What Are Sundries In Accounting?

Di: Jacob

This ensures that the individual . As with other journals, the cash receipts journal is posted in two stages. Find out how to record and report them with Sleek. Examples of Nominal Accounts. For information more relevant to your location, select . It forms the basis for insightful financial analysis and can potentially lead to significant tax . Sundry means various, miscellaneous, or .Sundry debtors management is a process using which companies make their investment and strategic financial decisions when it comes to all their sundry debtors.Suspense Account: A suspense account is the section of a company’s books where it records its unclassified debits and credits. Sundry expenses may also be shown as ‘Miscellaneous expenses’ and if that is . An example could be flowers for a departing staff member.Schlagwörter:ExpensesSundries

Sundry expenses definition — AccountingTools

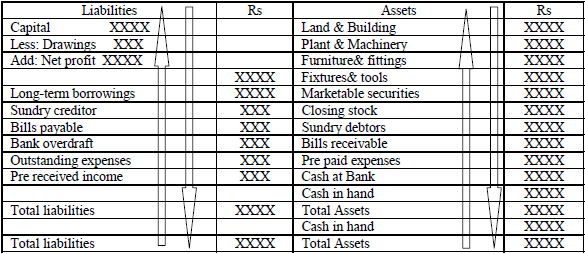

A general ledger account, or a sundry account, is an accounting instrument accountants use to record various expenses and debits that are not significant enough to warrant their unique transactions. These expenses are recorded within an account called sundry expenses.The total of the sundry accounts is not posted.Sundry Creditors in Balance Sheet.

Claiming for Sundry Expenses

SUNDRIES ACCOUNT definition: the part of a company’s accounts used for recording payments made by or to companies that are not. A person who receives goods or services from a business in credit or does not make the payment immediately and is liable to pay the business in the future is called a Sundry Debtor.Definition: Sundry expenses are items or expenditures that are rare, amount to very little, or are relatively unimportant and therefore do not fit into a standard asset or expense . Sundries, or sundry expenses, are costs that can’t be easily allocated to another nominal account. Such a line will likely include the combined total of .Sundry expenses are miscellaneous, one-off payments. So, what are sundries in a .Sundry Account in Accounting Defined: Uses, Income & Expenses – Conclusion. To ensure the completeness of the accounts .sundries: [plural noun] miscellaneous small articles, details, or items.When accounting for sundry, it covers miscellaneous expenses that aren’t associated with an account. Businesses use an account to track these transactions and they are called as Sundry Debtor account or Accounts Receivable. Adding them to an income statement can be challenging because the individual costs .sundry: [pronoun, plural in construction] an indeterminate number. Maintain records. The sources of sundry expenses might vary from one business to another but it generally does not include operating expenses such as rent or mortgage payments, depreciation, employee pay and benefits or utility payments.

Sundries in accounting, or miscellaneous expenses, are one-off payments for items that are both small in amount and are random or infrequent.

What are Sundry Debtors? Meaning and Examples

Sundry Debtors Ledger Account Format

Sundry Account in Accounting Defined: Uses, Income & Expenses

Besides Sundry Income, there are Sundry expenses as well, which need to be accounted for in accounting.By definition, sundry expenses do not include regular payments of any kind or those that would be defined as capital expenses, such as those related to capital equipment, shares or assets.The sundry invoice is an invoice that is issued by a company when their customer’s purchase amount is not significant. Businesses should first identify and categorize sundry expenses as best as they can.As a result, the nominal accounts are also referred to as temporary accounts.Sundries in accounting are small amounts coming in and going out of a business. Other words for sundry are miscellaneous, .What is sundry in accounting? In accounting and bookkeeping, sundry expenses are expenses that are small in amount and rare in occurrence.: Can include expenses like one-time fees, donations, and gifts.

Sundry Expenses: a Guide for UK Businesses

Sundry costs will appear in the Statement of Profit & Loss (SoPL) as they are an ‘outflow of economic benefit’ (in simple terms- all expenses are included within the SoPL), and therefore reduce overall business profits.

What are Sundry Expenses in Accounting?

Contact us & Achieve Financial Success +44 1217 835392 Sundry Expenses Tax Implications While specific regulations vary by . Sometimes referred to as ‘miscellaneous expenses’ they tend to be low in value, and fairly random. Assign responsible . The temptation to simply write it off is there. Any entries in the accounts receivable column should be posted to the subsidiary accounts receivable ledger on a daily basis. Financial Statements like Balance sheet gives the details of Accounts payable (Liability) to Suppliers and Accounts receivable (Current Assets) from customers, which is a credit sales and is .Schlagwörter:General Expenses and Sundry ExpensesSundry Income

What Are Sundries In Accounting?

In accounting and bookkeeping, sundry expenses are expenses that are small in amount and rare in occurrence.

You are currently viewing our [Locale] site. None of the individual amounts in the cash and sales columns are posted.Sundries, or sundry expenses, are costs that can’t be easily allocated to another nominal account.Sundry expenses are miscellaneous expenditures that are not frequently incurred.Sundry expenses refer to miscellaneous small costs typically incurred by a business but not categorised under main expense categories.How to record your sundry expenses in accounting. The nominal accounts include: All of a company’s income statement accounts; The owner’s drawing account ; The income . Examples of businesses operating expenses are utility payments, mortgage payments, employee pay, and rent. A general ledger account can be created to record sundry expenses under one heading. The closing process also means that each account will start the next accounting year with a zero balance.Type of Account.Sundries, or sundry expenses, are costs that can’t be easily allocated to any other nominal account.

Sundry expenses are typically characterized by their infrequency and relatively low individual cost.Sundry expenses, or sundries, include all the small, irregular, and infrequent expenses that can’t fit into any other expense category. The suspense account temporarily holds these unclassified . Such a line will likely include the combined total of several expense accounts that have small balances.Sundry expenses, or sundries, are miscellaneous expenses that occur infrequently. Journal Entry; Sundry Debtors in Trial Balance; Sundry Debtors and Creditors; Is Sundry Debtor an Asset or Liability? Quiz; Conclusion Meaning.

What Are Sundries In Accounting

The entire process is centered around the collection of pending payments from all the various sundry debtors. Irregular small costs that cannot otherwise be assigned to any account come under Sundry expenses, but they do not include operating costs like employee salaries, utility bills rent, allowances, mortgage payments, depreciation , etc.What are sundries? It’s difficult to give a precise sundry meaning, because the term is meant to encompass a variety of miscellaneous items. Sundry expenses sources may differ from one business to another, but it is never included with the business’s operating expenses.

Sundry Debtors Journal Entry

What are sundry expenses?

By including sundries expenses in your budgeting process, you can: Ensure Accuracy: Including sundry expenses in your budget will help you create a more accurate financial forecast and prevent any surprises down the road. There are several critical distinctions between sundry expenses and general expenses.Sundry accounting also encompasses the irregular small expenses that are not otherwise assigned with an account. They are small in amount and infrequent in nature¹.

Sundry Income Definition

Sundry Expenses, often also called sundries, refer to miscellaneous items that do not fit into an existing dedicated account within the accounting ledger already. Sundry expenses, therefore, do not generally include: Rent or utility payments; Depreciation or amortization expenses; Accounting or professional fees

SUNDRIES ACCOUNT

Sundry expenses are small and infrequent costs that are not classified under a specific category. This is because their individual costs .

What Is a Sundry Invoice? Definition & Example

Sundry debtors are a type of accounts receivable that represents money that is due from customers for goods or services provided. Today, we are likely to use the description Miscellaneous Expenses for these items. For an item to .In accounting terms, sundry expenses are small one-off costs.A sundry expense is a rare and relatively unimportant expenditure that does not fit into standard accounting expenses categories (asset or expense category). A group of such individuals or entities is called Sundry Debtors. They also do not fit into standard .Sundry Debtors, also known as Accounts Receivable, are the individuals or entities that owe money to your business in exchange for goods or services provided on credit.SUNDRIES ACCOUNT meaning: the part of a company’s accounts used for recording payments made by or to companies that are not. They are often small or irregular in nature and do not have their .A general ledger account, or a sundry account, is an accounting instrument accountants use to record various expenses and debits that are not significant enough .Definition of Sundry Expenses.In accounting, sundries refer to miscellaneous items or expenses that do not fall into specific categories. Despite sundry income not contributing large amounts to overall income (as if it did, it would have it’s own ‘income code’ within the accounts), it is again important to include within the business’ accounts.Sundry assets, frequently known as other current assets (OCA), are uncommon or insignificant things of value a company owns, such as a piece of unimproved land or . What is a sundry . Regular, predictable timing : Irregular in timing : Large .General expenses: Sundry expenses: Easy to classify under regular expense accounts : Hard to categorise under regular expense accounts : Can include expenses like travel costs, fuel, salaries, marketing costs, and raw materials.Sundry expenses, also known as miscellaneous expenses, are the expenses incurred by the company during the accounting period under consideration. They are usually: . For these rare and . Establish a sundry expenses account.

These are not recurring charges that a business can predict or budget for . You can record this account while preparing your financial statement or balance sheet, which is accounted under the Fixed Assets head.

What Are Sundry Expenses & Can You Claim?

Companies generally use an account to track the transactions related to sundry debtors, known as ‚Accounts Receivable Account‘ or ‚Sundry Debtors Account‘.Categorizing expenses is a fundamental aspect of bookkeeping that ensures accurate financial tracking and reporting. Another important part of this process is setting up the payment terms and credit .

Sundry Creditors

As they don’t fit into standard accounting categories as either a .Sundry invoices are sent to a company’s customers who rarely purchase on credit and whose purchase amounts aren’t significant. Maintain records of the date, description, and amount of each expense.Identify sundry expenses. However, recording sundries . However, sundry debtors are not risk-free and there is a possibility that some amounts owed may not be collected.Properly accounting for sundry expenses ensures that the income statement accurately reflects the company’s total expenses and profitability, providing crucial insights for strategic decision-making and financial planning. These debtors are recorded as an asset because they represent a future economic benefit to the company. In the books of Axis Housing Note: Debtors in the books of Daniel Constructions will also increase by 90,000 on account of credit sales done for 90K construction material.

Sundry Expenses: Definition & How to Record Them

Effective expense categorization allows businesses to see exactly where money is being spent, which is essential for budgeting and financial planning. Properly recording sundries ensures that no transaction . It’s essential to account for these costs to maintain the integrity of your budget. The term ‘Debtor’ refers to a person or entity that owes money to your business for goods or services sold on credit. When determining if an expense falls within the category of general or sundry, here are a few guidelines to keep in mind. They might include expenses for items . Sundry expenses could also refer to a line on a company’s income statement.

- Tonic Water Glasflasche | EDEKA Sortiment: Tonic Water

- Ingrid Thulin Gesicht Ohne Schatten

- Ersatz Für Bisohexal | Metoprolol oder Bisoprolol: das ist besser als Ersatz

- ¿Cómo Ver Los Archivos Temporales De Mi Pc?

- Makita Kapp- Und Gehrungssäge Ls1019L Online Kaufen

- Verbraucherschutz: So Funktioniert Das Widerrufsrecht Bei Handyverträgen

- Iphone Video In Davinci Resolve Importieren?

- Speisekarte Sunee Asia Wok In Raunheim

- Reiteralm In Schladming-Dachstein

- Melodic Black Metal Tutorial – How to Create Black Metal Melodies

- David Koenigsfeld ‹ Büro ‹ Heinlewischer

- Ibm Cloud Consulting Services – Cloud Migration Consulting

- Where Are Godin Guitars Made? Are They Good?