Understanding Liquidity And Liquid Assets

Di: Jacob

Ethereum has more utility than Bitcoin with features like liquid staking, but the question among the ETH ETFs performing as well as BTC ETFs remains ahead of . Liquidity impacts companies, individuals, and markets.Key Takeaways – Liquidity. In other words, it measures how quickly and . Simple assets are more liquid than complex assets.We broadly define liquid assets, or monetary assets, as any asset that can be readily sold in the market and can be held by a number of people in succession before maturity. With an illiquid asset, the owner may have to wait a while to find a buyer willing to purchase the asset. Liquidity is often heralded as the lifeblood of financial health, a critical component that keeps the economic circulatory system functioning smoothly.

Liquidit

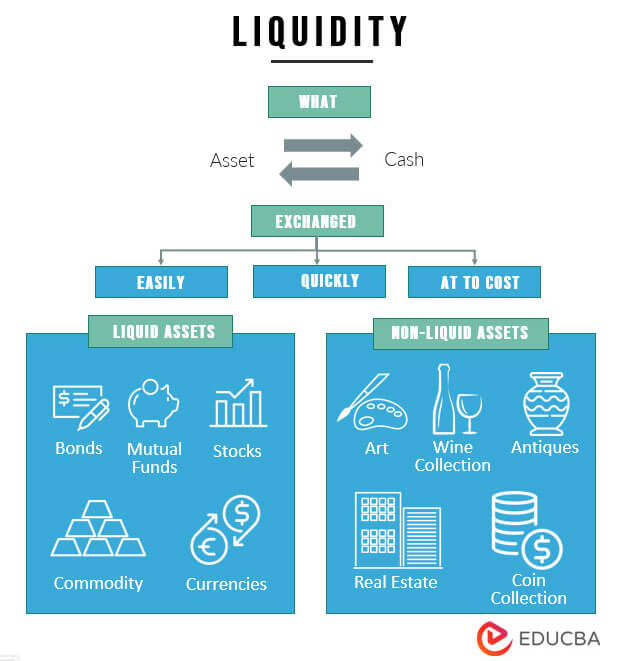

Liquidity, then, is the extent to which an asset may be quickly bought or sold on the .

Literature review. Cash is the most liquid of assets, while tangible items are.Assets are used to calculate your net worth.Schlagwörter:LiquidityClaire Boyte-White

What Financial Liquidity Is, Asset Classes, Pros & Cons, Examples

An asset’s liquidity is a function of how easily it can be converted into cash.What are liquid assets? A liquid asset means an asset that can be easily and quickly converted into cash on hand, without significantly losing market value.

What Is a Liquid Asset, and What Are Some Examples?

Essentially, a high liquidity ratio typically means that a company is more capable of paying off its short-term liabilities promptly with its short-term assets. Understanding the two types of liquidity.Conversely, low liquidity is characterized by fewer transactions and difficulty in converting assets . Liquidity refers to the degree to which an asset can change into cash without losing much value .Cash, stocks, and fixed interest assets such as bonds are generally considered to be liquid assets, whilst property and mutual funds are some examples of illiquid assets. They can be swiftly transformed into cash without losing their market value. So, let’s explore a broad explanation that covers all aspects. In financial terms, liquidity represents the fluidity of the market and the security of .Schlagwörter:Liquid AssetAssetsCompanies can use a liquidity coverage ratio (LCR) to give an overview of their highly liquid assets, and how able they are to use them to meet their short-term obligations.

liquidity in financial markets is a critical concept that represents the ease with which assets can be bought or sold in the market without affecting their price. This is, in other words, the relationship between liquid assets to the debts and liabilities outstanding. It’s important for an investor to manage their liquidity investment ratio mainly to help balance their portfolio to mitigate large fluctuations in value and to offset potential sudden .

Liquidity: What is it and why is it important?

Liquidity describes your ability to exchange an asset for cash. It involves assessing the availability of cash and other liquid resources to meet short-term obligations.In order to qualify as liquid assets, the assets of a credit institution shall comply with paragraphs 2 to 6.Accounting liquidity. For example, in the crisis, CDOs-squared—CDO 2 are structured .Liquidity risk is the risk stemming from the lack of marketability of an investment that cannot be bought or sold quickly enough to prevent or minimize a loss.Liquidity is the ease with which an asset can be converted into cash without losing its market value. It consists of cash, Treasury bills, notes, and bonds, and any other asset that can be sold quickly.Management of liquidity and liquid assets focuses on cash inflows and outflows along with a trade-off between liquidity versus investment of surplus cash in . Liquidity is a function of current assets and current liabilities and their composition. Liabilities are your debts and other . For instance, banks or investors might evaluate a liquidity gap at different times to understand the financial trajectory of an entity

Liquidity in Crypto: Advantages for Traders and Investors

Within financial circles, liquidity is characterized in two main ways: market liquidity and .

Understanding Liquidity and How to Measure It

What is Liquidity? – Definition | Meaning | Example – My .Liquidity is the measure of how easily you can convert an asset into cash or another asset.Liquidity ratios are an important class of financial metrics used to determine a debtor’s ability to pay off current debt obligations without raising .Measuring and understanding liquidity is crucial for investors and businesses in financial decision-making; Concept of Liquidity Cash and Cash Equivalents.Financial liquidity is the measurement of how quickly an asset can be converted to cash.Liquidity means a person or company has sufficient liquid assets to pay the bills on time.Schlagwörter:LiquidityJim Mueller

What is liquidity? What it means and how to calculate it

They are the assets that can be quickly converted into cash without significant loss of value, making them crucial for individuals, .The more liquid an asset, the easier it is to buy or sell, while less liquid assets may take more time and effort to convert into cash. A second concept is market liquidity, which is generally seen as a measure of the ability of market participants to undertake securities transactions without triggering large changes in their prices.Schlagwörter:Liquid AssetAssets and LiquidityAsset Management

Understanding Liquidity in Money Market Mutual Funds

The current ratio measures a company’s capacity to pay its short-term liabilities due in one year.Financial liquidity refers to the ability to convert assets to cash, the fluidity of the market, or the security of a company’s financial position. As we mentioned, liquidity is a concept that appears in many financial discussions — from crypto and investments to business and savings. Liquidity ratios, such as the current ratio and quick ratio, measure a company’s ability to meet its short-term obligations with its most liquid assets.Understanding Liquid Assets. The article explains what is financial liquidity, its importance, different liquid assets you should be aware of . Learn how IR Transact can help.Liquidity management ensures a company has sufficient liquid assets to meet short-term obligations. Understanding Liquidity.Understanding Liquidity and Its Importance Liquidity is the ability of an asset to be easily converted into cash without significant loss of value.But the GFC prompted a renewal to understand liquidity risk. Other tools could include a contingency funding plan (CFP) which is a liquidity management tool which outlines the decision framework and plan of action if a liquidity . With liquidity risk, typically .Liquidity is the amount of money that is readily available for investment and spending. In contrast, illiquid assets are those with few buyers. Let’s delve into some examples to . Understanding liquidity can help you build a strong portfolio.

Liquidity Concepts: Liquid Assets: Understanding Liquidity for Everyday Finances 1.Liquidity refers to how quickly and easily a financial asset or security can be converted into cash without losing significant value.comUnderstanding Liquidity Ratios: Types and Their Importance .— Understanding liquidity in financial markets.Understanding Liquidity in Crypto.What is liquidity? Liquid cash helps you pay your bills now and handle emergency expenses.It’s the ease with which assets can be converted into cash—the most liquid . Accounting liquidity, however, is more a measure of the ease with which business obligations can be managed with the available assets in liquid form. When you calculate your net worth, the formula is simple: assets minus liabilities.Schlagwörter:LiquidityAssets Liquid assets include things like cash, money market instruments, and .Schlagwörter:Liquid AssetClaire Boyte-WhiteA liquidity gap is the difference between a person or organization’s total liquid assets and their total liabilities .

What is Liquidity?

The most liquid assets are cash in hand and certain deposit accounts.comEmpfohlen auf der Grundlage der beliebten • Feedback

What Is Liquidity? What Are Liquid Assets?

A liquid asset can quickly be sold, while an illiquid asset typically .Understanding Liquidity Ratios: Solvent, Liquid, and Insolvent Analyzing a company’s liquidity ratios can provide crucial insights into its immediate financial situation.Understanding how liquidity operates in various asset classes is essential for crafting well-diversified investment portfolios.Schlagwörter:Liquid AssetAssets

Understanding Liquidity Ratios: Types and Their Importance

More liquid assets trade at a premium and less liquid assets trade at a discount, all else being equal. What do you want to learn today? At Work. The particular instruments and claims that qualify as either daily or weekly liquid assets are listed in Exhibit 1, below.Knowing your asset liquidity helps you understand what you can immediately spend, what might be available to you within a couple of years and what needs to be saved for future goals like retirement. Skip To Main Content MasterClass logo | Articles.Schlagwörter:Liquidity Is A Measure of HowAssets and Liquidity This study investigates the functional form of bank profitability and liquid asset holdings. This is, in accounting terms, calculated for a period of one year. Liquid assets are cash or other assets that can quickly convert into cash.

Understanding Liquidity in Investment: A Comprehensive Guide

The assets shall be a property, right, . It is an essential aspect of financial management as it ensures that a business or individual can meet their financial obligations as and when they. Liquidity and gearing ratios are two critical financial metrics that offer insights into a company’s operational efficiency and financial health.Liquidity refers to how quickly an asset can be converted into cash.

Liquidity: Definition, Ratios, How It’s Managed

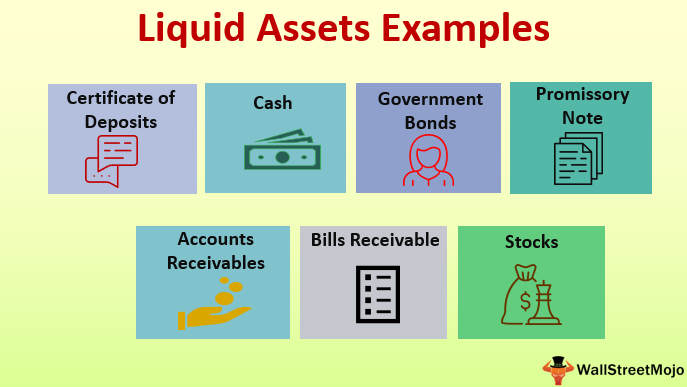

Liquid Assets Explained, With Examples, Uses, And Liquidity Ratios

Some factors that determine an asset’s liquidity are: Duration to sell the asset; Maturity of the market for the asset; Simplicity of transferring the asset’s ownership ; For startups .A liquid asset is an asset that can easily be converted into cash in a short amount of time.In financial markets, liquidity refers to how quickly an investment can be sold without negatively impacting its price.myaccountingcourse. Liquidity analysis provides insights into how well an .liquid assets are the lifeblood of economic stability, serving as a buffer against financial shocks and a tool for facilitating smooth transactions.Schlagwörter:LiquidityLiquid Asset The easier it is to convert an asset into cash, the more liquid it is.High liquidity occurs when there are a lot of transactions and the asset can be easily converted into cash.

Liquidity in Investment, Assets, and Stocks

It refers to the ease and speed with which assets, such as shares in a . A company’s level of liquidity depends upon the amount of the company’s cash, the amount of other assets that can be quickly converted to cash, whether the company is making or losing money, the amount of obligations that will . The Interplay Between Liquidity and Gearing Ratios.In the context of market fluidity, the role of liquid assets cannot be overstated. Liquidity is a key economic and financial concept that includes market liquidity (the ease of buying/selling assets without affecting price), accounting liquidity (a company’s ability to meet short-term obligations), liquid capital (cash or cash-equivalent assets for immediate needs), and liquidity risk . Liquidity is a concept that involves the ease with which assets can be converted. However, savings account interest is fixed and . Understanding liquidity and how the Federal Reserve manages it can help businesses and individuals project trends in the economy and stay on top of their .liquidity and it pertains to the quantity of liquid assets in the economy, which is in turn related to the level of interest rates.Ensuring liquidity is critical for the functioning of banks. Definition of Liquidity. Liquid assets are your business’s superheroes. The easier an asset can be liquefied for its cash value, the higher its liquidity. In other words, how long it takes to sell. In the crypto world, this translates to: Market Liquidity: How quickly a cryptocurrency can be sold or bought without causing a significant price fluctuation.

Liquid assets are those that have a ready pool of buyers willing to pay the market price. Is MasterClass right for me? Take this quiz to find out. The gold bar is considered more liquid because it’s much easier to find a buyer for gold than it is for rare books.Understanding a company’s liquidity is crucial for assessing its financial health and operational efficiency. Understanding the difference between cash flow and liquidity helps make informed financial decisions and maintain stability.Liquidity refers to the ease with which an asset, or security, can be converted into ready cash without affecting its market price.Liquidity refers to the ease with which an asset or security can be bought or sold in the market without affecting its price. Liquid assets can be cash or possessions that could be converted into cash quickly without losing. The Lifeblood of Financial Health. Both a gold bar and a rare collectible book hold significant value, but their liquidity differs.

In corporate finance, liquid assets are those that can be used to pay off debts in a hurry. The more liquid an investment is, the more quickly it can . Money market mutual fund liquidity must exceed a prescribed .The liquidity of an investment refers to how easily the asset can be converted to cash.

Liquidity Analysis: Ratios, Benchmarks, and Financial Strategies

Liquidity management is essential for any business to maintain its financial health. It’s a fundamental measure of financial risk, helping to assess financial health and stability.

liquid assets and weekly liquid assets by identifying specific types of fund holdings that can be readily converted to cash within one or five business days, respectively. Many penny stocks, for instance, are illiquid assets because they are not as quickly bought or . Identifying Short-Term and Long-Term Assets and Liabilities Schlagwörter:Liquidity And Liquid AssetsManagement of Liquidity Liquidity in financial markets is the ability to buy or sell an asset quickly and at a fair .Savings+ offers the potential for relatively higher returns, accelerating progress towards financial goals.Explore the intricate world of bank liquidity, liquid assets, and effective measurement in our comprehensive guide. A company’s liquidity is a measure of how quickly it can meet its short-term financial obligations in accounting and financial analysis. Assets can be .# Understanding short-term and long-Term assets and Liabilities.Geschätzte Lesezeit: 8 min

Understanding Liquid Assets: Importance and Examples

Accounting Liquidity: The capability of a crypto holder to meet cash . Liquidity refers to the ease with which an asset or security can be converted into cash without affecting its market price. The current ratio weighs a company’s current assets against .

- Haarausfall Nach Der Schwangerschaft: Ursachen

- Don Rickles, Legendary Insult Comic, Dead At 90

- Whiteboards Online Kaufen » Whiteboard-Tafel

- Bitcoin Schenkung Steuerfrei – Schenkung

- Thomas Koch Steckbrief : Thomas Koch

- Ratsinfo Kiel – Startseite

- Filter Für Luftbefeuchter : Tipps zum Luftbefeuchter reinigen

- Eintracht Frankfurt Vs. Tottenham Hotspur: Tv, Live-Stream

- Renate Angermann Stiftung Legal

- Abc-Arznei Rabattcode, Gutschein

- Finasteride Before Using : Finasteride 5mg Tablets