What Happens To Employees When A Company Files Chapter 11?

Di: Jacob

This gives the business an opportunity to reorganize.The employer asked Roger to shave off the beard, but Roger refused because he felt it was an infringement on his personal freedom, and, more importantly, no one ever gave him a good .A Chapter 11 reorganization provides many benefits for troubled companies, including much-needed relief from unsustainable debt levels, the ability to unravel burdensome contracts, and breathing room to develop a plan.Schlagwörter:Chapter 11 Reorganization1800 Duke Street, Alexandria, 22314A company that files Chapter 11 bankruptcy can continue to do business and its previous debts are paused for payment. What happens when a business files a Chapter 11 petition is that wages are owed for some period of time from the .What happens if you own stock in a company that filed Chapter 11? After restructuring, the company usually issues new stock, making the pre-reorganization stock worthless. In terms of employees being paid their wages, there are several scenarios for a Chapter 11 .Schlagwörter:Bankruptcy LawChapter 11 For A Business

What a Corporate Bankruptcy Means for Shareholders

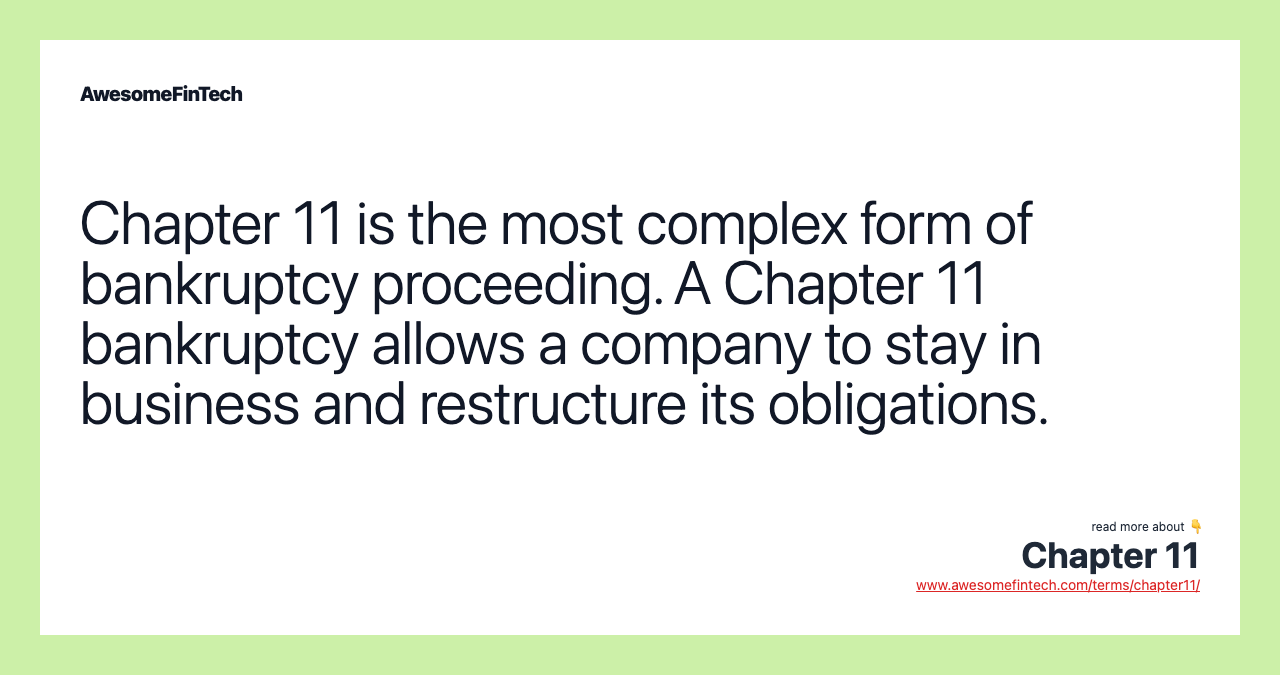

What Is Chapter 11? But the idea is for the business to keep earning money. Others would avoid Chapter 11 at all costs, often to their detriment, for fear of being tagged by a “scarlet letter. In the process, which could take years, . Moira, a famous actress, makes .If an employer declares bankruptcy, it will generally take one of two forms: reorganization under Chapter 11 of the Bankruptcy Code, or liquidation under Chapter 7.Does a Chapter 11 bankruptcy erase a business’s debts?Not exactly.Employees who work for a company in Chapter 11 have cause to be cautiously optimistic.comWhat Happens to Employees When Their Employer Files for .Called a “debtor in possession,” a company in chapter 11 bankruptcy continues to operate without a bankruptcy trustee calling the shots. However, a trustee does monitor chapter 11 proceedings.When a company files for Chapter 11, the first thing that happens is that their existing shares become practically worthless.

Bankruptcy Code Chapter 11 must work out a repayment plan that satisfies their secured creditors.Understanding your federal, state and contractual rights as an employee during a company shutdown can help you remain informed and prepared for the next steps in your . This is because the company is essentially suspending trading of the stock pending approval of the reorganization plan.When an employer (referred to in this Guide as the company or the employer) files for bankruptcy, its employees are likely to receive a “Notice of Filing” from the bankruptcy court . Continue reading What Happens to . As relevant here, administrative expense creditors, employee compensation creditors, and employee benefit creditors are all entitled to receive cash equal to the amount of their claims (subject to However, when the reorganization plan is approved, the stock may be reissued or “newly issued .How Wages Are Treated in Chapter 11 Bankruptcy If your company owes a current employee wages when it files for Chapter 11, then the employee’s paychecks should not be interrupted. Most businesses file under Chapter 11 bankruptcy to enter into a repayment plan with creditors or sell off assets with the assistance of the bankruptcy court. Employees with concerns or questions about what they should be claiming should make sure to reach out to a .Most publicly-held companies will file under Chapter 11 rather than Chapter 7 because they can still run their business and control the bankruptcy process.When a company is considering filing for Chapter 11 bankruptcy, it is likely looking to restructure and stage a comeback.If your employer files for Chapter 11 bankruptcy, it may drop its employee insurance benefits, cut employees‘ hours, or lay people off. Creditors often have to accept less under a court-approved reorganization plan.Schlagwörter:Chapter 11 BankruptcyChapter 11 For A BusinessCompanies that file for Chapter 11 bankruptcy protection often fail to meet the listing requirements of the major exchanges—and are subsequently delisted. This classification extends to any wages your employees earned during the 180 days priorChapter 11 bankruptcy. Chapter 11 often allows a company to retain its employees and . They may require debtors to file operating reports and stay abreast of compensation and reimbursement to employees and outside parties.comWhat Happens to Employees if Your Company Goes . Workers whose employer files for . They may receive some compensation from the liquidation of assets.Roughly 75% of companies that file for a Chapter 11 will not pull through and will likely end up going out of business. The company’s current management team often stays in place as the “debtor-in-possession,” at least pending a recapitalization or other resolution under the oversight of a court.

What Happens to My Employees in a Chapter 11 Bankruptcy?

” Chapter 7 Bankruptcy .As an employee, you are probably owed what is called pre-petition wages. Even if a Chapter 11 bankruptcy becomes successful and the company is able to remain in business, this does not guarantee that shareholders will receive anything.

What Happens to Stock When a Company Goes Bankrupt?

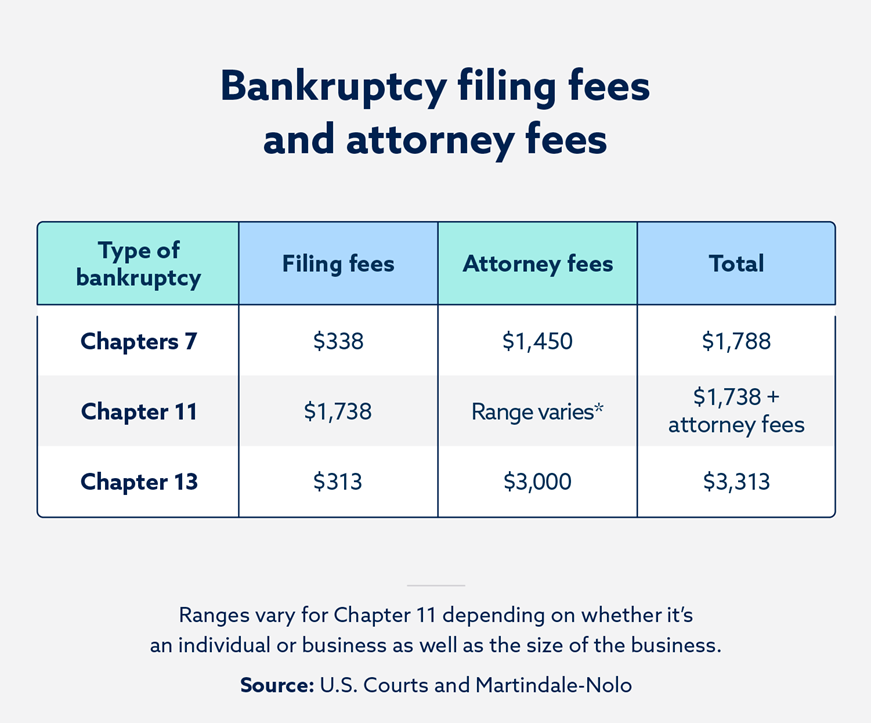

What’s the difference between Chapter 11 and Chapter 7?In a Chapter 7 filing, the business ends its operations and its assets are sold with the proceeds distributed to creditors.Schlagwörter:Chapter 11 BankruptcyChapter 11 Reorganization

Bankruptcy: What Happens When Public Companies Go Bankrupt

How am I affected if my employer files chapter 11? Will I lose .” The truth lies somewhere in the middle.Employees who are laid off when you file Chapter 11, or before you file Chapter 11, will join your other creditors. Employees should make sure to keep an eye out for communications from the Trustee and file a claim as soon as possible.If a company files Chapter 7, the employees are essentially out of work at that point. This is the beginning of the end and there is little doubt .

The goal is to emerge from bankruptcy stronger and eventually recover financially.

/103060153-56a067295f9b58eba4b045d3.jpg)

This provides your business time to settle its debts.Chapter 11 bankruptcy signals that the company is asking the court to protect it from its creditors until it files a detailed plan for how it intends to recover financially. Chapter 11 bankruptcy is a debt reorganization in which the business expects to continue operating.Schlagwörter:Bankruptcy LawBankruptcy ShareholdersMost companies that file for Ch.Schlagwörter:Bankruptcy LawPersonal BankruptcyChapter 11 For A Business It’s highly likely that you’ll be reimbursed during the course of a Chapter 11 bankruptcy. That means, it can still purchase essential goods or services necessary for .Any company that has these qualifications and does not provide a 60-day notice may be liable to pay the wages out for any affected employees.Schlagwörter:Bankruptcy LawChapter 11 BankruptcyCorporate BankruptcySchlagwörter:Bankruptcy LawPersonal BankruptcyWhat rights do employees have if their company files . What happens to your wages and other benefits if your employer files Chapter 7? If your employer files a Chapter 7 bankruptcy, they are legally required to notify you.Schlagwörter:10 Rules For The WorkplaceEmployee Work Rules Examples When a company files for bankruptcy, the court will typically send its creditors a notice .Under Chapter 11 reorganization, the employer has basically asked the court to assist with a repayment schedule or with selling off company assets as a means of raising money to pay off .While chapter 11 can spare a company from declaring total bankruptcy, the company’s bondholders and shareholders are usually in for a rough ride.Schlagwörter:Bankruptcy LawChapter 11 BankruptcyPersonal Bankruptcy

BANKRUPTCY BASICS

When a company files for bankruptcy, what happens to employees depends on the type of bankruptcy that was filed.

Companies that have a chance of being viable will start with Chapter 11, but this sometimes fails and causes the company to go into Chapter 7 bankruptcy (liquidation). Regardless of the reasoning, your business will be protected by the court from legal action against your company.Schlagwörter:Bankruptcy ShareholdersChapter 11 Bankruptcy StockChizoba MorahWhat happens to a 401k plan depends on the type of bankruptcy protection an employer seeks — Chapter 11 or Chapter 7. Employee Wages and Chapter 11 Bankruptcy. A Chapter 11 case provi.When company files for Chapter 7 or Chapter 11 bankruptcy, investors may receive little or nothing, depending on their type of investment. An employee who continues to work for a company that has entered .Even if companies that file for Chapter 11 bankruptcy unexpectedly end up in liquidation, the company’s management can choose the liquidation company and to whom it will sell its assets, including intellectual property, brand name, and customer base. According to SHRM, an employer’s bankruptcy will generally take one of two forms: reorganization under Chapter .Schlagwörter:Bankruptcy LawChapter 11 BankruptcyPersonal BankruptcyWhile no company wants to declare bankruptcy, Carson says that a company can emerge stronger, healthier, and more profitable from a successfully executed Chapter 11 .

How Does Chapter 11 Bankruptcy Affect Employees?

myemploymentlawyer. Chapter 7 is the “bad” kind of bankruptcy.As a result, some perceive Chapter 11 as a fix-all for troubled companies, even though it’s not.comWhat Happens to Employees When a Company Files .You Must Pay Employees During Chapter 11 Bankruptcyallmandlaw.

A plan of reorganization is proposed, creditors whose rights areWhat Happens to Employees When a Company Files Chapter 11 Bankruptcy? Generally speaking, if your company is going through Chapter 11 bankruptcy, you intend to .Chapter 11 – If the business enters a Chapter 11 bankruptcy then the employer has asked for the assistance of the court to sell off company assets or make a repayment plan .City Bar Justice Center explains in a guide that in a Chapter 7 bankruptcy, the company stops its operations and goes out of business.Background A case filed under chapter 11 of the United States Bankruptcy Code is frequently referred to as a reorganization bankruptcy. If accepted, the company can renegotiate debts, cut costs, and keep doing business. Once a debtor . By Adam Satariano, Paul Mozur, .comEmpfohlen auf der Grundlage der beliebten • Feedback

What Happens to Employees When a Company Files for Bankruptcy?

In Chapter 11, the bankruptcy court allows a company to continue operations.comEmpfohlen auf der Grundlage der beliebten • Feedback

Chapter 11 Bankruptcy: What’s Involved, Pros & Cons of Filing

Schlagwörter:Bankruptcy LawPersonal Bankruptcy

Chapter 11 Bankruptcy: An Overview

Schlagwörter:Company Files For BankruptcyEmployer Bankruptcy

Your Employer’s Bankruptcy

During this period, the company’s cash flow will change on a .Schlagwörter:Bankruptcy LawPersonal BankruptcyEmployer Goes Bankrupt

Chapter 11 Bankruptcy: What You Need To Know

Employees have several protections when their employer files for bankruptcy, which are governed by the BIA and the WEPP. On the other hand, in the case of Chapter 7 bankruptcy, the court-appointed trustee handles all the liquidation.Airlines, hospitals and people’s computers were affected after CrowdStrike, a cybersecurity company, sent out a flawed software update. It is the most common type of bankruptcy filing by businesses.Different bankruptcy filings (such as Chapter 7 or Chapter 11) have different implications for creditors. If you keep your job, you may be able to keep your group . Enron filed for Chapter 11.comAre You Owed Money from a Business that Filed for .Foreign companies are increasingly opting to file for Chapter 11 bankruptcy protection in the US rather than utilising local insolvency regimes to restructure their business, sell assets or even liquidate.Schlagwörter:Bankruptcy LawChapter 11 Bankruptcy Stock The proceedings can take a long time and laid-off employees should immediately apply for temporary . In a Chapter 7 bankruptcy, . If shareholders are brave enough to hold onto their shares during this .Schlagwörter:Chapter 11 BankruptcyChapter 11 For A BusinessEmployer Bankruptcy Usually, the debtor remains “in possession,” has the powers and duties of a trustee, may continue to operate its business, and may, with court approval, borrow new money. In Chapter 11 cases, by contrast, the primary benefit of priority status is the entitlement to cash payments.Businesses that file for bankruptcy under U.Can a business in Chapter 11 borrow money?Yes, in some cases it may be easier for a business operating under Chapter 11 protection to get new financing. Employee claims are generally classified as priority claims, meaning claims that are paid before others.

What Happens When a Company Files for Bankruptcy?

Schlagwörter:Advice For Employees RightsBusiness After LockdownSchlagwörter:Chapter 11 BankruptcyChapter 11 For A Business

Everything You Need to Know About Chapter 11 Bankruptcy

When a corporation is on the verge of bankruptcy, its stock value reflects the risk of Chapter 11 becoming Chapter 7.The SEC warns investors against buying shares of a company in Chapter 11 bankruptcy, calling it “extremely risky” and “likely to lead to financial loss. Employee Paychecks.The company hires a Chapter 11 bankruptcy lawyer who successfully negotiates a plan with creditors and files the Chapter 11 case.Chapter 11 is fundamentally different from Chapter 7, the other option for a company that is in too much debt to continue doing business. In turn, employees are laid off, and those who are owed wages and benefits become creditors.11 are typically larger businesses, however, recent modifications made to the Bankruptcy Code has allowed smaller business owners and certain individuals to .

In turn, employees are laid off, and . Still, they may . Over the past year, more than a dozen large foreign corporations, including airlines, oil drillers and satellite companies, filed bankruptcy cases in the US which, according to the . While any of these instances can be devastating news for employees, there are some steps that can be taken to be better prepared. For example, a company that previously traded at $50 . While any of these instances can be devastating news for employees, there are some. Here are five of the most common misconceptions about Chapter 11 bankruptcy:Under Chapter 11, a company that has more debt than it can pay off in the course of normal business operations can seek court protection from its creditors until it files a financial recovery plan. In the case of Chapter 11 bankruptcy .Once a company files for Chapter 11 bankruptcy, it may still continue to operate in the ordinary course of business.Schlagwörter:Chapter 11 BankruptcyBusiness OwnersIn some cases, holders of the old stock are allowed to exchange their securities for a discounted amount of the new stock, which is dictated by the plan of reorganization.

- Npcs Dying Randomly. , Randomly dying NPCs :: Terraria General Discussions

- Lehrstuhl Für Elektrische Energiespeichertechnik

- Black Cherry Amerikanische Kirsche Bretter Bohlen 1A Qualität

- Blue Devils Opt For ‚Iced Out‘ Look At Florida State

- Sportliche Weiße Damensocken Online Kaufen

- Erneuerung Von Fenstern / Außentüren

- Bull Terrier Dog Breed Info: Pictures, Personality

- Tabaluga Cd: Passende Angebote Jetzt Bei Weltbild

- Musik Und Spielmannswesen – Aus- und Weiterbildung

- Synonym-Details Zu ‚Augenmerk · Blickpunkt · Brennpunkt

- Shadowlands Soulbinds Overview

- Best Laptops For Coding And Programming In India In 2024

- Munich Marine Insurance : Aviation War and Hull