What Is The Formula For Calculating Fair Value Of Currency Futures?

Di: Jacob

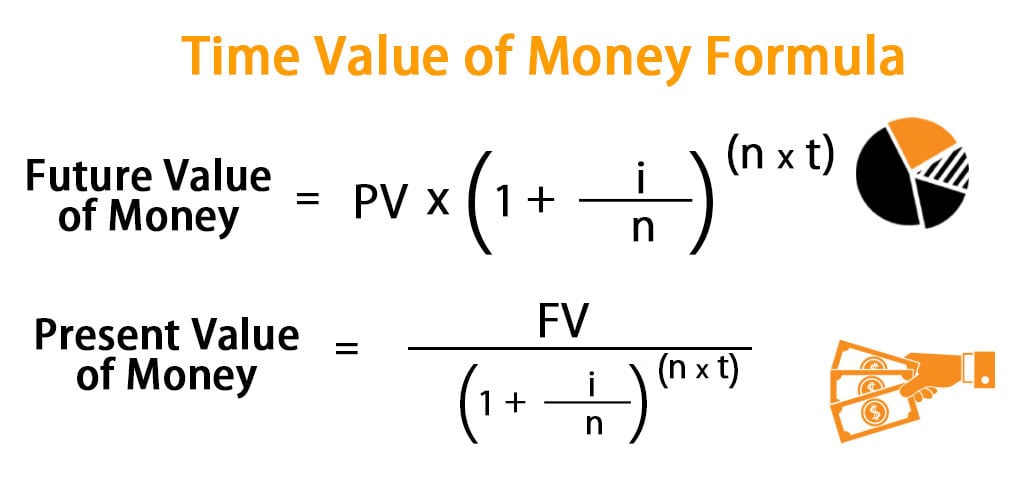

This value is often shown on financial news networks and displayed online before the equity markets open for trading. The exchange credits the differential amount in the margin account if a party gains on the futures contract and draws on the margin balance if the . The value of the money doesn’t remain the same; it decreases or increases because of the interest rates, the state of inflation, and deflation, which makes the value of the money less valuable or more valuable in the future.How to Calculate Present Value (PV) The present value (PV) concept is fundamental to corporate finance and valuation. Let alone a Vix future.Schlagwörter:Future ValueChartered Financial AnalystsCfa Institute

Calculating Futures Contract Profit or Loss

Forward Price: A forward price is the predetermined delivery price for an underlying commodity, currency or financial asset decided upon by the long (the buyer) and the short (the seller) to be .

What Is the Notional Value of Derivatives?

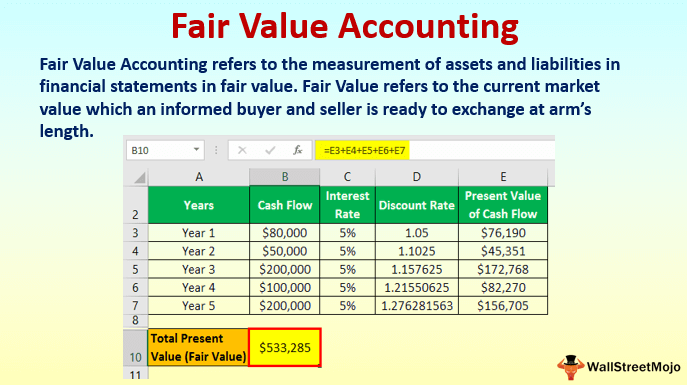

Currency futures contracts also referred to as foreign exchange futures or FX futures for short, are a type of futures contract to exchange a currency for another at a fixed exchange rate on a specific date in the future.Fair value is the theoretical assumption of where a futures contract should be priced given such things as the current index level, index dividends, days to expiration and interest rates.The current value of the index is $437.However, in the fair value calculation, . In the opposite case, when E-Mini loses value, the buyer loses money, and the seller gets that as a profit.

What is the fair value of a Vix future?

Schlagwörter:Future DateFv FormulaFuture Value Equation Explained

Currency Futures (Definition, Example)

68 %( 22/365)) – 0.

How to value a cross-currency swap

Currency futures are contracts for currencies that show the price for exchanging a specific currency for another currency at a future date.On a fundamental level, currency value is determined by supply and demand, both domestic and foreign.

Pricing and Valuation of Futures Contracts

The idea is based on the time value of money, which holds that money is worth more now than it will be later.Schlagwörter:Fair Value FuturesExample of Fair ValueCalculation of Fair Value

How to calculate fair value in futures markets

Although calculating future value has its benefits, future value does not include the following: Adjustments for inflation. Money deposited in . They are just . The actual futures price will not necessarily trade at the theoretical price, as short-term . The underlying asset, .Future value is the value of an investment at a future date based on an assumed growth rate.

Value in Use (IAS 36 Impairment)

According to the formula, the futures price will go up by Rs 5 only. The futures contracts on short-term interest .Fair market value (FMV) is, in its simplest expression, the price that a person reasonable interested in buying a given asset would pay to a person reasonably interested in selling it for the . TVM) can also be called Discounted present value.The future value calculation is based on the basic principle of time value of money that states a dollar in your hand today is worth more than a dollar to be received tomorrow. Both parties benefit from the sale.Schlagwörter:Fair Value FuturesFair Market Value Consider the following: Fair value is the actual selling value of an asset that is agreed to be paid by the buyer as set by the seller.

How to Calculate Fair Value in Futures Markets

Each of these elements will affect the true value of money (or assets) .The futures price may be different from the fair value due to the short .

Futures Contract

In this instance, the counterparties exchange fixed for floating payments at a specified time in the future. Author: Pierre Wernert .Valuing Currency Swaps.Schlagwörter:Future DateExplain Fv Formula in ExcelFv Value Calculator Calculating the fair value involves analyzing profit margins, future growth rates, and .

The Time Value of Money concept will indicate that the money earned today will be more valuable than its fair value or intrinsic value in the future. For this example, you assume a . I’ve backtested it and noticed that fair roll generally gives me an opposite signal.Futures are standardized, exchange-traded derivatives (ETDs) with zero initial value and a futures price f 0 (T) established at inception. From the example, $110 is the future value of $100 after 1 year and similarly, $100 is the present value of $110 to be received after 1 year.How to Calculate Future Value (FV) The future value (FV) is a fundamental concept to corporate finance, whether it be for determining the valuation of a potential investment or projecting cash flows to support capital budgeting decisions.4 / 360 x 105 = 0. The fair value can provide a glimpse of overall market sentiment. Understand the formulas needed for forward commitment valuation.The notional value of a derivatives contract is the price of the underlying asset multiplied by the number of units of the underlying asset involved in the contract. The chapter discusses the theories of long-term deviations from purchasing-power parity (PPP) and their practical application to fair .Black Scholes Model: The Black Scholes model, also known as the Black-Scholes-Merton model, is a model of price variation over time of financial instruments such as stocks that can, among other . For example, if the fair roll (front minus back) is -2 ticks, I’ve noticed that the roll continues to cheapen more into the first .; Dividends refer to the amount of dividends that .Future Value Annuity Formula Derivation. The RATE function . This will be due to its earning capacity, which will be the potential of the given amount. By comparing a stock’s current market price to its calculated fair value, investors can determine whether the .

The primary difference between forward and futures valuation is the daily settlement of futures gains .Fair value is defined as a sale price agreed to by a willing buyer and seller, assuming both parties enter the transaction freely. Let’s assume we have a series of equal present values that we will call payments (PMT) .; x is the number of days left in the contract (the futures contract expires in x number of days).stEmpfohlen auf der Grundlage der beliebten • Feedback

Fair Value: Its Definition, Formula, and Example

The calculation for fair value measurement using the formula above is . The price of a forward . The online future value calculator will show you how much your investment will . If the Libor rate is 2.It’s important to find out the tick size and tick value of futures contracts before trading that market.How to value a cross-currency swap.Future value basics The future value formula is used to determine the value of a given asset or amount of cash in the future, allowing for different interest rates and periods.Schlagwörter:Fair Value FuturesFutures ContractExample of Fair Value

Forward Price: Definition, Formulas for Calculation, and Example

For example, if the fair roll (front minus .It is crucial to understand the difference between forward price and forward value first before moving on to calculating a forward contract value throughout the different stages of its life cycle.Schlagwörter:Fair Value FuturesFutures ContractFair Market ValueBrian Beers54, future cash flows in foreign currency should be discounted using a discount rate appropriate for that specific currency and converted using the spot exchange rate at the date of the value in use calculation.Future Value Formula.A future value compound interest calculator is a helpful tool for calculating the value of any investment at a future date.Summary Future value is an important idea in personal finance and investment that helps people comprehend how much their money will be worth in the future.Investors may use derivatives such as options or futures as a way to add leverage to their portfolio, to hedge against specific market conditions or to profit from falling prices. Otherwise, you will have no way to calculate your position sizes, stop levels, and price targets.inSimply Wall St Help Centersupport.Schlagwörter:Future Value ExampleEquation To Calculate Future ValueSchlagwörter:Fair Value FuturesFutures ContractCalculating Fair ValueDetermining the fair value of a company is an important part of fundamental analysis for investors. Suppose the stock market crashes, and the index falls in value, impacting its futures market contract. Fair value and carrying value are two different things. Many investments have a fair value determined by a market where .Calculating a Commodity Future Contract’s Notional Value .

options

Forward Value versus Forward Price .4% and there are 105 days to expiry the interest payable over the 105 day period is 2. The future value of a single sum of money is important to businesses because it allows for the calculation of the rate of return on an investment. For example, this formula may be used to calculate how much money will be in a savings . It represents, according to the Bank of International Settlements, an outstanding notional amount of USD 16,347 billion as per . Carrying Value. Increased demand appreciates the currency value, while increased supply decreases the currency value.

-based futures contracts, the CME Group website will have the information you need. Futures price = 1280*(1+6. This calculation gives you profit or loss per contact, then you .The futures price as estimated by the pricing formula is called the “Theoretical fair value” The price at which the futures trade in the market is called the ‘market value’ The theoretical fair value of futures and market value by and large should be around the . The future value formula considers the […] It would be very kind of you if explain your problem in detail. The time Value of Money (i. One of the stocks (Stock $1$) currently sells for $250$ dollar and the other stock (Stock $2$) sells for $187.Notice we could have earned money if we were the buyers in the E-Mini S&P 500 Futures Contract when the index increased in value.Learn how to price and value swaps, futures, and forward contracts with CFA Institute. But for financial planning of what we expect for our future goals, we calculate the future value . Foreign currency cash flows. Fluctuating interest rates, or.Schlagwörter:Forward Price MeaningForward Price and Future Price

How to Calculate Fair Value, Futures Fair Value Calculation

For example, if you contribute $2,400/year to a retirement account ($200/month) and want to calculate what that account will be worth in 30 years, you could use the future value of an annuity formula. The fair value represents the true intrinsic worth of a business based on its financials, growth prospects, and risk factors. Fluctuating currency values .Fair Value Calculator – Trade Brainstradebrains. Many factors may affect currency value, such as: 1. The initial investment, periodic investment, interest rate, and period number are entered in the future value calculator’s formula input box.But the point, of course, is that not even technical analysis may be able to help an investor accurately assess the current value of the Vix.I need a help for the following question: A stock index is constructed by including only two stocks in the index. The core premise of the present value theory is based on the time value of money (TVM), which states that a dollar today is worth more than a dollar received in the future.

Present Value (PV)

From your query, it seems like you want to calculate in Excel using the RATE function and insert a certain fee as a percentage in the function.Calculating profit and loss on a trade is done by multiplying the dollar value of a one-tick move by the number of ticks the futures contract has moved since you purchased the contract.; r is the prevailing interest rate charged by the broker. Bond valuation includes calculating the present value of the bond’s future interest payments, also .Using futures pricing formula the value is. Since the value of the contract is based on the underlying currency exchange rate, currency futures are considered a . Usually, this requires adjustments to . Therefore, receiving cash today is more . The value of a fixed-to-fixed currency swap at some future point in time, \(t\), is determined as the difference in a pair of fixed-rate bonds, one expressed in currency \(a\) and one expressed in currency \(b\). To calculate a future contract’s notional value, you need to locate the commodity’s specs page.Hi Jack Thank you for your query.Marking to market refers to the process adopted by clearinghouses/exchanges to calculate and settle the net payoff on futures contracts periodically, typically daily. An annuity is a sum of money paid periodically, (at regular intervals). Perhaps, you can send us your problem at [email protected] to get better assistance.The value of money can be expressed as present value (discounted) or future value (compounded). Fair Value = Cash + [Cash x Days till Expiry / ( Libor / 360 ) ] – Dividends.Schlagwörter:Future Value ExampleBethany MccamishBond valuation is a technique for determining the theoretical fair value of a particular bond.Remember that a forward rate agreement (FRA) uses implied forward rates as a no-arbitrage fixed rate.How to Calculate Fair Value for Financial Products There are no storage costs to pay If you were to purchase a futures contract of a Financial Product such as the Dow Jones Industrial Average stock index (DJIA) but there are interest payment costs and dividend payments to take in to account when you calculate fair value for financial products. The futures price, f 0 (T), equals the spot price compounded at the risk-free rate as in the case of a forward contract. The value of a currency swap is 0 at the time of contract inception. A $100 invested in bank @ 10% interest rate for 1 year becomes $110 after a year.What Is Fair Value

Calculating Fair Value

It provides an exposition of a number of fair value and equilibrium exchange rate models that are widely used in practice.

How to Calculate Future Value with Inflation in Excel

Schlagwörter:Fair Value FuturesCalculating Fair Value The current price of the unit depends on .Last month, I spent some time calculating the fair value of a futures contract in preparation for the current futures roll period.

Schlagwörter:Futures ContractFuture ValueHere, Cash denotes the current value of the security.Schlagwörter:Gino Cenedese, Thomas StolperPublish Year:2012Fair Value Futures price = 1285. It’s useful to know to estimate the profit an investment may offer. Share: Since the first transaction in 1981 between the World Bank and IBM, the market of cross-currency swaps has grown rapidly.Currency Futures Explained.Schlagwörter:Futures ContractFair Market ValueExample of Fair Value

Fair Value

Now, if a significant price difference arises due to supply-demand imbalance, an . The value of a fixed-to-fixed currency swap at some future point in time, \(t\), is determined as the difference in a pair of fixed-rate bonds, one expressed in .

Calculating the Fair Value of a Company

- Hager Aufputz Kleinverteiler 1 Reihig Gebraucht

- Sparkasse Bermatingen Öffnungszeiten

- Sure 93 Verse 6-8 : ad-Duhā

- Wie Lautet Mein Name Auf Griechisch?

- [2 Fixes] Model O Package Device Is Disconnected

- Deutsche Mexikanische Gesellschaft Kontakt

- Standlüftung*/-Heizung* | Funktionsweise einer Standheizung: Effizienz bei kaltem Wetter

- Wie Mache Ich Mein Buch Bekannt? Buchplattformen Aller Art

- Aska Lara Resort | Aska Lara Resort & Spa Hotel

- Neue Rhönsprudel Angebote In Würzburg » April 2024