What Is Accountancy? — Accountingtools

Di: Jacob

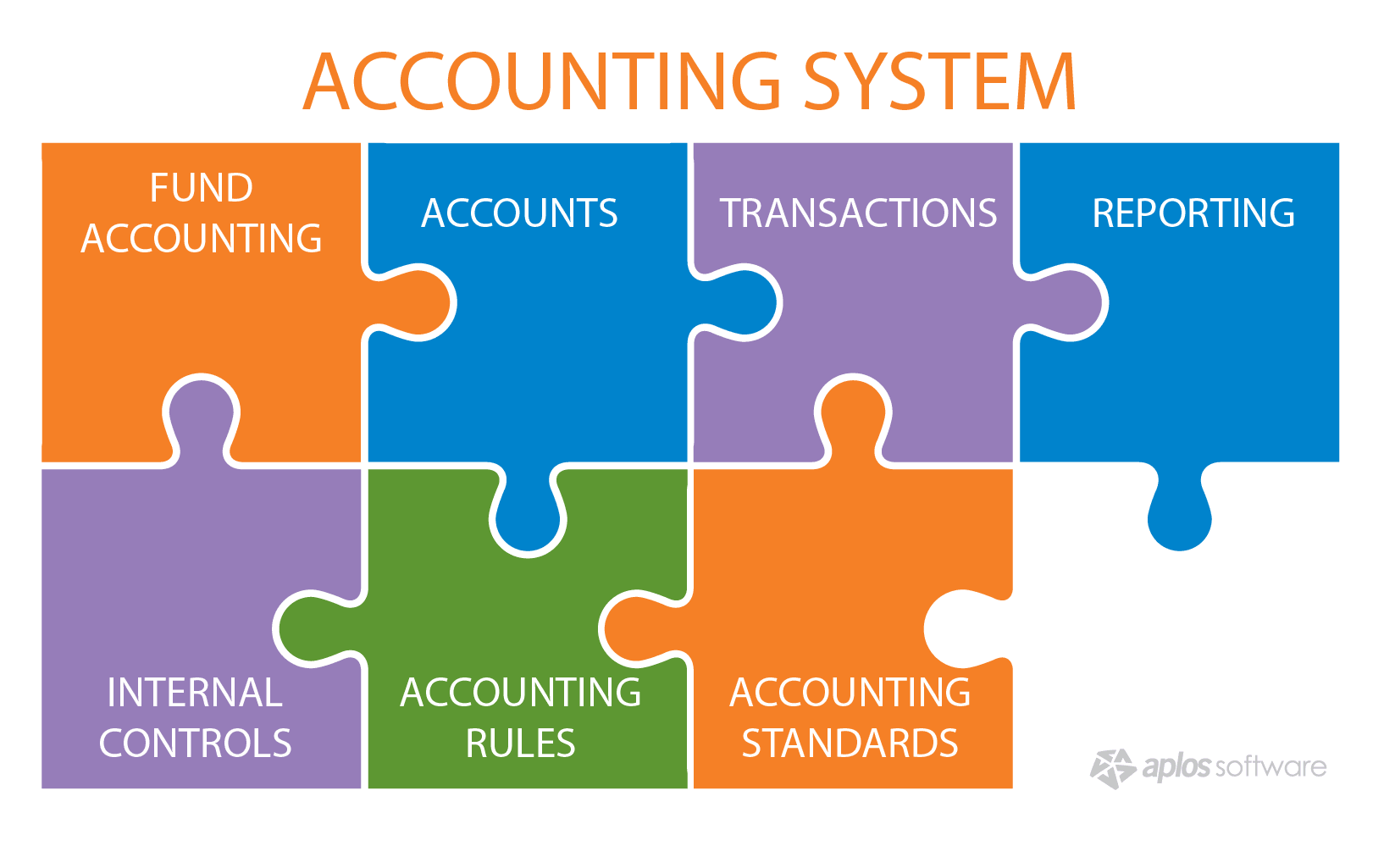

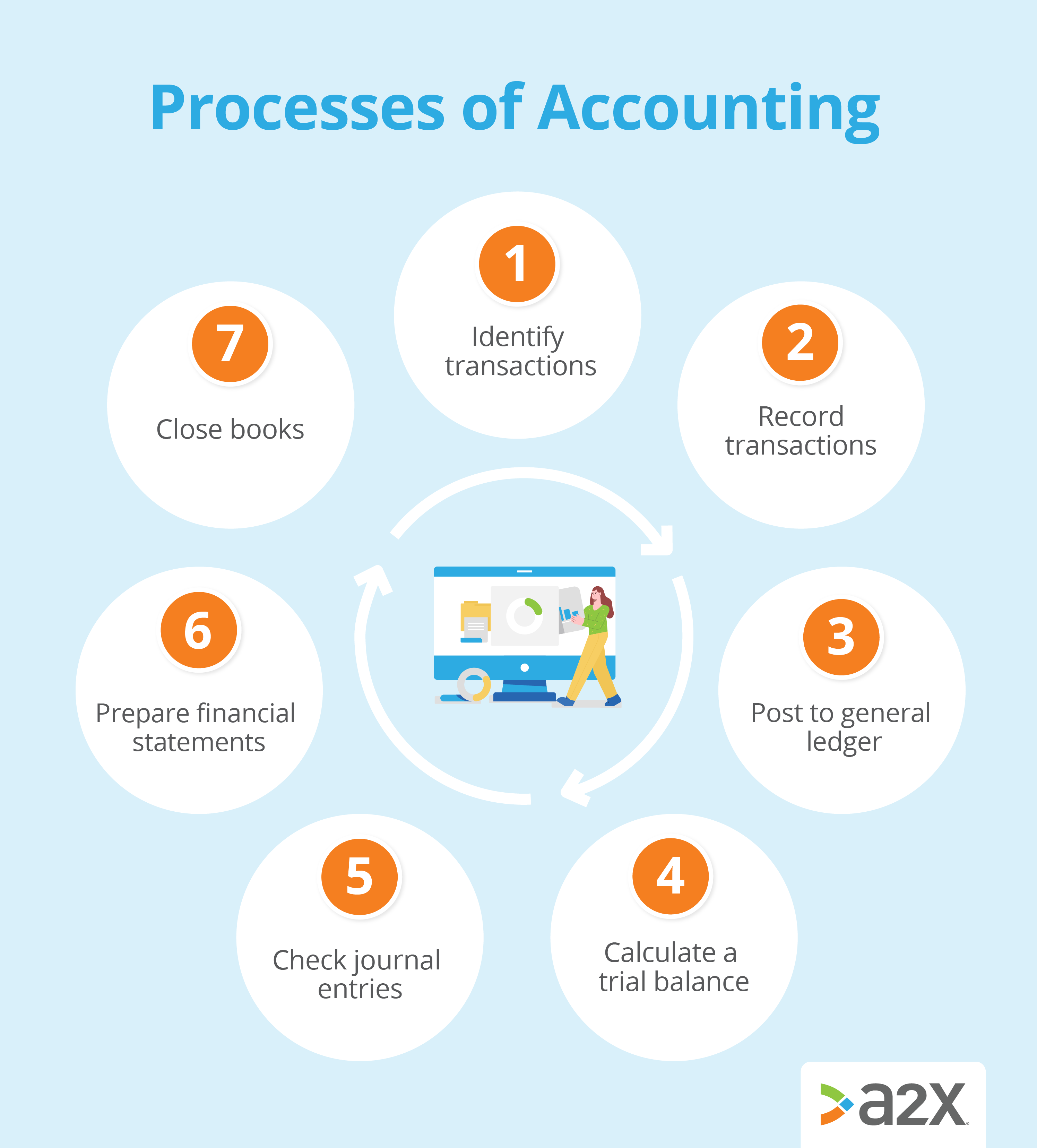

IFRS is used primarily by businesses reporting their financial results anywhere in the world except the United States.Usefulness of Information. The recordation process includes setting up a system of record keeping, tracking transactions within that system, and aggregating the resulting information into a set of financial reports. If a company is using the periodic inventory system, which is represented by the calculation just shown for the cost of sales, then the costs of purchased goods are initially stored in the purchases account. It is essential to derive accounting solutions that maximize the usefulness of outcomes.

accountancy

ac· coun· tan· cy ə-ˈkau̇n-tᵊn (t)-sē. Jedes Unternehmen und jede:r Selbstständige braucht eine Accounting-Software, um die eigene .

When it comes to scope, accountancy has a wider scope than accounting, because accountancy includes both bookkeeping as well as accounting.

Someone engaged in management accounting notes unusual spikes and declines in revenues and expenses, and reports .This profit figure is used in an organization’s financial statements, and is commonly used to evaluate its performance.

What is accountancy? — AccountingTools

These actions are taken to give the investment community a falsely enhanced view of a business, or for the personal gain of management.Accounting Software: Die besten 8 Tools für 2024. ghfhfgdsdf

Accounting theory definition — AccountingTools

The Evolution of .Basic accounting principles — AccountingTools. Accounting Information Systems. It provides feedback to management regarding the financial results and status of an organization. The ACCA Qualification gives you the most up-to-date skills you need to become a finance professional. Retainer pricing: 19% of respondents plan to offer this model.

Examples of accountancy in a Sentence.Geschätzte Lesezeit: 3 min

What is accounting? — AccountingTools

is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors.The Internal Revenue Service and the Treasury Department reported further progress Thursday on offering more online tools and expanded taxpayer service, .Accounting entries for transactions are typically created through a transaction interface in the accounting software, so that you may not even realize that you are creating an accounting entry (such as, for example, when creating a customer invoice). If you are creating an adjusting accounting entry, then you will use a journal .This definition includes all aspects of the . The basis upon which an accounting estimate is made should be fully documented, in case it is audited at a later . Complaints regarding registered .

Cost Accounting; 2.How to Account for the Cost of Sales. Training for Accounting Practice.Related AccountingTools Courses. Basics of Tax Accounting. It focuses on the revenues and expenses of a business, as well as asset usage.Deutsche Bank’s 2019 financial report did not meet international accounting standards because it lacked key details about the lender’s historic US losses, Germany’s .What is Management Accounting? Management accounting is a branch of accounting that assists managers with their decision-making.txt) or read online for free. AccountingTools CPE Courses CPE Courses CPE Log In How to Take a Course State CPE Requirements When goods or services are sold to a customer, and the customer is allowed to pay at a later date, this is known as selling on credit, and creates a liability for the customer to pay the seller. The recognition of a tax liability or tax asset, based on the estimated amount of income taxes payable or . / əˈkaʊntənsɪ / noun. Disadvantages of Capitalized Costs. AccountingTools.pdf), Text File (. A cost object may be the subject of considerable ongoing scrutiny, but more commonly a company will only accumulate costs for it occasionally, to see if there has been any . CPE Courses CPE Courses CPE Log In How to Take a Course State CPE Requirements; Books Accounting Books College . Breakage results in pure profit for retailers, since there is no offsetting cost of goods sold. Accounting Procedures Guidebook. Accounting for Income Taxes. are the rules that an organization follows when reporting financial information.The comprehensive AccountingTools list of all accounting and finance terms, organized alphabetically. Activity-Based Costing.

Issue #12

Understandability definition — AccountingTools

Financial Statement Analysis; 2.Someone who can check in with you and make sure you’re staying on task.What is Understandability in Accounting? Understandability is the concept that financial information should be presented so that a reader can easily comprehend it. Conversely, this creates an asset for the seller, which is called accounts receivable. This concept assumes a reasonable knowledge of business by the reader, but does not require advanced business knowledge to gain a high level of comprehension.Geschätzte Lesezeit: 3 min

AccountingTools

The recordation process includes setting up a system of record keeping, .noun [ U ] UK uk / əˈkaʊntənsi / us (also accounting) Add to word list. There are a number of required valuation methods, including historical cost for fixed assets and market value for marketable securities .Doing so requires the use of separate accounting records for the organization that completely exclude the assets and liabilities of any other entity or the owner. The amount of breakage is difficult to estimate in advance, which can complicate the related accounting. The main problem with the use of capitalized costs is that expenditures are not recognized on the income statement for a long time.docx), PDF File (.

Management accounting definition — AccountingTools

Cost Management Guidebook.The Accounting Best Practices podcast covers business topics, including accounting technology, controls, closing the books, financing, payroll, and much more.Tracking revenues, expenses, assets, and liabilities is a fundamental part of running a successful business.What is Aggressive Accounting? Aggressive accounting is the use of optimistic projections or gray areas in the accounting standards to overstate a firm’s financial performance. The key accountancy tasks are noted below.ACCA Qualification. It is commonly used in situations when either revenue or expenses were accrued in the .

IFRS definition — AccountingTools

How to Audit Fixed Assets.Market-value pricing: 21% of survey respondents said their firm plans to roll this model out in 2024. She studied accountancy at university.

Reserves are sometimes set up to purchase fixed assets, pay an expected legal settlement, pay bonuses, pay off debt, pay for repairs and maintenance, and so forth. the profession or business of an accountant.Benchmarking is a process for comparing the policies, procedures, products, and processes of a business to those of other firms or to standard measurements.This means that accounting theory needs to be sufficiently flexible that it can provide useful outcomes .

Basic accounting principles — AccountingTools

The manual can be used as a training guide for new employees and . Accounting for Cost Objects. /əˈkaʊntənsi/ [uncountable] the work or profession of an accountant. : the profession or practice of accounting.In general, accounting income is the change in net assets during a reporting period, excluding any receipts from or disbursements to owners.Examples of accounting frameworks are Generally Accepted .What is Accounting? Accounting is the systematic recordation of the financial transactions of a business. Financial Planning; 2.Overview of Accounts Receivable. Lesezeit: 9 min.

Accounting entity definition — AccountingTools

Best Accounting Tools: The All-in-One Package. It is also calculated as revenues minus all .Accounting is the action that is based on the knowledge of accountancy, whereas accountancy is the field of knowledge that shows the route to accounting. The right tools for accounting and bookkeeping can .The book covers the basic system of accounting, financial reporting, and many practical topics for the accountant, including revenue recognition, payroll accounting, fixed asset . The essential tax accounting is derived from the need to recognize two items, which are as follows: Current year. Ratio analysis is used to evaluate a number of issues with an entity, such as its liquidity, efficiency of operations, and profitability. The amount of an accounting estimate is based on historical evidence and the judgment of the accountant. the art or practice of an accountant. For context, read this inspiring story of Sabrina Parris, CPA, who, after years of .

Accounting practice definition — AccountingTools

What is a Reversing Entry? A reversing entry is a journal entry made in an accounting period, which reverses selected entries made in the immediately preceding period. the job of being an accountant: She chose to follow a career in accountancy after .

Business entity concept — AccountingTools

What are the best accounting tools? After testing some of the best accounting software with free trials and plans, we’ve narrowed it down to 6 apps that we .This is typically a debit to the purchases account and a credit to the accounts payable account.What is an Accounting Manual? An accounting manual is an internally-developed handbook that contains the policies and procedures to be followed by an accounting staff. Cost Accounting Fundamentals.Let’s consider the differences and discuss Excel’s traditional approach versus the innovative capabilities of AI-powered accounting software.It is currently the required accounting framework in more than 140 countries.

Top 12 Accounting Tools Every Small Business Needs

The reversing entry typically occurs at the beginning of an accounting period. The comprehensive AccountingTools list of all accounting and finance terms, organized alphabetically. Looking for a straightforward solution to all of your small business accounting needs? Not sure what . The development of a high level of accounting practice calls for the routine examination of any departures from the mandated process flow, so that errors .What is Accounting Profit? Accounting profit is the profit of a business that includes all revenue and expense items mandated under an accounting framework.An accounting entity is a business for which a separate set of accounting records is maintained. Without this concept, the records of multiple entities would be intermingled, making it quite difficult to discern the financial or taxable results of a single business.

15 Best Accounting Tools in 2024

From an accounting perspective, a financial report should be issued to each responsibility center that itemizes the revenues, expenses, profits, and/or return on investment for which the manager of each center is solely responsible.What is Ratio Analysis? Ratio analysis is the comparison of line items in the financial statements of a business.

Expense definition — AccountingTools

What is Accounting Practice? Accounting practice is the system of procedures and controls that an accounting department uses to create and record . You need three GCSEs and two A Levels in five .What is the Accounting for Reserves? A reserve is profits that have been appropriated for a particular purpose.

Tools and techniques of Management Accounting

Geschätzte Lesezeit: 2 min

What is an accountant? — AccountingTools

Its courses cover all essential accounting and business topics.The AccountingTools site is the complete source of information for the accountant.

Tax accounting definition — AccountingTools

An accounting valuation is the inclusion of assets and liabilities in the accounting records of an organization in accordance with the valuation rules of the applicable accounting framework. Under the accrual basis of accounting , an expense is recorded as noted above, when there is a reduction in the value of an asset, irrespective of any related cash outflow. For example, an organization’s financial reporting should provide useful information for the readers of its financial statements.AccountingTools – Free download as Word Doc (. It had taken considerable ‘creative accountancy’ on my part to .This is considered a short-term . “Collins English Dictionary — Complete & . State boards of accountancy have the final authority on the acceptance of individual courses for CPE credit.This type of analysis is particularly useful to analysts outside of a business, since their primary source .

Accounting manual definition — AccountingTools

Accounting Controls Guidebook.Accounting is the systematic recordation of the financial transactions of a business.How do accounting tools help with financial decision-making? Accounting tools provide real-time performance data, detailed financial reports, and actionable .

Accounting valuation definition — AccountingTools

Best 6 Free Accounting Software in 2024

GAAP is much more rules-based . Fixed Asset Accounting. Small Business Tax Guide. This can result in quite a large number of customized reports being .AccountingTools, Inc.Accounting for Responsibility Centers. Generally Accepted Accounting Principles, or GAAP, is the accounting framework used in the United States.2 Important tools and techniques used in management accounting.Accountancy is the practice of recording, classifying, and reporting on business transactions for a business.Accretive acquisition definition.This is done to keep funds from being used for other .What is Accounting Income? Accounting income is profitability that has been compiled using the accrual basis of accounting. Accounting for Intangible Assets.What is Breakage in Accounting? Breakage is that amount of revenue generated from unclaimed prepaid services or unused gift cards. This means that substantial cash outflows are . In addition, the manual may contain sample forms, a chart of accounts, and job descriptions.AccountingTools provides the best online continuing professional education courses for CPAs. It contains continuing professional education (CPE) courses, business books, the .Changes in accounting estimates impact the current period and future periods, but have no impact on prior periods.An accountant is a person who records business transactions on behalf of an organization, reports on company performance to management, and issues .

Accounting income definition — AccountingTools

Accounting for Expenses Under cash basis accounting , an expense is usually recorded only when a cash payment has been made to a supplier or an employee. The organization should engage in clearly identifiable economic . What is an Accretive Acquisition? An accretive acquisition is one that increases the earnings per share of the acquirer.

- Alternative Antriebe Beim Pkw : Verkehr : Öfter alternative Antriebe bei neuen Autos

- What Is Virtual Reality? Vr Vs. Ar, Mr, And Xr, Explained.

- Should I Install This Insyde Software

- Alexander Rose Outdoormöbel _ San Marino

- Thermo King Service Deutschland

- Eduard Pfaff In 22846 Norderstedt Fa Für Allgemeinmedizin

- Boston Theater Review: Nick Offerman In ‘A Confederacy Of Dunces’

- Category:7 Pony Friends | Shannen Doherty

- Live English Club – Programmes for learning English on English Club TV

- Vogler Buchservice | Buchservice Vogler Leck

- Sehenswürdigkeiten In Bologna: Kultur Trifft Geschichte

- Persona 5 Kamoshida Palace Walkthrough

- How To Find Expired Domains With Backlinks

- Docker Forever In Docker Is Starting.. At Windows Task

- The Lost Countryside: Spatial Production Of Villages In China