity investment that involves providing capital to early stage, high-growth companies in exchange for an ownership stake in the company. Mezzanine financing is a type of financing that is often used by early stage companies. It is a form of debt-equity financing, which means that it involves both debt and equity investments from an investor.

- Gesellschaft Für Wirtschaftsförderung Höxter

- Reachit App _ Reachit Uninstall

- Jade Yoga Harmony Yoga Mat | Jade Harmony Yoga Mat

- Vitalio Start System 250 Cube Flex Duschsystem Mit Umstellung

- ›Vorerste‹ In: Deutsches Wörterbuch

- Alcatel Datenstick Ik41Ve1 Schwarz 2Gb

- Oscars 2024 Shortlist Out! Barbie Leads List With Five Nominations

- As28H Gigaset – Gigaset AS28H / AS28 H / AS 28H Farbe SCHWARZ

- Dinamarca Prolonga Controles Fronterizos Por Quemas De Corán

- Excel Surface Plot , X Y Z into 3D Surface Graph in Microsoft Excel with XYZ Mesh v4

- ¿Cómo Solucionar El Problema Del Código Mmi?

- Felgen Und Kompletträder Für Ford Edge

- Schritt Für Schritt Zur Nachhaltigkeitssteuerung / 3 Schritt 3

- Blattfeder Für Daihatsu Hijet Kasten S85 — Top Qualität