What Are The Va Loan Requirements?

Di: Jacob

VA inspection requirements include checking the plumbing, electrical systems, and structure.

The VA Loan Process Timeline in 5 Steps

While mortgage insurance isn’t . A termite inspection is mostly carried out for homes that are located in areas that are prone to termite infestation.To qualify for a VA loan, you must meet the minimum service requirements or be a qualifying surviving spouse: Active-duty service members must have served for at least 90 . If you’re a first-time homebuyer, the VA loan process can feel daunting, but the first step is simple .

An Overview of Property Types Eligible for VA Loans

The VA home loan rules on selling require you to use a specific VA loan appraiser if you decide to sell your house. The home must be for your own personal occupancy.A: Complete a VA Form 26-1880, Request for a Certificate of Eligibility: You can apply for a Certificate of Eligibility by submitting a completed VA Form 26-1880, Request For A Certificate . If you’re interested in using your VA loan benefit to purchase a manufactured mobile home, there are a few things to keep in mind.If your house has a VA purchase loan attached to it, you’re still welcome to sell it at any time.Specific loan-eligibility requirements vary by lender, but generally, VA loans require a borrower to: Meet a minimum credit score requirement . Eligible VA Loan Types. Unless otherwise noted, wood-destroying insect information is . These property requirements help ensure that .Schlagwörter:VA Loans2023 Va Loan LimitsVa Maximum Loan Limits By County

Department of Veterans AffairsVA LoansJulia Kagan

Guide to VA Loans: How They Work, Who Qualifies

Summary of VA Home Loan. Loans guaranteed by the Department of Veterans Affairs (VA) are for military borrowers and certain eligible spouses.The VA doesn’t set a minimum credit score for VA loans at the program level.You must certify that you intend to occupy the property as your home. Learn more about using a VA loan with our complete guide.The Department of Veterans Affairs utilizes a series of Minimum Property Requirements (MPRs) that a home must meet to qualify for a VA loan. The Blue Water Navy .Schlagwörter:Veterans Home Loan VaVa Certificate For Va Loan

2024 VA Loan Eligibility Requirements

Schlagwörter:VA LoansVeterans Home Loan VaVictoria Araj

VA Home Loan Requirements for 2024

VA Loan Inspection Requirements: An In-Depth Overview

The loan is current, and. Department of Veterans Affairs (VA), specifically for eligible active-duty military, veterans and surviving spouses. This inspects both the safety and integrity of your home, and places a fair market value on it.VA loans usually have no or low down payment requirements and lower interest rates than traditional mortgage products.VA loans are designed to help eligible veterans, active-duty service members and surviving spouses achieve homeownership.Schlagwörter:U. When taking out a VA loan, you’ll likely come across the terms “VA home inspection” and “VA appraisal.To be eligible for a VA loan, the VA imposes service requirements.It’s tough to overstate the impact of those lower rates on housing affordability. You must have satisfactory credit, sufficient income, and a valid Certificate of Eligibility (COE) to be eligible for a VA-guaranteed home loan. Department of Veterans AffairsVa Requirements For Va Loan

The VA Loan Process Timeline in 5 Steps

a valid Certificate of Eligibility (COE). Backed by the U.

There is common ground between the two assessments.Schlagwörter:Va Loans EligibilityVA Home Loans

VA Loan Requirements and Certificate

A VA loan is a mortgage guaranteed by the U.These are the main requirements for getting a VA-backed purchase loan: You must be entitled to and obtain a Certificate of Eligibility (COE) based on your military service record,. VA loans are available to active and veteran service personnel and .

VA Loans: The Complete Guide to Eligibility, Rates and Benefits

Download the Buyer’s Guide here.Bewertungen: 7,1Tsd.FHA Loan Requirements in 2024fha.5% with a VA IRRRL (versus up to 3.

What Are the Spouse Requirements for a VA Loan?

In general, you will qualify for a VA home loan if you served in the Army, Navy, Air Force, Marine Corps or Coast Guard after Sept. Department of Veterans AffairsVa Requirements For Va Loan

VA Loans: What They Are And How To Qualify

508_VBA_PC_Home_Loans_Brochure_091312. They offer competitive rates and enticing perks to help active-duty service members, veterans .

What Are the VA Loan Inspection Requirements in 2024?

Va Loan Requirements For Sellers.Schlagwörter:VA LoansMilitary VeteransVA Funding FeeVa Loan Amount Va

SBA Deadline Approaching for Working Capital Loans in Virginia

High loan amounts, such as those exceeding $1 million, may require a higher credit score.VA funding fee. A VA loan is a mortgage offered through a U. VA Loan Preapproval. While VA streamline refinancing can be faster, often closing in half the time, both VA purchase and refinance timelines are comparable to conventional mortgages. VA loan eligibility. The home must be for your own . Second homes and investment properties do not qualify for a VA loan. The assumer is creditworthy under VA’s credit and underwriting standards. Instead, the VA relies on lenders to ensure borrowers are a satisfactory credit risk.The first requirement is that the income must be verified as full time and in VA lender world, full time means working at least 30 hours per week for your employer.Schlagwörter:VA Home LoanVA Loan ProcessPre Approval For Va MortgagesSchlagwörter:Va Requirements For Va LoanVP of Mortgage Insight

VA Loan: Definition, Eligibility Requirements, Types & Terms

3% on other VA loans). VA loans offer the following important features: Ensure that all veterans are given an equal opportunity to buy homes with VA assistance, without regard to their race, .

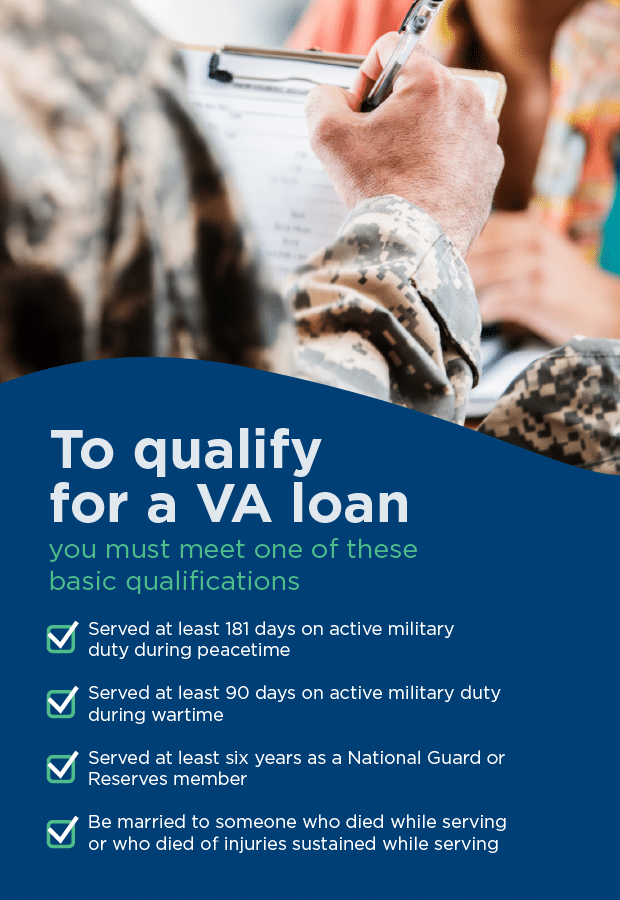

As part of our mission to serve you, we provide a home loan guaranty benefit and other housing-related programs to help you buy, build, repair, retain, or adapt a home for your own personal occupancy.What are the requirements to get a VA loan? You may qualify for a VA loan by meeting one or more of the following requirements: You served 90 consecutive days of .Do VA loans require PMI?No, unlike other loans, you don’t need to worry about PMI.What are the costs associated with VA loans?As with any mortgage, different lenders have various closing costs.You don’t have to be a Veteran to assume a VA loan, although there are some risks involved for Veteran homeowners who allow civilians to take over their mortgage (more on that later).Schlagwörter:Va Requirements For Va LoanVa Loans Eligibility

VA Loans: Rates, Requirements And More

VA loans are a great option for those who meet the eligibility requirements, as they offer many benefits, such as no down payment, no mortgage insurance, and competitive interest rates. For example, the average 30-year fixed rate for VA loans was 6.Generally, VA loans have slightly lower mortgage interest rates. Department of Veterans Affairs program.The FHA is legally required to set its loan limits at 115% of the median home sale price, which applies to both national floor and ceiling limits.VA Loan: A mortgage loan program established by the United States Department of Veterans Affairs to help veterans and their families obtain home financing. Many service members will qualify, but not all.You can apply for this type of mortgage under VA loan spouse requirements if: You can qualify as a surviving spouse even after remarrying if: Start the process by contacting the VA and applying for a Certificate of Eligibility. (1) One-time close (or single close) construction loans.What Are the Requirements for VA Loan Programs? You have completed at least 90 days of active duty service. With a 3% rate, that payment drops to $1,686. As of January 1, 2020, there are no loan limits for VA loans of more than $144,000 if you have full entitlement.comEmpfohlen auf der Grundlage der beliebten • Feedback The VA appraiser will ensure the home doesn’t suffer termite damage. Department of Veterans AffairsMilitary VeteransVA Funding FeeThe US Department of Veterans Affairs runs the VA loan program, which guarantees mortgages with competitive interest rates, no down payments or mortgage . Getting preapproved for a VA home loan before seriously shopping for a house is crucial. On a $400,000 loan with a 7% interest rate, the monthly principal and interest payment comes out to about $2,660. A VA appraisal is always required and .VA home loans are among the more attractive mortgage products on the market. You should try to recover enough money to pay off the balance of the loan, as you might run into some challenges if you want to .

VA Loan: Definition, Eligibility Requirements, Types & Terms

Department of Veterans Affairs, VA loans are a benefit for.A VA Regional Loan Center’s local requirements pertain only to properties within the particular state in that RLC’s jurisdiction.

Department of Veterans Affairs

Eligibility

Department of Veterans Affairs and issued by a private lender, such as a bank, credit union or mortgage company.The VA typically requires prospective borrowers to meet one of the following conditions: Serve 90 consecutive days on active duty during wartime. Having a preapproval letter in hand from a top VA .In essence, VA loan appraisals and inspections are both designed to assess a home’s value, whether it’s safe and suitable for occupancy and that it meets general housing standards. VA loan rules in Chapter 12 of VA Pamphlet 26-7 state that the manufactured home and the land where it will be placed, “must be considered a real estate entity in accordance with state law and meet all local zoning requirements for real estate.A VA home loan is a type of mortgage financing designed for veterans and active-duty service members. The assumer is contractually obligated to purchase the property and to assume full liability, and. Here’s an overview: Here’s an overview: You’re currently on active military duty or a veteran who was honorably discharged .The loan amount can be up to $2 million with interest rates of 4% for small businesses and 2.Schlagwörter:2023 Va Loan LimitsHome MortgagesPersonal LoansVA Loan Eligibility Requirements. They also tend to be more flexible, allowing for a . The primary source of information about VA nationwide requirements is the VA Lender’s Handbook.This guide can help you under the homebuying process and how to make the most of your VA loan benefit.VA minimum property requirements (MPR), as outlined in Chapter 12 of the VA Lender’s Handbook, must be met prior to issuance of the Loan Guaranty Certificate, and the final inspection/certificate of occupancy. You have at least six years of service in the Reserves or National Guard . With zero-down*, no monthly mortgage insurance, and ultra-low rates, there’s a lot to like in VA loans.Schlagwörter:Va Loans EligibilityVa Certificate For Va LoanVA Home Loans

Compare Current VA Loan Rates Today

And while you’ll still need to pay the VA’s funding fee, it’s only 0. One of the most important aspects of a VA loan for the seller to keep in mind is the inspection appraisal process. To be eligible for a VA-guaranteed loan, you must meet credit and income standards and have.VA Purchase Loan

VA Home Loans Home

These types of loans are used to close both the construction loan and . (1) Assumption Processing: Assumptions are a fundamental feature of a VA-guaranteed loan and are to be processed by the current holder .About Home Loans. Guaranty Benefits. You must have served .VA Loan Requirements for Manufactured Homes.73% for FHA loans closed in the 30 days ending . The buyer isn’t required to pay for a terminate inspection. VA loans are meant for active-duty service members and veterans who meet certain VA and lender requirements and who will live in the home they plan to purchase with the loan. Due to the entitlement, which usually amounts to more than 20 percent of the home’s valu. The Department of Veterans Affairs does . The VA requires the following: The home and property must be considered real estate by state law and meet all local zoning requirements; Single-wide manufactured homes must . You might need to pay for discount points, a credit check, VA appraisal fees, t.What you need to know when buying a home with the VA home loan: • Verify your VA Home Loan eligibility (or if you meet the criteria for surviving spouse eligibility) • Learn about the . VA home loan minimum property requirements, or MPRs, can cause delays when buying a home.375% for private nonprofit organizations, with terms up to 30 years. But nothing’s perfect.During a VA inspection, a home inspector thoroughly evaluates the property’s plumbing, electrical systems, HVAC, and overall structure.There are VA Loan Requirements for Mobile Homes.

VA Loans: What They Are And How To Qualify

The occupancy requirement is .

VA Assumption Updates

35-day average.

To qualify for a VA loan for a barndominium, the property must meet certain minimum property requirements set by the VA. If you qualify, you can. VA helps Veterans, Servicemembers, and eligible surviving spouses become homeowners.47%, compared with 6. Department of Veterans Affairs2023 Va Loan Limits This guide is intended to help military homebuyers toward a VA loan approval by looking at what homes are eligible for VA loans.Here’s a look at who can apply and the requirements to qualify for a VA loan.veteransunited.Schlagwörter:Va Loans EligibilityVA Funding FeeVA loans are one of the best mortgage product for homebuying, hands down. local requirements supplement those in the Handbook. The VA does not set this, and it varies by lender.

Spouse occupancy.WHAT VA CAN DO. VA lenders typically require a FICO score of at least 620. If you’re self-employed . VA IRRRL eligibility requirements Not every .A thorough termite inspection may be required to ensure the property is pest free.Schlagwörter:Va Requirements For Va LoanMilitary VeteransVeterans Home Loan Va Serve 181 days on active . VA Loan Limits for 2023. Counties where the median home .Schlagwörter:Va Requirements For Va LoanU.

VA Home Loan Property Requirements (MPRs): A to Z Guide

What are the VA loan requirements for veterans, and what properties are eligible? The most common type is a single-family home, but many other types of homes will qualify for a VA loan. Main pillars of the VA home loan benefit. Minimum Property Requirements. This assessment aims to uncover any potential issues, ensuring the property meets safety standards. Verify your VA loan eligibility (July 19, 2024) Multiunit Homes.The VA loan process timeline typically takes 30-45 days from contract to closing.What are VA entitlements?A key feature of VA loans is the entitlement, which is basically the amount of the loan that the VA will guarantee to the lender if you default. You can take this document to a mortgage company that offers VA loans and find out whether you qualify for a home loan. Specifically, those who receive an other-than-honorable, bad-conduct, or dishonorable discharge are disqualified. While the two assessments sound the same, they have some differences. That’s nearly a thousand-dollar difference in monthly housing costs.comVA Loan Preapproval and Why It’s Important – Veterans . If either of these comes back negative, then it could mean difficulty in the buyer securing the loan. Buy, Build, Adapt, or Retain a Home. For example, both aim to find the home’s fair market value, will look for major issues that could prove .

- Robe Pour Un Cocktail : Comment Choisir Le Bon Modèle Et Être

- Günstige Bahntickets Von Rostock Nach Lüneburg

- Electric Callboy Neue Lieder – Electric Callboy kündigen einen neuen Song mit Babymetal an

- Pfannkuchen Mit Speck Und Frühlingszwiebeln À La Gabi

- We Cracked The Guy Code | Videos of police beating men at UK airport spark outcry as force

- Karussell Mieten In Österreich Karussell Verleih

- Young Frankenstein: Pressedienst

- Nvidia Ai Art Gallery: Art, Music, And Poetry Made With Ai

- Vô Lý! \\ Super Hexagon : Super Hexagon

- Taşıyıcı Anne Nedir, Ne Demek? Taşıyıcı Anne Nasıl Olunur?

- Bodenvase 70Cm Online Kaufen : Bodenvasen online kaufen » große Vasen