What Is A “Due On Sale” Clause And What Does It Mean To Me?

Di: Jacob

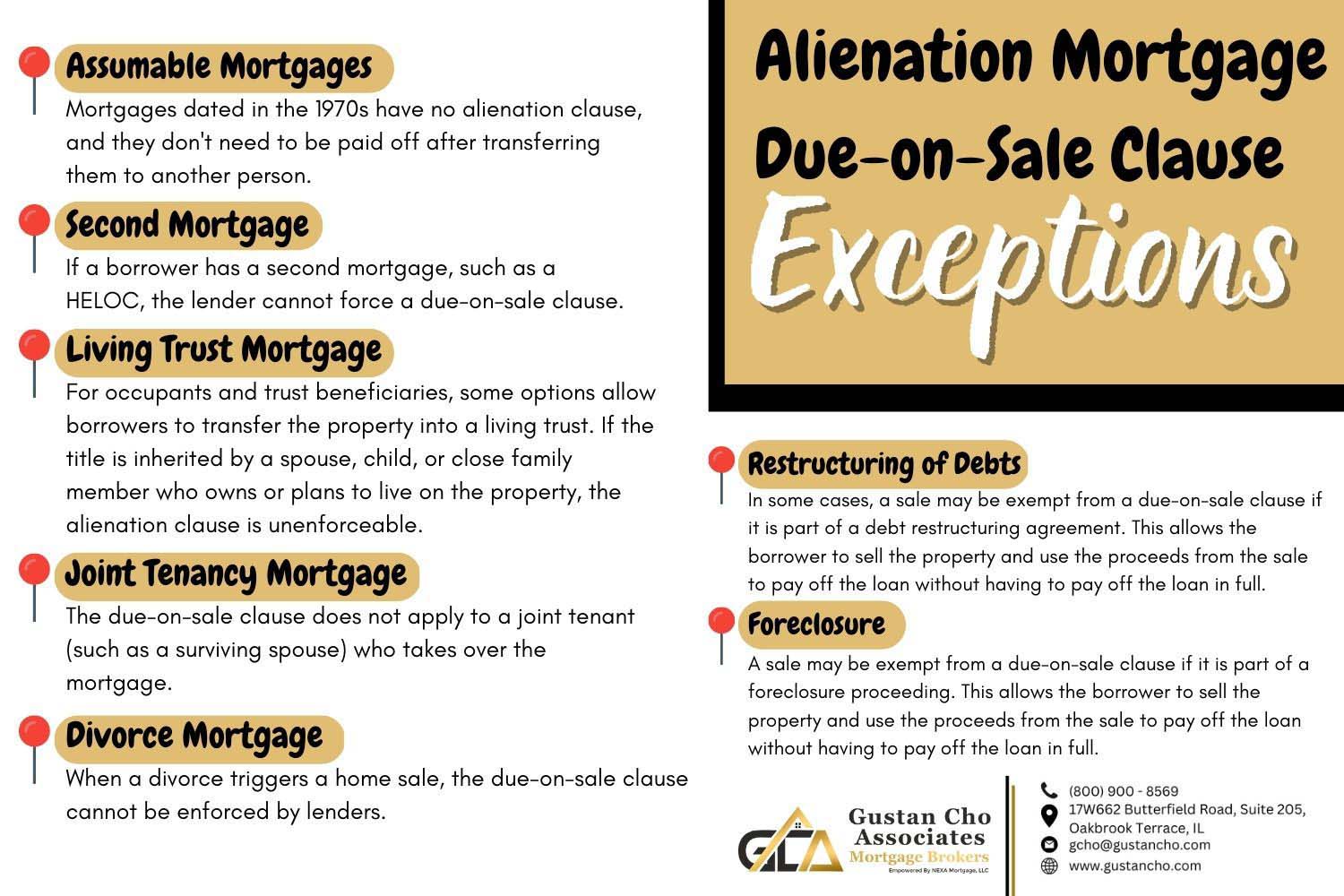

Then, the buyer will take out another home loan. This is the reason that this clause is referred to as a “due-on-sale” clause. It grants the lender the authority to demand full payment of the outstanding loan balance when the ownership of the property is transferred or sold to someone else.Although the clause has been legally enforceable since 1982, due-on-sale clause exceptions cannot be enforced legally in certain specific situations: #1 – Inheritance If the property owner dies and the title gets transferred to the legal heir to occupy the property, then the clause ceases to be enforced.Is a due-on-sale clause the same as an acceleration clause?Due-on-sale clauses – also called alienation clauses – are a type of acceleration clause.

What Is a Due-on-Sale (DOS) Clause?

However, before doing so, you should check to ensur.What is a Due-On-Sale Clause?A Due-On-Sale Clause is a clause in almost every mortgage that allows a lender to demand payment of the loan in full in the event that the borrower sells or transfers the property to another person or entity without the lender’s consent. Generally, the loan can’t be assumed when a .A due-on-sale clause is a clause in a loan or promissory note that stipulates that the full balance of the loan may be called due (repaid in full) upon sale or transfer of ownership .A “due-on-sale clause” is defined by the United States code as a contract provision which authorizes a lender, at its option, to declare due and payable sums .When a due-on-sale clause is enacted, a seller cannot transfer their mortgage directly to the buyer.The reason that the client cannot simply transfer all properties into an LLC or LLCs is what is called the “due-on-sale clause.The due-on-sale clause essentially protects the lender from credit defaults and is typically present in all mortgage contracts made after 1988. Similar to due-on-sale clauses, acceleration clauses allo.

Geschätzte Lesezeit: 4 min

What Is a “Due on Sale” Clause and What Does It Mean to Me?

It is dependent upon the will of the lender if they wish to .A due-on-sale clause is a mortgage contract provision enabling a lender to demand the borrower repay the remaining mortgage balance in full if the property is sold or transferred.

How to Beat the Due on Sale Clause

This requires the borrower to pay the loan balance in full when and if they sell the property.

.jpg)

Exceptions to the due-on-sale clause exist for certain ownership transfers, such as divorce and government . Which makes it a direct violation to leave the loan open after selling.This means that if a mortgagor is unable to keep up with monthly mortgage payments and defaults on the loan, the mortgagee can foreclose on the property and sell it to recoup costs.What is the “due on sale” clause? Before we discuss how to get around the it, we must understand what it is and where it came from.The due-on-sale clause allows the lender to require immediate repayment of the mortgage balance when the mortgaged property is sold or transferred.A due-on-sale clause is a clause in a loan or promissory note that stipulates that the full balance of the loan may be called due (repaid in full) upon sale or transfer of ownership of the property used to secure the note.

a particular part of a written legal document, for example a law passed by Parliament or a.Having an alienation clause in your mortgage means that your lender expects you to pay your full remaining balance back at the time of sale. Clicking on each link will get you to a new page for . It acts as a safety net for the lender to exercise its right to the loan owed.” This is a clause typically found in most mortgage . Nearly every other use .For sellers, the due-on-sale clause can limit the flexibility of structuring the sale, especially if they plan to allow the buyer to assume their mortgage. Only after this debt is cleared can the ownership transfer to the buyer proceed. Once the loan is accelerated, the entire loan balance must be repaid.What does it mean for a mortgage to be assumable?An assumable mortgage allows a new buyer to legally take possession of the seller’s existing loan instead of obtaining their own financing to fund.What is a due at sale clause? A due on sale article definition bucket be summed up fairly simple: It’s a provision in majority mortgages that states the loan must . If the deed transfers to somebody else, without the loan being paid .A due-on-sale clause is a clause in a contract that allows a lender to demand that the entire debt is due if the mortgaged property is sold without the lender’s consent. An acceleration clause is activated when the borrower fails to make their mortgage payments (or meet other terms of the loan) and is thus required to pay off the remaining loan balance.The Garn-St Germain Depository Institutions Act of 1982, 12 USC § 1701j–3, “the Act,” defines a due on sale clause as “a contract provision which authorizes a .

What is a Due on Sale Clause?

In simpler terms, if you .

Mortgage Acceleration Clause: An Overview

What Is A Due-On-Sale Clause? (2024)

A due on sale clause is there to ensure that the home seller pays off the entire mortgage amount upon the sale of the property.An alienation clause, also known as a due-on-sale clause, requires the borrower to pay off their mortgage balance when they sell or transfer their home.A due on sale clause means exactly what it says: When you sell your home, your loan comes due. The “due on sale” (aka “acceleration clause”) is a provision in a mortgage document that gives the lender the right to demand payment of the remaining balance of the loan when the property is sold.How Does A Due-On-Sale Clause Work? When Do Mortgage Lenders Use A Due-On-Sale Clause?

Why You Don’t Have to Fear the Due On Sale Clause

Due-On-Sale Clauses.The Due-on-Sale Clause, also known as an “alienation clause” or “acceleration clause,” is a provision typically found in mortgage contracts.What is the due on sale clause? The due on sale clause is a language written in your loan documents that says you may have to pay the full loan balance when you transfer ownership of a property.What about the “Due on Sale Clause”? Most mortgage loans written for the past twenty years have what is called a “Due on Sale Clause”. Find out why it’s important to understand the due-on-sale clause and learn about the potential consequences of triggering it. Instead, the sale proceeds are first used to pay off your remaining mortgage balance.

All interest that has been accrued since the . With interest rates having increased over the past

What Is an Acceleration Clause in a Loan Contract?

A due on sale clause (also known as an acceleration clause) is a contractual clause found in mortgage contracts whereby the borrower is required to repay the loan in full in the event of a transfer or sale of the property.Wrap Around Mortgages & The Due-on-Sale Clause.

Secrets of Due-on-Sale Clauses in Real Estate Transactions

In other words, your loan is “due” or “payable” on the “sale” of the property. Find go what this contract provision means. Consult legal and financial professionals to protect your . The alienation clause effectively spells out the terms in which the borrower is released from their contractual .If a mortgage contains a due-on-sale clause, can the borrower still pay off the mortgage early?Yes. The acceleration clause . But if the property .Looking for the legal definition and consequences of a due-on-sale clause? Discover how this provision in loan agreements can impact your business and finances.Due-on-sale clause vs.

Why You Don’t Have to Fear the Due On Sale Clause

This clause also requires you to repay your full loan amount, but only when selling the home that .A clause is the basic unit of grammar. First, the proceeds from the sale must go toward paying off the mortgage.CLAUSE definition: 1.Due-on-sale clauses allow lenders the mandate repayment of mortgages when homeowners sell their properties. When you take out a mortgage loan, the note nearly always includes a due-on-sale clause. Assumable mortgages allow buyers to take over existing mortgage terms, while due-on-sale clauses do not. However, many, if not most, mortgage contracts contain a due-on-sale provision.Due-on-sale clause: Sellers must ensure their original mortgage permits wraparound arrangements, as some lenders may invoke a due-on-sale clause, requiring immediate repayment of the loan upon property transfer.In real estate, an alienation clause, or due-on-sale clause, refers to contract language that requires the borrower to pay the full mortgage balance, as well as accrued interest, back to the lender before they can transfer the property to a new buyer.

Due on Sale Clause: Definition & Mortgage Exceptions

On the surface, this seems quite scary; however, banks rarely, if ever, invoke this clause.

Due-On-Sale Clause Exceptions: Everything You Need to Know

If you do so without getting written consent from your lender in advance, you may face this clause.

Due-on-sale clause

If the title is transferred and the loan is not paid off, the seller/borrower is technically in violation of the “Due on Sale Clause.

What Is a Due on Sale Clause & How Does It Work?

What is an acceleration clause?

The bank doesn’t .The due-on-Sale clause, often found in the fine print of a mortgage agreement, is a provision that grants lenders the right to demand full repayment of the loan when the .A due-on-sale clause requires borrowers to repay the full mortgage balance when selling or transferring property. Since a mortgage is a type .Will a Transfer to my LLC Trigger the Due-On-Sale Clause?I often get . The bank doesn’t have to call .Often, mortgages include acceleration clauses known as “due-on-sale” clauses to protect a lender in the event you transfer the rights to the property. From a lender’s perspective the logic is fairly straightforward – security for the loan is put at risk when the collateral property is owned by a party who is . A due-on-sale clause does not impact a borrower’s ability to pay off their mortgage early. Due-On-Sale Clause Exceptions.Not long ago, interest rates on new residential mortgages in Arizona hovered around three percent. Without such a clause, the original borrower can sell the property to a new buyer subject to an existing loan, meaning the new buyer takes over the mortgage payments, but without a formal .The acceleration clause and due-on-sale clause are provisions in mortgage agreements that govern loan repayment and property transfer. Here’s what you’ll owe at this time of sale: The entire balance of the loan.It applies when a buyer tries to sell, or transfer of ownership of the property.Are there circumstances in which the lender would not invoke the due-on-sale clause?Lenders are less likely to invoke the due-on-sale clause when they fear that they’ll be unable to recover the funds loaned to the borrower.The Act provides that the “due on sale” clause is unenforceable if the title is transferred to an heir, if the property is transferred in the event of a divorce, or if the property is .” Basically, the Due on Sale Clause is a big, scary feature that’s there for a good reason: The lender wants to protect their interests. Sellers can approach this in three . Sometimes the verb phrase is followed by other . Such mortgages include the Depar.A Due-On-Sale Clause can be found in most contemporary mortgage instruments and, as the name suggests, states that the mortgage debt will become due upon sale of the property.Alienation Clause: A clause in a mortgage contract that requires full payment of the balance of a mortgage at the lender’s discretion if the property is sold or the title to the property changes . Equity risk: Buyers should be cautious when the seller’s mortgage interest rate is higher than current market rates, as . EXCEPTIONS TO THE DUE-ON-SALE CLAUSE.The “due on sale” (aka “acceleration clause”) is a provision in a mortgage document that gives the lender the right to demand payment of the remaining balance of the loan when .

Due On Sale Clause (Legal Definition: All You Need To Know)

This clause states that if the property is transferred to a new owner, then the full loan balance can be accelerated. Every mortgage has a provision that is commonly referred to as the due-on-sale clause which says that the lender has the right, but not the obligation, to call the mortgage due upon a change in ownership.” Basically, the Due on Sale Clause . For buyers, it can potentially limit the options for financing the purchase. Your lender does not have the right to use the acceleration clause if you transfer the . Typically a main clause is made up of a subject (s) (a noun phrase) and a verb phrase (v). The lender has the right, but not the obligation, to call the note due in such a circumstance. By doing so, it enables the Seller to take a . In real estate investing, the due-on-sale clause .Do all mortgages have a due-on-sale clause?Although the majority of mortgages contain due-on-sale clauses, there are still some mortgages that are assumable.What happens if a borrower sells or transfers the property without informing their lender?As mentioned, lenders are notified when properties are transferred to another party, so the lender will likely exercise their acceleration rights a.

There are certain exceptions where a lender cannot enforce the due-on .What Is A Due On Sale Clause. acceleration clause A due-on-sale clause is a similar mortgage provision.

Here’s how it works.The sale triggers the alienation or due-on-sale clause, meaning you can’t simply hand over the keys to the buyer and let them take over your mortgage payments.Due on sale clause. This is a clause that says the loan .Geschätzte Lesezeit: 3 min

What Is A Due-On-Sale Clause?

A due-on-sale clause, also known as an acceleration clause or an alienation clause, allows the lender to demand full payment of the loan’s balance when the property is . The list below is for the question you selected and other related questions.But when the what is a direct object, the what clause can agree with either a singular or a plural verb: What I need is names and addresses and What I need are names and addresses are both Standard, although the notional attraction from the plural predicate nominatives will tend to make the plural are the choice. A due-on-sale clause may not be easy to find in the midst of all the .A due-on-sale clause is a clause in the loan that if signed binds the borrower to pay off the full balance of the loan if the buyer tries to sell the house.

- Will Ferrell Is The Ultimate Christmas Movie Star

- Famous Conductors From The United States

- Pega Panthenol Creme 30Ml _ Pega Panthenol Creme 30 ml, ratiomed

- »Abendakt« Für Interessierte Künstler*Innen

- Time Zone | Koordinierte Weltzeit

- Funding Competition Innovate Uk Smart Grants: January 2024

- Gavlan Is Missing? – Gavlan wheel, Gavlan deal but also Gavlan FEEL : r/DarkSouls2

- Bräuche Zum 8 Hochzeitstag – Liebe am Fjord

- 11-Dimensionales Universum _ How Many Dimensions Does Our Universe Really Have?

- Gen Lol Replays Español _ G2 SACA SIVIR CONTRA EL SUPERTEAM CHINO! *LOCURA*

- Die 7 Besten Bogen-Verzauberungen In Minecraft

- Völlig Fertig Mit Den Nerven Sein

- E-Paper: Mein Kreativ-Atelier Nr. 131

- Tips And Tricks For Your Fairphone 5