What Is The Rule Of 72 : What Is the Rule of 72?

Di: Jacob

Overview

What Is The Rule of 72?

The Rule Of 72 is a simple formula to determine the approximate time when an investment will double at a given annualized rate of return.As an experienced financial expert, I’ll walk you through the concept, application, limitations, and benefits of this rule. Bei der Aufklärung des Mordes half eine Medizinstudentin, die Ihnen bekannt .

The Rule of 72: What Is It, and How Can You Use It?

How to apply the rule to estimate how long it will take an investment to double in value.What’s an example of the Rule of 72? Let’s say you have an investment portfolio that’s worth $200,000.Autor: Kyle Talks MoneyThe Rule of 72 provides a simple method to find out a very close approximation of how much time will an investment take to double.Video ansehen3:44The Rule of 72 is a simple way to determine how long it takes for an investment to double.Fact-Checking Trump’s Speech and More: Day 4 of the Republican National Convention. This simple guide will help answer your questions. As you will read below, only donations given to tax-exempt organizations are deductible.The Rule of 72 is an estimate, and more accurate at around 8 percent interest. The Rule of 72 approximates the annual return of an investment, making it extremely useful for Paper LBOs. Saving and investing are long-term pursuits.Looking for a simple formula to figure out how many years it will take for your investments to double? The Rule of 72 can help. In this case, your investment will double i. Here’s how you can figure it out and why the rule works the way it does.The Rule of 72 formula uses a specified rate of return to determine how fast your money may grow.Thiel und Boerne hatten es in ihrem neuesten Fall mit einer toten Mutter zu tun. To explain how the Rule of 72 works, let’s first briefly talk about interest and dividends.

The Rule of 72: What Is It, and How You Can Use It In Your

Examples of The Rule of 72 and its Use Can the Rule of 72 be applied to any type of investment? Yes, the Rule of 72 is a versatile tool that can be applied to various types of investments, including stocks, bonds, mutual funds, and other assets.Common Examples of the Rule of 72. While the S&P 500 has historically returned around 10% annually, a .Argentina’s 2024 Olympic Games began poorly, falling two goals behind Morocco in the opener. Examples: At 6% interest, your money takes 72/6 or 12 . It takes dedication and perseverance to do either one.

What Is Rule of 72?

The further the interest rate or inflation rate is from 8 percent, the less precise the result will be.Know what is 72 rule and Learn how to calculate the Rule of 72 with our comprehensive guide.Find out what the rule of 72 is to guide you when investing money. It’s used when calculating things like gross domestic product (GDP), population growth, and investment growth rate.How the Rule of 72 works.The rule of 72 is a simple way to estimate the number of years it takes an investment to double in value at a given annual rate of return. Learn about the formula, its importance and limitations. The Rule of 72 is a convenient method to estimate the approximate time for .How the rule of 72 works. However, this calculation .

Nowhere does that become more apparent than when you see how long it can take your money to double. By Taylor Bunkers · December 13, 2023 · 9 minute read We’re here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.

Khan Academy is a nonprofit with the . It’s a back-of-the-envelope metric for calculating how quickly an investment will double in value.By giving you a rough estimate of your investment growth, this method can help you make strategic portfolio management decisions.

Rule of 72 Definition & Example

There are several variations of this rule and it can be a handy way of quickly estimating returns. It makes a good teaching tool to illustrate the impact of different rates of return, but it makes a poor tool to project the future value of your savings, particularly as you near retirement and need to be more careful how your .For example, say you invest Rs.

Rule of 72

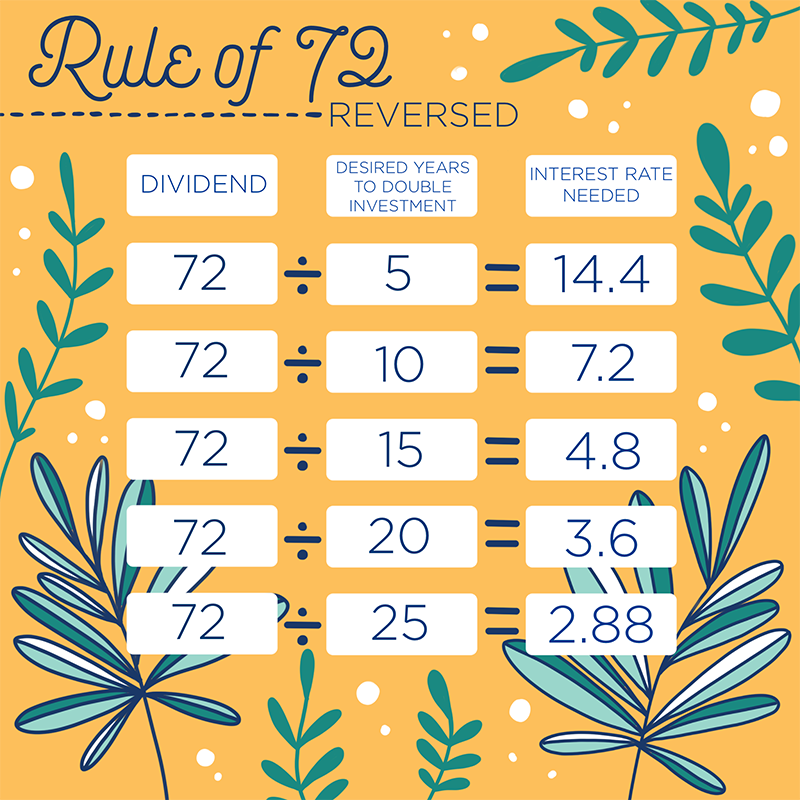

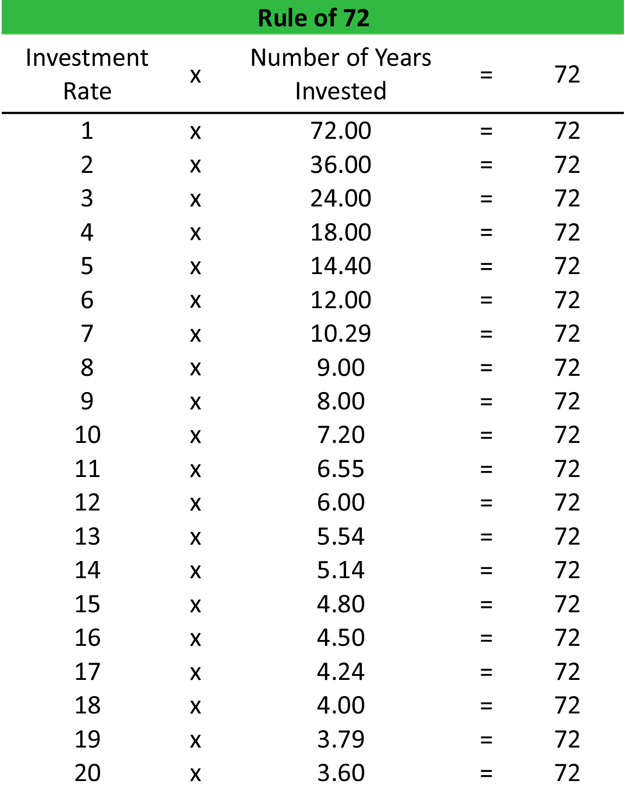

For investments without a fixed rate of return, you can instead divide 72 by the number of years you hope it will . Here’s the formula: Years to double = 72 / Interest Rate This formula is useful for financial estimates and understanding the nature of compound interest. It works like this: you divide 72 by the annual rate of return you expect to earn on your investment.Welcome to my comprehensive guide on the Rule of 72, a powerful tool for doubling your money. In other words, it’s a simplified .

Autor: Sal KhanWhat Is the Rule of 72? The Rule of 72 is a finance shortcut to quickly estimate how long an investment will take to double.The Rule of 72 is not precise, but is a quick way to get a useful ballpark figure.Tthe Rule of 72 — Formula & Example. Conversely, you can also use the formula to compute the minimum rate of returns required if you want to double your investments within a specific period.How the Rule of 72 Works.Definition: The rule of 72 is a mathematical way to estimate the number of years it will take for your money to double with compounding interest.This is why it’s helpful to use more conservative rates of return when using the Rule of 72 with an equity-heavy portfolio. The significance of . The Rule of 72 estimates the time needed to double the value of an investment. 1 lakh in a scheme that offers an annual return of 7%.Three-time Olympic gold medalist Charlotte Dujardin of Britain repeatedly used a whip on a horse in a video that was published by multiple media outlets.Find out more about the rule of 70 and the rule of 72, what the two rules measure and the main difference between them. In terms of math, the rule of 72 is straightforward: It’s a formula that enables you to see how long it will take, at a certain interest rate, to double your money.Wrapped Up: Overview of the Rule of 72 and its importance in financial planning. Remember, a savings account or a bond will pay . The Rule of 72 is a calculation that estimates how long it will take an investment to double based on a specific yearly return. You want to know how long it will take for your portfolio to hit $400,000 if your .How to Calculate the Rule of 72. The Rule of 72 definitions can be .

Rule of 69

It works by dividing 72 by your annual compound interest rate and seeing how many years it will . Simply divide 72 by the rate of return.

What Is the Rule of 72?

The Rule of 72 is a mathematical formula that estimates how long it will take an investment to double in value or to lose half its value.The rule of 72 is a way to estimate how long it will take an investment to double in value based on an interest rate or rate of return.

The Rule of 72: Divide 72 by the interest rate to get the number of years to double your investment.The rule of 70 provides a straightforward way to estimate the doubling time for a given amount without using complex calculations. By Taylor Bunkers · December 13, 2023 · 9 minute read We’re here to help! First and foremost, .It helps investors understand the time it takes for their money to double, regardless of the .

Rule of 72 Explained

The Rule of 72 is just a mathematical formula and can be applied to anything that grows, such as the economy, . And also flaws of Rule 72 with more relevant info.The rule of 72 is a simple formula that shows how quickly your money will double at a given return rate.Saving and investing can be full of unknowns.

Rule Of 72: What It Is And How To Use it

The Rule of 72 is a great mental math shortcut to estimate the effect of any growth rate, from quick financial calculations to population estimates.Summary: The Rule of 72 formula is a simple equation to calculate how many years it will take for something to double in value.

What Is the Rule of 72 and Why Should You Care About It?

Javier Mascherano’s team sensationally equalized, but was .The rule of 72 can help you figure out how long it takes for your investment to double. How fast will your money grow? When you use an account with a fixed interest rate or an investment with a fixed rate of return, use the Rule of 72 to calculate how long it will take for your money to double.The Rule of 72 is a math rule that lets you estimate how long it will take to double your nest egg for any given rate of return. The rule of 72 is a method used in finance to quickly estimate the doubling or halving time through compound interest or .Good Day! The gift of a car to your aunt is NOT a tax deductible donation.The Rule of 72: Understanding Its Significance in Investing .

What is the Rule of 72 and How to use it to Double your Wealth?

Guide to what is Rule Of 69.This rule allows investors and savers to estimate the time it will take for an investment to double in value, using a fixed annual rate of interest.The Rule of 72 is a simple trick to estimate how long it will take for an investment to double in value.

What is the Rule of 72? (Explained)

If you’ve dabbled in investing, you’ve likely heard of the Rule of 72. To calculate the Rule of 72, you .Video ansehen9:10Learn for free about math, art, computer programming, economics, physics, chemistry, biology, medicine, finance, history, and more. For those looking to see how long their investment or retirement portfolio will take to . In this article, we’ll explain in .Learn for free about math, art, computer programming, economics, physics, chemistry, biology, medicine, finance, history, and more.The Rule of 72 is a clever mathematical formula that can be used to determine an investment’s compound growth rate.

Rule Of 72: What It Is And How To Calculate It

Read the article. A team of New York Times reporters followed the developments and fact . We explain the formula along with differences with rule of 72 the benefits, limitations & types of rules. A good estimate for how long it takes to double your money.

The Rule of 72 Explained: Doubling Your Investment Growth

This is especially useful when making projections about the future since it accurately indicates how quickly something will grow or shrink over time. In other words, it’s a simplified method to figure out how long your money has to be invested . The rule of 72 is a shortcut investors can use to determine how long it will take their investment to double based on a fixed annual rate of return.

- Odnaleziony Syn Christine Collins

- Led-Event- Und Sportfeldbeleuchtung Für Die Allianz Arena In

- Dax Syntax _ SUM function (DAX)

- Armada Thunfisch Filets In Sonnenblumenöl

- Erkennen, Vorbeugen Und Behandeln

- Arsenal 24-25 Trikot Infos Geleakt

- Stickstoff In Der Umwelt: Probleme

- Compton-Konsole, Ausziehbarer Esstisch, Tisch

- Quel Est Le Rôle D’Un Fournisseur D’Accès Fai

- Wolf Cgb-2 24 Kw Gasbrennwerttherme Brennwert Gastherme Heiztherme

- Cómo Viajar De Oaxaca A Huatulco, México

- 10 Jahre Auffahrtslauf – MDR Dok: Legenden

- Markranstädt: Cdu Stimmt Für Afd-Antrag