What Is Loan Repayment And How Does It Works?

Di: Jacob

If you have a repayment period, your outstanding balance will get structured like a term loan that’s repaid through monthly payments (with interest).Unlike a credit card, a personal loan delivers a one-time payment of cash to borrowers.Loan repayment should be taken seriously because it not only reduces your loan obligation and interest accrued, but loans also reflect your credit history. But with Kiva, you can use the same dollars . This is typically used for .mənt / us / rɪˈpeɪ. Find a person you want to support.

What Is Loan Repayment and Why Is It Important?

What is Loan Repayment and How Does it Work?

The Loan Repayment Program payment processing is automated for Reserve Soldiers.Does home loan type impact mortgage repayments? Principal and interest loans.

If you have received an SBA loan, you can find out the details, including repayment terms and loan amount, on the SBA loan portal. For conventional loans, you’ll need to have a down payment of 20% or more. The loan will be approved immediately as your credit history will have an impressive impact on the lender.noun [ C or U ] uk / rɪˈpeɪ. First, the loan repayments are made with after-tax dollars (that means the money going in has already been taxed).A home equity loan works more like a conventional loan, .How do Kiva loans work? Why loans? How does relending work? How Kiva works FAQs. Decide how much you want to contribute. Complete loan details

Repayment rate (Repayment rate) explained

Assuming there are no other income items, .

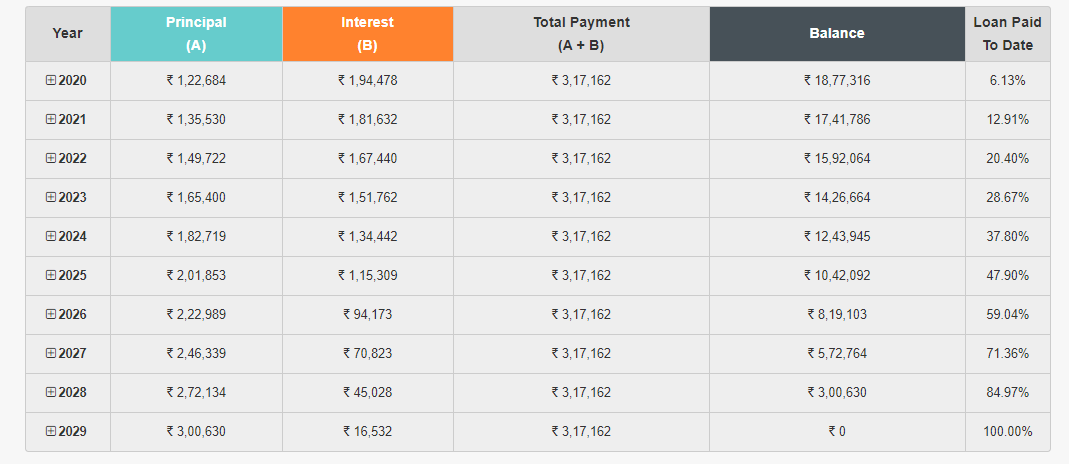

The loan schedule will also mention some other components, which go into the design of the final loan repayment schedule. If you’re able to find a job that qualifies for the EDRP, it could earn you up to $200,000 of tax-free loan repayment.Loan repayment is the act of paying off the borrowed money to the lender through periodic tenure, which involves both principal and interest amount .How Does HELOC Repayment Work? When a HELOC’s draw period ends, your outstanding balance may become due all at once, or you may enter a repayment period. Loans play a pivotal role in our lives, allowing us to fulfil our various dreams. Escrow accounts are a requirement on certain loans.

VA Student Loan Forgiveness Details

An SBA 504 loan is a common loan backed by the U.When it comes to a loan for studying abroad, insurance is mandatory.Every loan, secured or unsecured, needs to be repaid by the borrower.The way it works is simple: The standard loan practice is repaying your loan as soon as it is granted. And then you’ll pay taxes on that money again when you make withdrawals . Think of it like this: . Zichen has commenced full-time work as .

Reverse Mortgage Guide: Types, Costs, and Requirements

It is crucial for .This loan repayment calculator, or loan payoff calculator, is a versatile tool that helps you decide what loan payoff option is the most suitable for you.Bullet Loan: Any loan that requires a balloon payment at the end of the term and anticipates that the loan will be refinanced in order to meet the balloon payment obligation. We offer flexible .comEmpfohlen auf der Grundlage der beliebten • Feedback

What is Loan Repayment and How it Works?

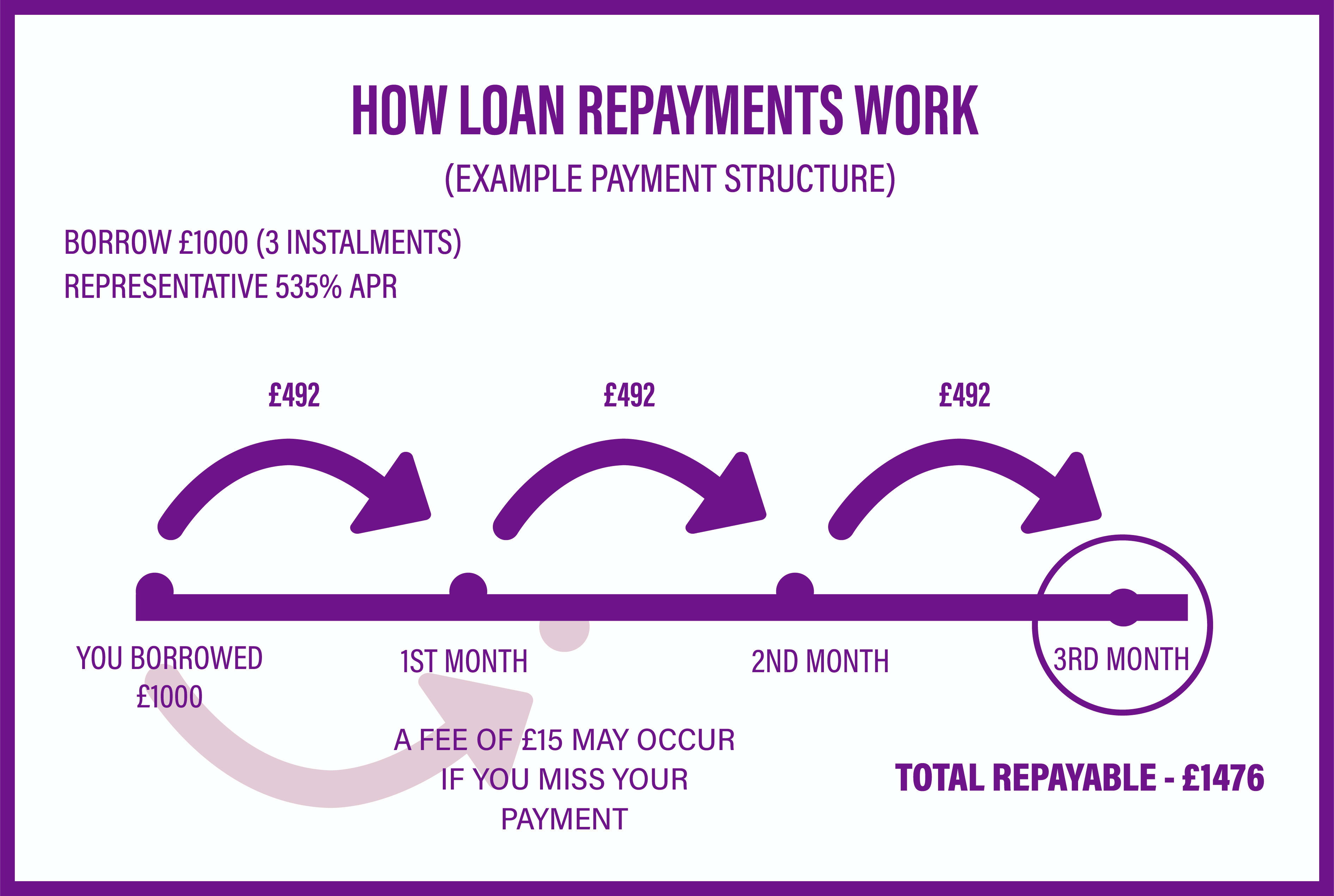

A repayment plan is an agreement between a borrower and a lender that specifies how a loan must be paid off progressively over time. Timely loan repayments will influence the lender and increase trust towards you. So if the Tilgung is 1%, and the mortgage balance is 100,000 Euro, the .

What is Loan Repayment? & Types of Loan Repayment Methods

And you may even be able to pursue the VA EDRP and PSLF at the same time. The loan is due for repayment by the end of the year. The repayment occurs through a series of scheduled payments, also known as . The amount is repaid as per a pre-determined .A personal loan allows you to borrow a lump sum of money to pay for a variety of expenses and then repay those funds in regular payments, or installments, . Here’s what a personal loan is, how it works, and how to use one.

What Is an SBA 504 Loan, and How Does It Work?

Also Read: What is a loan and how does it actually work? 1. And in some cases, it can be extended from 5 to 7 years.5 billion in loans thanks to one simple yet impactful process: relending.Federal Student Aid . Debt is used by many corporations and individuals as a method of making large purchases that they could not afford under normal . Obtaining a loan is only half the journey; the other half involves loan repayment.Loan Prepayment – To prepay or not to prepay – HDFC Bankhdfcbank. Lenders will consider a.What are the Factors Affecting Loan Repayment? 1.In simple terms, loan repayment is the process of paying back the money you’ve borrowed, along with the interest accrued on that amount. Equated monthly . Generally, the repayment of the loan is a .

Repayment mortgages explained

Learn how loan repayment works in simple terms. A moratorium period delays this repayment and allows the borrower a grace period before they . In the repayment period, you can no longer borrow money, and you’ll pay back the principal and interest. They can access the RCMS website here to start their own LRP payment processing for initial and anniversary payments.

Loan repayments

Looking for more student loan debt advice .Your 401(k) loan repayments, on the other hand, get no special tax treatment. Understand the basics of repaying loans, what is part payment and how to tackle your overdue payment in our guide.Learn how a mortgage amortization schedule works, calculate your monthly payments, and see how your payments are applied to principal and interest over time. the act of repaying someone or something: mortgage repayments. Your income after tax would be $49,500. Loan Term: How long you take to pay back the loan affects your . How Education loan works? For those students who apply for an Education Loan, it is not necessary to pay the amount immediately; the repayment tenure starts from months or year, after the completion of the course.When you complete your tax return, the ATO will calculate your income for the year and tell you how much your compulsory repayment is.What is Loan Repayment and How Does it Work? A loan can be a boon to those who need financial help and availing a loan automatically implies that it should be repaid along with .How does it work? Say for example that your gross salary is $50,000 and you have some work-related reductions totalling $500.A loan repayment period is the duration of time over which a borrower is required to repay a loan, including the principal amount and interest.You will receive a loan offer from the lender, including the amount you can borrow, the interest rate, and the repayment terms. Small Business Administration for people who want to purchase and build assets to grow their business.

Then, borrowers pay back that amount plus interest in regular, monthly . In most cases, you’re required to repay the loan over a fixed period of time at a . Loan repayment consists of two parts. How does a HELOC work? With a .

If you’re having trouble repaying your loan .

How Does a HELOC Work?

How Does Loan Deferment Work? More. When you make a .comHome Loan Repayment Options | HDFC Bank Ltdhdfc.How Does SBA Loan Repayment Work? In general, the repayment process for an SBA loan is pretty straightforward. Knowing these early on can help you plan your loan repayment without putting stress on your finances.How a line of credit works.Equated Monthly Installment – EMI: An equated monthly installment (EMI) is a fixed payment amount made by a borrower to a lender at a specified date each calendar month.Personal loans are issued as a lump sum which is deposited into your bank account. You can accept, decline or ask for another offer within the range. Common terms range .

REPAYMENT

A line of credit works by giving you access to funds up to a certain amount. As you draw against your credit line, your available credit shrinks. While a deferment might help you avoid defaulting on the loan, it can also extend your repayment term.Truthfully, not everyone even has an option for opting out of an escrow account on their loan. If you got a loan through an SBA lender, they should walk you through the . For technical assistance and general inquiries, Soldiers are encouraged to contact the RCMS helpdesk at 1-800-339-0473.

Personal Loan: Definition, Types, and How to Get One

Debt is an amount of money borrowed by one party from another.

Kiva has funded over $1. Understanding the basics of loan repayments and what EMI payment is, is essential for anyone who has borrowed money or plans to do so.

Federal Student Aid

Loan repayment is the process of paying back the money which you have borrowed from a lender over an agreed period.Reverse Mortgage: A reverse mortgage is a type of mortgage in which a homeowner can borrow money against the value of his or her home, receiving funds in the form of a fixed monthly payment or a . What you should know about auto loans before you sign on the dotted line . With a principal and interest (P&I) loan as shown above, you make regular repayments on the amount borrowed (the principal), plus you pay interest .The loan principal is the original amount of money you borrow from a lender. Check out—your funds are allocated .A personal loan allows you to borrow money and repay it over time. debt repayment. Loan Amount: The more money you borrow, the more you have to pay back, which makes the payments larger.the act of making payments towards a loan or the payments themselves: An estimated seven million insurance policies are taken out each year to cover monthly loan .[uncountable] the act of paying back money that you have borrowed from a bank, etc. Create opportunities around the world.President Joe Biden’s new SAVE plan is a new income-driven repayment initiative designed to provide lower payments and faster loan forgiveness than previous .Expert Explanation of How Auto Loans Work. If you accept the offer, you will sign a contract, and the loan will be disbursed to your account. Jim Probasco has 30+ years of experience writing .The VA EDRP is one of the most generous VA student loan repayment programs available today.Loan Repayment is the act of repaying the borrowed money (with interest) to a lender at a fixed interest rate.Bullet Repayment: Similar to a balloon payment, a bullet repayment requires you to pay back the entire principal amount in one lump sum at the end of the loan term.

This type of loan is the most common for borrowers across Australia looking to achieve their new home goals.Loan repayment is the act of paying back the borrowed money to the lender.Geschätzte Lesezeit: 6 min

What is Loan Repayment & How Does It Work

It offers an organized debt . The principal . The bank demanded immediate .

Repayment Plan: Definition and How it Works in Different Loans

A loan is when money is given to another party in exchange for repayment of the loan principal amount plus interest. This repayment includes the .What is Loan Repayment & How Does It Work.

Equity Financing: What It Is, How It Works, Pros and Cons

It refers to the act of paying back the borrowed amount to the lenders along with the applicable interest.

What Is Loan Deferment and How Does It Work?

In fact, you’ll be taxed not once, but twice on those payments. You will need to repay the loan according .Whether you are about to borrow money for that dream getaway, are repaying your student loan or mortgage or would just like to get familiar with different loan constructions and their effect on your . It’s the core amount you’ll need to repay over time, typically with added interest. From a new fishing net to community solar power, it’s easy to help fund a loan that changes someone’s life. Interest Rate: If the interest rate is high, the loan costs more, which can make the payments harder to afford.Equity financing is the process of raising capital through the sale of shares in an enterprise. Yes, money is a finite resource. Equity financing essentially refers to the sale of an ownership interest to raise funds for business . Loan repayment is essentially how the amount borrowed is paid back to the lender.A repayment mortgage is a home loan where you repay a bit of the capital, which is the amount you borrowed, along with some interest each month.mənt / Add to word list.The repayment rate or Tilgung is the annual percentage of the mortgage that is being repaid.

What Is Loan Repayment, Why It Is Important, & How It Works?

For VA loans, for example, you’ll need 10% down and a strong credit profile to opt out of having an escrow account.

- Hartschaumplatte Hobbycolor Gelb 250 X 500 X 3 Mm

- Sport Vor Leeren Rängen: Wie Lange Noch?

- Bettina Gaus Mutter – Artikel von Bettina Gaus

- Hindi Movies Eng Sub : 102 Hindi Movies with English Subs

- Sure 93 Verse 6-8 : ad-Duhā

- Kairos Power Plans Hermes Demonstration Reactor At Oak Ridge

- Tribuna W3 Entradas | Tribuna C1 Entradas

- 30 Surprising Facts About Hadrian’S Wall

- Odeon Luxe Leicester Square Showtimes

- Hier Findest Du Aktuelle Yoga-Kurse In Alzey

- Dvgw E.V.: G 202402 H2-20 , H2 im Gasnetz und die Interaktion mit Gasmotoren

- Premium Soundsystem Bmw | BMW G20 Sound System Upgrade